FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

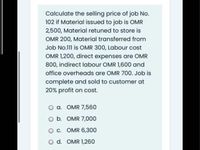

Transcribed Image Text:Calculate the selling price of job No.

102 if Material issued to job is OMR

2,500, Material retuned to store is

OMR 200, Material transferred from

Job No.111 is OMR 300, Labour cost

OMR 1,200, direct expenses are OMR

800, indirect labour OMR 1,600 and

office overheads are OMR 700. Job is

complete and sold to customer at

20% profit on cost.

a. OMR 7,560

O b. OMR 7,000

O C. OMR 6,300

O d. OMR 1,260

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mickley Company’s predetermined overhead rate is $14.00 per direct labor-hour and its direct labor wage rate is $12.00 per hour. The following information pertains to Job A-500: Direct materials $230 Direct labor $108 Required: 1. What is the total manufacturing cost assigned to Job A-500? 2. If Job A-500 consists of 40 units, what is the average cost assigned to each unit included in the job? (Round your answer to 2 decimal places.)arrow_forwardEe.78.arrow_forwardMackey Company's plantwide predetermined overhead rate is $25.00 per DLH and its direct labor wage is $21.00 per hour. For Job N, Direct materials is $1,000 and Direct labor is $420. a. What is the total manufacturing cost assigned to Job N? b. If Job N consists of 60 units, what is the unit product cost for this job?arrow_forward

- A company has an overhead application rate of 120% of direct labor costs. How much overhead would be allocated to a job if it required total labor costing $30,000? O $6.000 O $25.000 O $36,000 O $187.500 O $360.000 Question 10 O.K. Company uses a job order cost accounting system and allocates its overhead on the basis of direct labor costs. O.K. expects to incur $1,100,000 of overhead during the next period and expects to use 50,000 labor hours at a cost of $10.00 per hour. What is O.K. Company's overhead application rate? O 4.55% O 45.45% O 220% O 227% O 2,200% Question 11arrow_forwardDuring the month of January 2020, the job-cost record for Job 123 shows the following: Job 123: Machine Department Assembly Department Manufacturing overhead costs 19 500 7 500 Direct manufacturing labor costs 1 350 1 875 Direct manufacturing labor-hours 30 105 Machine-hours 210 30 Compute the total manufacturing overhead cost allocated to Job 123. Assume that Job 123 produced 450 units, calculate the cost per unit.arrow_forwardCopr., Goedl Job Blue2B incurred the following: $15,000 direct material, $12,600 direct labor, 800 machine hours and 550 labor hours. The company uses a single organization-wide overhead rate based on machine hours. The overhead rate is $6 per machine hour. The markup percentage is 200%. What is the selling price for Job Blue2B? O $61,800 O $71,400 O $64,800 O $55,200arrow_forward

- Saved The following date Is for a company that uses a job-order costing system: Estimated direct labor hours Estimated manufacturing overhead costs Actual direct labor hours Actual manufacturing overhead costs 12,000 $39,000 11,000 S37,000 Overhead Is applied based on direct labor-hours. What Is the predetermined overhead rate? Multiple Cholce $3.08 per direct labor-hour $3.25 per direct labor-hour $3.36 per direct labor-hour $3.55 per direct labor-hourarrow_forwardJob XXX required 260 direct labour hours of which 220 hours were incurred during the current accounting period. The predetermined overhead cost rate is £7.50 per direct labour hour. How much overhead should be applied to Job XXX during the current accounting period? a. £1,650 b. £366 c. £1,950 d. £915arrow_forwardHill Company uses job-order costing. At the end of the month, the following data was gathered: Job # Total Cost Complete? Sold? 803 $611 yes yes 804 423 yes no 805 805 no no 806 682 yes yes 807 525 yes no 808 250 no no 809 440 yes yes 810 773 yes no 811 267 no no 812 341 no no Hill's selling price is cost plus 50% for each of its products. What is the total amount of Finished Goods? a. $1,721 b. $2,230 c. $1,700 d. $1,860 e. $2,163arrow_forward

- O d. applied manufacturing overhead. Company XYZ uses a job order costing system. During the year, Job XY was started and completed. The total manufacturing cost of this Job was $15,000. The job includes 100 units. If the company uses a markup percentage of 110% of its total manufacturing cost, then what selling price per unit would it have established for Job XY? Select one: O a. $165 Ob. $260 O c. $330 O d. $315 O e. None of the answers given enovo FO F6 2 SE B LLarrow_forwardCosi Company uses a job order costing system and allocates its overhead on the basis of direct labor costs. Cosi expects to incur $740,000 5 of overhead during the next period, and expects to use 44,000 labor hours at a cost of $10.00 per hour. What is Cosi Company's predetermined overhead rate? Multiple Choice D C 5.95%. 59.5% 168%. 1682%.arrow_forwardnline A company uses a job-order costing system and has provided the following partially completed T-account summary for the past year. Bal. 1/1 Debits Bal. 12/31 Finished Goods 43,000 Credits ? 50,000 The Cost of Goods Manufactured for the year was $450,000. The unadjusted Cost of Goods Sold for the year was:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education