FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

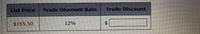

Calculate the trade discount (in $). Round your answer to the nearest cent.

Transcribed Image Text:List Price

Trade Discount Rate

Trade Discount

$155.50

12%

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Calculate the missing information. Round dollars to the nearest cent and percents to the nearest tenth of a percent. Item PercentMarkupBased onCost PercentMarkupBased onSelling Price Flashlight ____ % 55%arrow_forwardRequired: a. A firm currently offers terms of sale of 3/25, net 50. Calculate the effective annual rate. a-1. Calculate the effective annual rate if the terms are changed to 4/25, net 50. a-2. What effect does an increase in the discount rate have on the implicit interest rate charged to customers that pass up the discount? b-1. Calculate the effective annual rate if the terms are changed to 3/35, net 50. b-2. What effect does a decrease in the extra days of credit have on the implicit interest rate charged to customers that pass up the discount? c-1. Calculate the effective annual rate if the terms are changed to 3/25, net 40. c-2. Is there any difference between the implicit interest rate for terms of 3/35, net 50 and 3/25, net 40?arrow_forwardIf your supplier offers 3/5 net 28, what is the implied interestrate if you choose to forgo the discount and pay on day 28?arrow_forward

- An invoice dated April 22 shows a net price of $175.00 with the terms 3/10, n/30. What is the latest date the cash discount is allowed?arrow_forwardc-1. Over what range of discount rates would you choose Project A? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. c-2. Over what range of discount rates would you choose Project B? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. c-3. At what discount rate would you be indifferent between these two projects? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Project A c-1. c-2. Project B c-3. Indifferent interest rate an interest rate of an interest rate of % % %arrow_forwardhow about the cash discount 5% ?arrow_forward

- Give your answer as a rate, accurate to five decimal places.What discount would exactly offset a 10% surcharge?arrow_forwardThe Pharoah Acres Inn is trying to determine its break-even point during its off-peak season. The inn has 50 rooms that it rents at $65 a night. Operating costs are as follows: Salaries $5,200 per month $1,200 per month Depreciation $1,300 per month Maintenance $3,324 per month $13 per room $26 per room Utilities Maid service Other costs Determine the inn's break-even point in number of rented rooms per month. Break-even point Textbook and Media rooms SIarrow_forwardCalculate the forward discount or premium for the following spot and three-month forward rates: (a) Spot Rate = $2.00/£1 and Forward Rate = $2.01/£1 (b) Spot Rate = $2.00/£1 and Forward Rate = $1.96/£1arrow_forward

- (Related to Checkpoint 18.2) (Evaluating trade credit discounts) If a firm buys on trade credit terms of 5/15, net 90 and decides to forgo the trade credit discount and pay on the net day, what is the annualized cost of forgoing the discount (assume a 365-day year)? The annualized cost of the trade credit terms of 5/15, net 90 is %. (Round to two decimal places.)arrow_forwardTo calculate the withdrawal amount from an account in which you want to maintain a static balance, you use the __________________ formula. Group of answer choices Installment Payment Simple Interest Annuity Compound Interestarrow_forwardA trade credit bill of $80,000 with terms of sale of 2/5, net 30 means the buyer saves if the bill is paid within the discount period A:1600 How much discount will a buyer receive if the buyer pays a trade credit bill of $60,000 with terms of sale of 2/5, net 30 on the net due date? A: 0arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education