FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

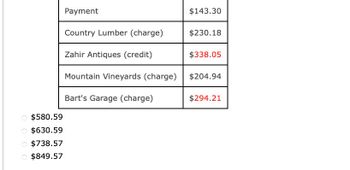

Candida has a revolving credit account at an annual percentage rate of 24%. Her previous monthly balance is $589.79. Find the new balance using the previous month's balance method if Candida's account showed the following activity.

Transcribed Image Text:0 0 0 0

$580.59

$630.59

$738.57

$849.57

Payment

Country Lumber (charge)

Zahir Antiques (credit)

Mountain Vineyards (charge)

Bart's Garage (charge)

$143.30

$230.18

$338.05

$204.94

$294.21

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- On August 19, Siobhan O’Sullivan started an ordinary annuity. She arranged to have $150 deducted from her end-of-month paychecks. The money would earn 6 7/8 % interest compounded monthly. a) Find the future value of the account on December 1.b) Find Siobhan’s total contribution to the account.c) Find the total interest earned.arrow_forwardArnold Brown has a Visa Card with an annual percentage rate of 19.2%. The unpaid balance for his June billing cycle is $1,147.56. During the billing cycle he purchased a printer cartridge for $47.78, books for $281.37 and gasoline for $16.65. He made a payment of $1,200. If the account applies the unpaid balance method, what are the finance charge and the new balance? The finance charge is $. The new balance is $ (Round to the nearest cent as needed.)arrow_forwardJoseph Simpson, a student at State College, has an average balance of $250 on his retail charge card; if the store levies a finance charge of 22 percent per year, how much monthly interest will be added to his account? Assume that the balance is computed by the average daily balance method. Round the answer to 2 decimal places. $arrow_forward

- Use the unpaid balance method to calculate the finance charge on Joanna's credit account if last month's balance was $1,350, she made a payment of $375, she bought hiking boots for $120, and she returned a jacket for $140. Assume an annual interest rate of 21%.arrow_forwardMr. VanJergen's credit card uses the average daily balance method for calculating interest. His balance for the first 12 days of October was $850.00. His balance for the rest of October was $2,495.00. What was his average daily balance?arrow_forwardSamantha and Samuel both have student credit cards issued by VISA. Their credit card statements show they are at their credit card limit of $500 this month. Samantha manages her credit well and ensures that her credit card balance is paid off in full each month before the payment deadline while Samuel cannot manage to pay off the minimum amount required each month. Complete the sentence: For Financial Statement reporting purposes, __________________________________________. a) It does not matter where Samantha or Samuel report the$500 as long as it is shown on one of their Financial Statements. b) Both Samantha and Samuel would report their $500 on their Balance Sheet as a current liability. c) Both Samantha and Samuel would report their $500 on their Cash Flow statement as an expense. d) Samantha would report her $500 on her Cash Flow statement as an expense while Samuel would report his credit card debt of $500 on his Balance Sheet as a current liability. e) Samantha would report her…arrow_forward

- 44. Subject :- Accountingarrow_forwardAlexis Monroe, a biologist from Dyersburg, Tennessee, is curious about the accuracy of the interest charges shown on her most recent credit card billing statement. Interest Charged Interest Charge on Purchases $6.40 Interest Charge on Cash Advances $4.65 TOTAL INTEREST FOR THIS MONTH $11.05 Use the average daily balances provided to recalculate the interest charges, and compare the result with the amount shown on the statement. Round your answers to the nearest cent. Annual Percentage Balances Subject to Type of Balance Rate (APR) Interest Rate Interest Charge Purchases 15.14% (V) $513.39 $ Cash Advances 22.43% (V) $252.98 $ Balance Transfers 0.00% $637.50 $ Penalty APR 28.99% $ 0.00 $arrow_forwardKathy Hansen has a revolving credit account. The finance charge is calculated on the previous month's balance, and the annual percentage rate is 27%. Complete the account activity table for Kathy. (Round your answers to the nearest cent.) Month June July Need Help? Previous Month's Balance (in $) $693.96 Submit Answer $822.08 Read It tA Finance Charge (in $) $18.50 X Purchases and Cash Advances $153.38 $76.59 Payments and Credits $300.00 $120.00 New Balance End of Month (in $) $693.96 Xarrow_forward

- How to calculate the total outstanding receivables?? For example if at the Dec 31 2013, total sales on account and invoiced during the year, the account receivable balance outstanding at the year end, the date when the invoice was issued and the date when the invoice was paid off was given!arrow_forward10. Elly's credit card record for the last 7 months is below. Based on the information from the table, what will be her new balance at the end of month 7? End of Month Previous New Payment Finance Principal New Balance Charges Received Charges Paid Balance 1 $0.00 $2200.00 $0.00 $0.00 $0.00 $2200.00 5 6 234567 2 $2200.00 $0.00 $44.00 $33.00 $11.00 $2189.00 $2189.00 $0.00 $43.78 $32.84 $10.95 52178.06 4 $2178.06 $0.00 $43.56 $32.67 $10.89 $2167.16 $2167.16 $0.00 $43.34 $32.51 $10.84 $2156.33 $2156.33 $0.00 $43.13 $32.34 $10.78 $2145.55 $2145.55 $0.00 $42.91 $32.18 $10.73 $?arrow_forwardOn august 10, a credit card account had a balance of $345. A purchase of $64 was made on august 15, and $165 was charged on august 27. A payment of $71 was made on august 15. The interest on the average daily balance is 1.35% per month. Find the finance charge on September 10 bill. (Round your answer to two decimal places)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education