ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

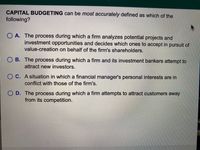

Transcribed Image Text:CAPITAL BUDGETING can be most accurately defined as which of the

following?

O A. The process during which a firm analyzes potential projects and

investment opportunities and decides which ones to accept in pursuit of

value-creation on behalf of the firm's shareholders.

B. The process during which a firm and its investment bankers attempt to

attract new investors.

O C. A situation in which a financial manager's personal interests are in

conflict with those of the firm's.

O D. The process during which a firm attempts to attract customers away

from its competition.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- If a corporation has $400 million in common stock, $200 million in preferred stock, and $500 million in bonds, A. How much is its capitalization?B.Theoretically, how much would it take to control it? C. Practically, how much would it take to control it?arrow_forwardMicrosoft has the opportunity to purchase a new factory today that will provide them with a $50 million return four years from now. If prevailing interest rates are 6 percent, what is the maximum that the project can cost for Microsoft to be willing to undertake the project? a. $53,406,002 b. $39,604,682 c. $43,456,838 d. $50,000,000 e. $34,583,902 D Darrow_forward7. Dividends a. are the rates of return on mutual funds. b. are cash payments that companies make to shareholders. c. are the difference between the price and present value per share of a stock. d. are the rates of return on a company's.capital stock.arrow_forward

- Suppose instead Larry decides to buy 100 shares of NanoSpeck stock. Which of the following statements are correct? Check all that apply. O C The price of his shares will rise if NanoSpeck issues additional shares of stock. NanoSpeck earns revenue when Larry purchases 100 shares, even if he purchases them from an existing shareholder. Expectations of a recession that will reduce economywide corporate profits will likely cause the value of Larry's shares to decline.arrow_forwardQuantity Price 0 $100 1 $90 2 $80 3 $70 4 $60 5 $50 6 $40 7 $30 8 $20 9 $10 10 $0 Marginal Cost $45 $40 $35 $30 $35 $40 $45 $60 $100 $180 Average Total Cost $80 $64 $52 $44 $40 $40 $52 $64 $80 $100arrow_forwardA firm's current profits are $900,000. These profits are expected to grow indefinitely at a constant annual rate of 2 percent. If the firm's opportunity cost of funds is 4 percent, determine the value of the firm:Instructions: Enter your responses rounded to one decimal place.a. The instant before it pays out current profits as dividends. b. The instant after it pays out current profits as dividends.arrow_forward

- 3. Which of the following must be included in an organization’s statement of accounting profits for the statement to be of use?a. the estimated amount the organization could have earned pursuing other optionsb. the extent to which technological improvements increased productivityc. the percentages planned for reinvestment or distribution to investorsd. the period in which the profit was earned, such as a year or a quarterarrow_forwardDefined capital budgeting. What are the capital budgeting methods used by managers?arrow_forwardWhat is capital recovery? A.The income recognized from insurance proceeds received after a capital asset is lost due to a casualty such as theft or fire. B. Matching the income you make from using capital assets with the expenses representing the use of the assets producing the income. C.Using a capital asset that had been previously taken out of service, but is now in use again. D. When the cost of capital assets exceed the gross revenue in the acquisition year.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education