Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

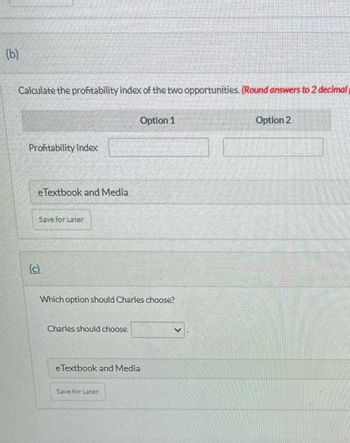

Transcribed Image Text:(b)

Calculate the profitability index of the two opportunities. (Round answers to 2 decimal

Profitability Index

eTextbook and Media

Save for Later

Which option should Charles choose?

Charles should choose

Option 1

eTextbook and Media

Save for Later

Option 2

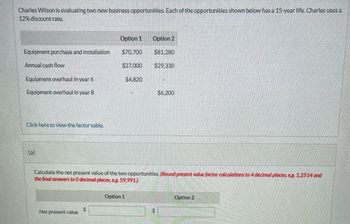

Transcribed Image Text:Charles Wilson is evaluating two new business opportunities. Each of the opportunities shown below has a 15-year life. Charles uses a

12% discount rate.

Equipment purchase and installation

Annual cash flow

Equipment overhaul in year 6

Equipment overhaul in year 8

Click here to view the factor table.

(a)

Net present value

Option 1

$70,700

$27,000

$

$4,820

Option 1

Option 2

Calculate the net present value of the two opportunities. (Round present value factor calculations to 4 decimal places, eg. 1.2514 and

the final answers to 0 decimal places, e.g. 59,991.)

$81,280

$29,330

$6.200

$

Option 2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- c. In the table above, two of the options are not priced correctly, i.e., are either more expensive or cheaper than what they should sell for. Which two? (Select all that apply) Mar call Apr call Oct call Mar put Oct put Apr putarrow_forwardQ2 (Exercise 9.9) Suppose call and put prices are given by Strike 50 55 Call premium 16 10 Put premium 7 14 What no-arbitrage property is violated? What spread position would you use to effect arbitrage? Demonstrate that the spread position is an arbitrage.arrow_forwardGive typing answer with explanation and conclusionarrow_forward

- Options have a unique set of terminology. Define the following terms: (12) Out-of-the-money callarrow_forwardDidn't get answerarrow_forward"Quadratic utility is the best form of the utility function to assume for any investor".Enumerate two argunentsagainst this statement.(maximum of two sentences per argument)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education