Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

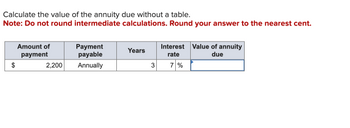

Transcribed Image Text:Calculate the value of the annuity due without a table.

Note: Do not round intermediate calculations. Round your answer to the nearest cent.

Amount of

payment

2,200

Payment

payable

Annually

Years

3

Interest Value of annuity

due

rate

7 %

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Calculate the value of the annuity due without a table. Note: Do not round intermediate calculations. Round your answer to the nearest cent. $ LA Amount of payment 3,500 Payment payable Annually Years Interest Value of annuity rate due 6%arrow_forwardNot use excel Q)Complete the ordinary annuity as an annuity due (future value) for the following. Do not round intermediate calculations. Round your answer to the nearest cent. Amount of payment $4,900 Payment payable: annually Years: 14 Interest rate: 4% Annuity due: ?arrow_forwardFor each of the following annuities, calculate the present value. Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Present Value Annuity Payment $ 2,750 $ 1,505 13,455 33,900 LA $ $ SA Years 7 9 16 30 Interest Rate 6 % 5 7 9arrow_forward

- For each of the following annuities, calculate the present value. Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Present Value Annuity Payment $ $ $ $ 1,950 1,265 11,455 29,900 Years 7 9 16 24 Interest Rate 8% 7 9 11arrow_forwardEf 07.arrow_forwardComplete the ordinary annuity. (Please use the following provided Table.) (Do not round intermediate calculations. Round your answer to the nearest cent.) amount of payment payment payable years interest rate value of annuity 12,700 semiannual 9 6%arrow_forward

- For each of the following annuities, calculate the present value. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Present Value Annuity Payment $ 2,000 $ 1,280 $ 11,580 30,150 69 $ Years 7 17 25 Interest Rate 9 % 8 10 12arrow_forwardImage attached of questionarrow_forwardCalculate the present value of the following annuities, assuming each annuity payment is made at the end of each compounding period. (FV of $1. PV of $1. FVA of $1, and PVA of $1) (Use tables, Excel, or a financial calculator. Round your answers to 2 decimal places.) 1. 2. 3. Annuity Payment $ 5,600 10,600 4,600 Annual Rate Interest Compounded Semiannually 9.0% 10.0% Quarterly 11.0% Annually Period Invested 3 years 2 years 5 years Present Value of Annuityarrow_forward

- Calculate the present value of the following annulties, assuming each annuity payment is made at the end of each compounding period. (FV of $1, PV of $1, FVA of $1, and PVA of S1) (Use tables, Excel, or a financial calculator. Round your answers to 2 decimal places.) \table[[, \table[[Annuity], [Payment]], \table [[ Annual], [Rate]], \table[[Interest], [Compounded]], \table [[Period], [Invested]], \table [[Present Value of], [ Annuity]]], [1., $5,000, 7.0%, Semiannually,3 years,], [2., 10, 000, 8.0%, Quarterly,2 years, ], [3., 4,000, 10.0 %, Annually,5 years,]]arrow_forwardanswer with working , explanation , formula answer in textarrow_forwardCalculate the future value of the following annuities, assuming each annuity payment is made at the end of each compounding period. (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use appropriate factor(s) from the tables provided. Round your answers to 2 decimal places.) 1. 2. 3. Annuity Annual Payment Rate $4,700 6.0 % 8.0 % 7,700 6,700 10.0 % Show Transcribed Text 1. 2. 3. Annuity Annual Payment Rate Interest Compounded Quarterly Annually Semiannually $ 5,700 Interest Compounded 8.0 % Quarterly 10,700 11.0% Annually 4,700 10.0 % Semiannually Period Invested 5 years 6 years 9 years Calculate the present value of the following annuities, assuming each annuity payment is made at the end of each compounding period. (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use appropriate factor(s) from the tables provided. Round your answers to 2 decimal places.) $ Period Invested 2 years 5 years 3 years Future Value of Annuity 172,892.28 Present Value of Annuityarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning