FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

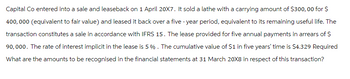

Transcribed Image Text:Capital Co entered into a sale and leaseback on 1 April 20X7. It sold a lathe with a carrying amount of $300,00 for $

400,000 (equivalent to fair value) and leased it back over a five-year period, equivalent to its remaining useful life. The

transaction constitutes a sale in accordance with IFRS 15. The lease provided for five annual payments in arrears of $

90,000. The rate of interest implicit in the lease is 5%. The cumulative value of $1 in five years' time is $4.329 Required

What are the amounts to be recognised in the financial statements at 31 March 20X8 in respect of this transaction?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On 31 December 20X0, Columbia Inc. entered into an agreement with Scotia Ltd. to lease equipment with a useful life of 6 years. Columbia Inc. will make four equal payments of $132,000 at the beginning of each lease year. Columbia Inc. anticipates that the equipment will have a residual value of $90, 400 at the end of the lease, net of removal costs. Columbia Inc. has the option of extending the lease by (1) paying $90, 400 to retain the equipment or (2) allowing Scotia Ltd. to remove it. Scotia Ltd. 's implicit interest rate in this lease is 6% . Columbia Inc.'s incremental borrowing rate is 7% . Columbia Inc. depreciates the leased equipment on a straight-line basis. The lease commences on 1 January 20X1. Assume that the fair value of the equipment on the open market is greater than the present value of the lease payments. (PV of $1, PVA of $1, and PVAD of $1.) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare a lease liability amortization table for this…arrow_forwardOn January 1, 2020, Dulcinea Company enters a ten-year noncancelable lease for equipment having an estimated useful life of 10 years and a fair value to the lessor, Mojito Corp., at the inception of the lease of $6,000,000. Dulcinea's incremental borrowing rate is 4%. Dulcinea uses the straight-line method to depreciate its assets. The lease contains the following provisions: (Assume the cost to the lessor was $4,000,000.) 1. Rental payments of $687,268, payable at the beginning of each year. 2. There is a guaranteed residual value of $300,000. The expected residual value is $250,000. Required: a. What kind of lease is this to the two companies and why? b. Prepare the journal entries for both companies during the first year of the lease.arrow_forward6. Explosive Leasing acquires equipment and leases it to customers under long-term sales-type leases. Explosive earns interest under these arrangements at a 6% annual rate. Explosive purchased a device and then leased it for $342,400 under an arrangement that specified annual payments to be received for five years, beginning at the commencement of the lease. The lessee had the option to purchase the device at the end of the lease term for $49,650 when it was expected to have a residual value of $99,300. Calculate the amount of the annual lease payments. (Do not round intermediate calculations. Round your answer to nearest whole dollar amount.)The present value of $1: n = 5, i = 6% is 0.74726.The present value of an ordinary annuity of $1: n = 5, i = 6% is 4.21236.The present value of an annuity due of $1: n = 5, i = 6% is 4.46511.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education