Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

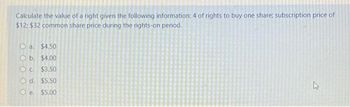

Transcribed Image Text:Calculate the value of a right given the following information: 4 of rights to buy one share; subscription price of

$12: $32 common share price during the rights-on period.

a $4.50

Ob. $4.00

c. $3.50

d. $5.50

Oe. $5.00

L

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Q6. Please calculate the fully diluted shares outstanding using the Net Settlement approach based on assumptions below. ( Assumptions Current Share Price $40.00 Convert Debt Amount Outstanding (Smil.) $500.00 Conversion Price $30.00 Basic Shares Outstanding (mil.) 10 OA. 11.67 O B. 12.50 OC. 10.00 OD. 14.17arrow_forward14. Laursen plc has announced a 1 for 3 rights issue at a subscription price of £2. The current price of the shares is £3.04. What is the theoretical value of the right per existing share? a. £0.78 b. £0.35 c. £0.26 d. £2.78arrow_forwardAssume the commission per trade is $20 plus $1.75 per contract. Stock Price (May 1) Price (Nov 1) IBM $185 $185 Manulife $26 $21 General Mills $6.25 $8.50 Barrick Gold $25 $30 If you purchase a 6 month PUT on 1,000 shares of General Mills on May 1 costing $0.70 per share, and exercisable at a strike price of $6.00... How much would you have gained or lost if you held the option to expiration?arrow_forward

- Pastner Brands is a calendar-year firm with operations in several countries. As part of its executive compensation plan, at January 1, 2024, the company issued 480,000 executive stock options permitting executives to buy 480,000 shares of Pastner stock for $43 per share. One-fourth of the options vest in each of the next four years beginning at December 31, 2024 (graded vesting). Pastner elects to separate the total award into four groups (or tranches) according to the year in which they vest and measures the compensation cost for each vesting date as a separate award as given below. Vesting Date December 31, 2024 December 31, 2025. December 31, 2026 December 31, 2027 Amount Vesting 25% 25% 25% 25% Assume Pastner measures the fair value of all options on January 1, 2024, to be $5.40 per option using a single weighted-average expected life of the options assumption.arrow_forwardUS Kinl, Fieecial Accouteg Be Mele 1 Thrsteen An emeds Problem L1-SA (Part Level Submivsion) ds Corp. has been authorined to issue 20,600 shares of $100 par value, 7%,, noncumdative preferred stok and 1,160,000 shares of no- par common shock. Te ration asigned a $3 stated vakse to the common shock. At December 31, 2017, the ledger contained the following balances pertaining to stockholders' equity. Preforred Stock $156,000 Paid-in Capital in Excess of Par Value-Prefered Stock 21,600 Common Stock Paid-in Capital in Excess of Stated Vakue-Common Stock Treasury Stock (4,600 common shares) Retained Earnings Accumulated Other Comprehensive Income 1,990,000 1,570,000 46,000 83,600 49,600 The preferred stock vas issued for $177,600 cash. All common stock issued was for cash. In November 4,600 shares of common stock wwere purchased for the treasury at a per share cost of $10. No dividends were declarud a (a) Your answer is partially correct. Try again. Prepare the journal entries for the…arrow_forwardAnswer and explain with computation Company's issued 20,000 share capital receiving land with fair value of P500,000. If the share capital is no par and no stated value and the cost of the land is P200,000, how much in the legal capital? A. P-0 b. P200,000 c. P300,000 d. P500,000arrow_forward

- Question #5 please!arrow_forwardpls help and if needed, provide supporting computationsarrow_forwardConsider the following information about Firm A and Firm T: Item Firm A (Acquiring firm) Firm T (Target firm) Price per share $20 $15 Outstanding shares 50 25 Total market value $1000.00 $375 Total cost of the acquisition is $500.00 and the merger is estimated to create a synergistic gain of $700.00. What is the NPV of the acquisition to firm A? Select one: a. $1075.00 b. $575.00 c. $425.00 d. $555.00arrow_forward

- q16arrow_forwardQuestion 2The following Trial Balance is extracted from the books of FW Sdn Bhd as at31 December 20X1:Trial Balance as at 31 December 20X1 Dr CrRM RM20,000 non-redeemable Preference share capital 20,00070,000 Ordinary share capital 70,00010% debentures (repayable 20X8) 30,000Building at cost 110,500Equipment at cost 8,000Motor vehicles at cost 17,200Accumulated depreciation : equipment 1.1.20X1 2,400Accumulated depreciation : motors 1.1.20X1 5,160Inventories 22,690Sales 98,200Purchases 53,910Carriage inwards 1,620Salaries & wages 9,240Directors’ remuneration 6,300Motor expenses 8,120Rates & insurances 2,930General expenses 560Debenture interest 1,500Trade Receivables 18,610Trade Payables 11,370Cash at Bank 8,390General reserve 19,000Interim ordinary dividend paid 3,500Retained earnings: 31.12.20X0 16,940273,070 273,070 The following adjustments are needed:(i) Inventories at 31.12.20X1 were RM27,220.(ii) Depreciation of motor vehicles RM3,000 and equipment RM1,200.(iii)Accrued…arrow_forwardRequired: (a)Assuming a rights issue of shares is made, calculate: (i)the theoretical ex-rights price of an ordinary share in Devonian plc (ii)the value of the rights for each original ordinary share. (b)Calculate the price of an ordinary share in Devonian plc in one year’s time assuming: (i)a rights issue is made (ii)a loan issue is made. Comment on your findings.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education