Advanced Engineering Mathematics

10th Edition

ISBN: 9780470458365

Author: Erwin Kreyszig

Publisher: Wiley, John & Sons, Incorporated

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Calculate the present value (principal) and the compound interest (in $). Use Table 11-2. Round your answers to the nearest cent.

| Compound Amount |

Term of Investment |

Nominal Rate (%) |

Interest Compounded |

Present Value |

Compound Interest |

|---|---|---|---|---|---|

| $34,000 | 6 years | 4 | semiannually | $ | $ |

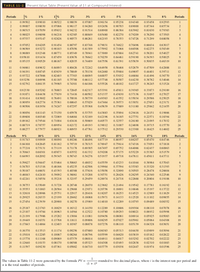

Transcribed Image Text:TABLE 11-2 Present Value Table (Present Value of $1 at Compound Interest)

Periods

2%

3%

4%

5%

6%

7%

Periods

0.99 502

0990 10

0.98522

0.98039

0.97087

0.961 54

0.95238

0.94340

0.93458

0.92593

a98030

0.94 260

0.87 344

0.81630

2

0.99007

0.97066

0.961 17

0.92456

0.90703

0.89000

0.85734

3

0.98515

09709

0.95632

0.94232

0.91514

088900

0.86 384

0.8.3962

0.79383

4

0.98025

0.96098

0.94218

0.92385

0.88849

0.85480

0.82270

0.79209

0.76290

0.73503

4

5

0.97537

0.95147

0.92826

0.90573

0.86 261

0.82193

0.78353

0.74726

0.71299

0.68058

0.97052

0.94205

0.91454

0. 88797

0.83748

0.79031

0.74622

0.70496

0.66634

0.6.3017

7

0.96569

093272

0.90 103

0.87056

0.81 309

0.75992

0.71068

0.66506

0.62275

0.58349

7

0.96089

0.92348

0.88771

0.85349

0.78941

0.7.3069

0.67684

0.62741

0.58201

0.54027

9

0956 10

09 1434

0.87459

0.836 76

0.76642

0.70259

0.64461

0.59190

0.54393

0.50025

10

0.95 135

0.905 29

0.86 167

0.82035

0.74409

067556

0.61391

0.55839

0.50835

0463 19

10

11

0.94661

0.89632

0.84893

0.804 26

0.72242

0.64958

0.58468

0.52679

0.47509

0.428 88

11

12

0.94 191

088745

O83639

0.78849

0.70138

0.62460

0.55684

0.49697

0.44401

0.39711

12

13

0.93722

087866

0.82403

0.77303

0.68095

0.60057

0.53032

046884

0.41496

0.36770

13

14

0.93256

0.86996

0.81 185

0.75788

0.66 112

057748

0.50507

0.44230

0.38782

0.34046

14

15

0.92792

0861 35

0.79985

0.74301

0.64 186

0.555 26

0.48 102

041727

0.36245

0.31524

15

16

0.923 30

0.85282

0.78803

0.72845

0.62317

053391

0.45811

0.39365

0.33873

0.291 89

16

0.714 16

0. 700 16

0.643

17

0.91871

0844 38

0.77639

0.60502

05 1337

0.43630

0.37136

0.31657

0.27027

17

18

0.91414

0.83602

0.76491

0.58739

049363

0.41552

0.35034

0.29586

0.25025

18

19

0.90959

082774

0.75361

0.57029

047464

0.39573

0.3.3051

0.27651

0.23171

19

20

0.90506

08 1954

0.74247

0.67297

0.55 368

0456 39

0.37689

0.311 80

0.25842

0.21455

20

21

0.90056

081143

0.73 150

0.659 78

0.53755

0.43883

0.35894

0.294 16

0.24 151

0.19866

21

22

0.89608

0.80340

0.72069

0.646 84

0.52 189

042196

0.34 185

0.27751

0.22571

0.18394

22

0.1 7032

0.157 70

23

0.89 162

0.79544

0.71004

0.634 16

0.50669

0.40573

0.32557

0.261 80

0.21095

23

24

0.88719

0.78757

0.69954

0.62172

0.49 193

0.39012

0.31007

0.24698

0.19715

24

25

0.88277

0.77977

0.68921

0.60953

0.47 761

0.375 12

0.29530

0.23300

0.18425

0.14602

25

Periods

10%

11%

12%

13%

14%

15%

16%

17%

18%

Periods

0.91743

0.90909

0.90090

0.892 86

0.88496

0877 19

0.86957

0.86207

0.85470

0.84746

0.84 168

082645

0.81 162

0.797 19

0.78315

0.76947

0.75614

0.743 16

0.73051

0.7 18 18

0.77218

0.75131

0.73119

0.71178

0.69 305

0.67497

0.65752

0.64066

0.62437

0.60863

4

0.70843

0.68301

0.65873

0.61552

0.61332

0.59208

0.57175

0.55229

0.53 65

05 1579

4

5

0.64993

0.62092

0.59345

0.56743

0.54276

05 1937

0.49718

047611

0.45611

043711

5

0.59627

0.56447

0.53464

0.50663

0.48032

045559

0.43233

04 1044

0.38984

0.37043

0.54703

0.513 16

0.48 166

0.452 35

0.42506

0.39964

0.37594

0.35383

0.33320

0.31393

0.50187

0.46651

0.43 393

0.403 88

0.37616

0.35056

0.32690

0.30503

0.28478

0.26604

0.46043

0424 10

0.39092

0.36061

0.33288

0.30751

0.28426

0.26295

0.24340

0.22546

10

0.42241

0.38554

0.35218

0.32197

0.29459

0.26974

0.24718

0.22668

0.20804

0.19106

10

11

0.38753

0.35049

031728

0.28748

0.26070

0.23662

0.21494

0.19542

0.17781

0.16192

11

12

0.35553

0.3 1863

0.28584

0.25668

0.23071

0.20756

0.18691

0.16846

0.15 197

0.13722

12

13

0.32618

0.28966

0.25751

0.229 17

0.20416

0.1 8207

0.16253

0.14523

0.12989

0.1 1629

13

14

0.29925

0.26333

0.23 199

0.20462

0.18068

0.15971

0.14 133

0.12520

0.11 102

0.09855

14

15

0.27454

0.2.39 39

0.20900

0. 182 70

0.15989

0.140 10

0.12289

0.10793

0.09489

0.08352

15

0.1 2289

0. 163 12

0. 14564

16

0.25 187

0.21763

0.18829

0.14 150

0.10686

0.09304

0.08 110

0.07078

16

17

0.23 107

0.19784

0.16963

0.12522

0.10780

0.09293

0.08021

0.06932

0.05998

17

18

0.21 199

0.17986

0.15282

0. 13004

0.11081

0.09456

0.0SOS I

0.069 14

0.05925

0.05083

18

19

0.19449

0.16351

0.13768

0.11611

0.09806

0.08295

0.07027

0.05961

0.05064

0.04308

19

20

0.17843

0.14864

0.12403

0. 10367

0.08678

007276

0.06110

0.05139

0.04328

0.0.3651

20

21

0.16370

0.135 13

0.11 174

0.09256

0.07680

0.06383

0.05 313

0.04430

0.03699

0.0.3094

21

22

0.15018

0.1 2285

0.10067

0.08264

0.06796

a.05599

0.04620

0.038 19

0.03 162

0.02622

22

23

0.13778

0.11168

0.09069

0.07379

0.06014

0.04911

0.04017

0.03292

0.02 702

0.02222

23

24

0.12640

0.10153

0.08 170

0.065 88

0.05 323

0.04308

0.03493

0.02838

0.02310

0.01883

24

25

0.11597

0.092 30

0.07 61

0.058 82

0.04710

0.03779

0.03038

0.02447

0.01974

a.01596

25

rounded to five decimal places, where i is the interest rate per period and

The values in Table 11-2 were generated by the formula PV =

n is the total number of periods.

(1 + iy

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, advanced-math and related others by exploring similar questions and additional content below.Similar questions

- Suppose a 40-year old person deposits $8000 per year in an individual retirement account until age 65. Find the total in the account with the following assumption of an interest rate. (Assume quarterly compounding, with payments of $2000 made at the end of each quarter period.). Find the total amount of interest earned. 7% The total in the account $___. (Round to the nearest CENT as needed.)arrow_forwardFind the future value of the investment. (Round your answer to the nearest cent.) $4,000 for 4 years at 4.25%, compounded monthly $arrow_forwardA saving account earns 1.8% interest, compounded monthly. If 9,000$ is in the account, how much has been earned after 5 years?arrow_forward

- Given a nominal interest rate of 2.5% compounded daily (ie: compounded on each calendar day), determine the starting principal required to produce an accumulated amount of $10000 after a term of 5 years. Round your answer to the nearest dollar. Starting Principal = $ Checkarrow_forwardA principal amount of $14,390 is placed in a savings account with an annual interest rate of 4.13% compounded monthly. How much interest does the account earn after 21 years? $19,814.06 $19,865.03 $34,204.06 $34,255.03arrow_forwardFind the future value of the given present value. Use 360 days per year for your calculation. Present value of $2688 at 17% for 120 days. Show all formulas / work.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education

Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY

Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Advanced Engineering Mathematics

Advanced Math

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:9780073397924

Author:Steven C. Chapra Dr., Raymond P. Canale

Publisher:McGraw-Hill Education

Introductory Mathematics for Engineering Applicat...

Advanced Math

ISBN:9781118141809

Author:Nathan Klingbeil

Publisher:WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:9781337798310

Author:Peterson, John.

Publisher:Cengage Learning,