Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

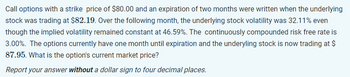

Transcribed Image Text:Call options with a strike price of $80.00 and an expiration of two months were written when the underlying

stock was trading at $82.19. Over the following month, the underlying stock volatility was 32.11% even

though the implied volatility remained constant at 46.59%. The continuously compounded risk free rate is

3.00%. The options currently have one month until expiration and the underyling stock is now trading at $

87.95. What is the option's current market price?

Report your answer without a dollar sign to four decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- An equity index is currently 1, 200. A fourteen month zero coupon bond costs 0.965 and a fourteen month forward on the index costs 1, 240. Calculate the value of the fourteen month continuously compounded dividend yield on the index. Explain the formulae you usearrow_forwardTDX stock is currently trading at $100. A 3-month call option in this stock has an exercise price of $105 and trading at $1 (the option premium). A put option with similar maturity period and strike price is trading at $0.5.i) Compute the theoretical value of call and put options if TDX stock price at the end of 3 months will be $95, or $100, or $105, or $110, or $115. ii) Draw diagrams showing TDX stock price and theoretical values of call and put. iii) If you purchase one stock and one put option today, what will be the total value of your portfolio at the end of 3 months? iv) Compute your return on investment or holding period return made in part (iii) above.arrow_forwardThe common stock of the C.A.L.L. Corporation has been trading in a narrow range around $105 per share for months, and you believe it is going to stay in that range for the next 3 months. The price of a 3-month put option with an exercise price of $105 is $12.86. a. If the risk-free interest rate is 5% per year, what must be the price of a 3-month call option on C.A.L.L. stock at an exercise price of $105 if it is at the money? (The stock pays no dividends.) (Do not round intermediate calculations. Round your answer to 2 decimal places.) Price of a 3-month call optionarrow_forward

- 9arrow_forwardIBM stock currently sells for 84 dollars per share. Over 8 months the price will either go up by 7.5 percent or down by -3.0 percent. The risk-free rate of interest is 4.5 percent continuously compounded. A call option with strike price 83 and maturity of 8 months has a delta of 0.82766. What is the value of this call option? 0.62579 O2.6708 O4.0788 2.9324 O4.3788arrow_forwardGeneric Stock Inc. (GS) is trading at $100. A call option with a strike price of $102, which expires in 6 months, costs $9.52 (assuming a risk - free rate of 5% and a volatility of 0.33). What is the Delta of this optionarrow_forward

- Assume a stock trades at $109, the volatility of the stock is 21%, and the risk - free interest rate is 4.4%. What is the Gamma of a $107 strike call option expiring in 120 days if the spot price of the stock increases by $1? Please answer to 2 decimal places. answer is.03 pleasearrow_forwardThe common stock of the CGI Inc. has been trading in a narrow range around $35 per share for months, and you believe it is going to stay in that range for the next three months. The price of a three-month put option with an exercise price of $35 is $2, and a call with the same expiration date and exercise price sells for $3. Suppose you write a strap ( = write 2 calls and write 1 put with the same strike price) and the stock price winds up to be $37 at contract expiration. What was your net profit on the strap? A. $200 B. $300 C. $400 D. $500 E. $700arrow_forwardA stock index is currently 1,500. Its volatility is 18%. The risk-free rate is 4% per annum (continuously compounded) for all maturities and the dividend yield on the index is 2.5%. Calculate values for u, d, and p when a six-month time step is used. What is the value a 12-month American put option with a strike price of 1,480 given by a two-step binomial tree.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education