FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

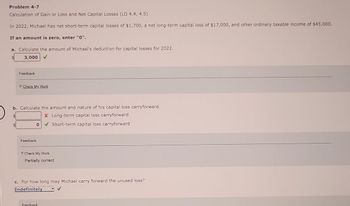

Transcribed Image Text:Problem 4-7

Calculation of Gain or Loss and Net Capital Losses (LO 4.4, 4.5)

In 2022, Michael has net short-term capital losses of $1,700, a net long-term capital loss of $17,000, and other ordinary taxable income of $45,000.

If an amount is zero, enter "0".

a. Calculate the amount of Michael's deduction for capital losses for 2022.

$

3,000

Feedback

Check My Work

b. Calculate the amount and nature of his capital loss carryforward.

$

X Long-term capital loss carryforward

0✔Short-term capital loss carryforward

Feedback

Check My Work

Partially correct

c. For how long may Michael carry forward the unused loss?

Indefinitely

Feedback

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- This is my second attempt on this problem please help!!arrow_forward1. No need to explain. Please answer all the questions correctly. Thank you in advancearrow_forward******** Tax Information for the Evans Family for 2023: Wages: Sarah ($79,500), James ($64,500) Interest Income: $1,750 Dividend Income: $700 Long-term capital gains: $4,200 Qualified Business Income (QBI) from Sarah's sole proprietorship: $54,000 Itemized Deductions: Medical Expenses: $7,200, State and Local Taxes: $10, 700, Charitable Contributions: $3,100 Allowable deduction for self-employment tax: $3,600 Calculate Sarah and James's: Adjusted Gross Income ( AGI) Taxable Income Potential Child Tax Credits Total Tax Liability (Before any other credits)arrow_forward

- X Your answer is incorrect. William, who is single, has the following items for the current year: Wages Rental loss Interest income Capital gains NOL carryforward from 2017 Mortgage interest expense Real estate taxes State income taxes What is William's net operating loss for the current year? Loss tA $54,500 ($76,500) $1,750 $2,550 ($13,500) $12,500 $6,000 $3,500 $ 53200arrow_forwardProblem 4-6 Calculation of Gain or Loss and Net Capital Losses (LO 4.4, 4.5) In 2021, Michael has net short-term capital losses of $1,700, a net long-term capital loss of $17,000, and other ordinary taxable income of $45,000. If an amount is zero, enter "0". a. Calculate the amount of Michael's deduction for capital losses on his tax return for 2021. 3,000 Feedback b. Calculate the amount and nature of his capital loss carryforward. $1 43,300 x Long-term capital loss carryforward o v Short-term capital loss carryforward Feedback c. For how long may Michael carry forward any long-term unused loss? Indefinitelyarrow_forwardJigu3arrow_forward

- Required information [The following information applies to the questions displayed below.] Rita is a self-employed taxpayer who turns 39 years old at the end of the year (2023). In 2023, her net Schedule C income was $300,000. This was her only source of income. This year, Rita is considering setting up a retirement plan. What is the maximum amount Rita may contribute to the self- employed plan in each of the following situations? Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. a. She sets up a SEP IRA. Maximum contribution $ 58,000arrow_forwardH5.arrow_forwardOnly typed solutionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education