FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Use

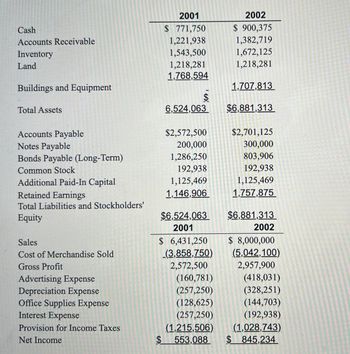

Transcribed Image Text:Cash

Accounts Receivable

Inventory

Land

Buildings and Equipment

Total Assets

Accounts Payable

Notes Payable

Bonds Payable (Long-Term)

Common Stock

Additional Paid-In Capital

Retained Earnings

Total Liabilities and Stockholders'

Equity

Sales

Cost of Merchandise Sold

Gross Profit

Advertising Expense

Depreciation Expense

Office Supplies Expense

Interest Expense

Provision for Income Taxes

Net Income

2001

$ 771,750

1,221,938

1,543,500

1,218,281

1,768,594

$

6,524,063

$2,572,500

200,000

1,286,250

192,938

1,125,469

1,146,906

$6,524,063

2001

$ 6,431,250

(3,858,750)

2,572,500

(160,781)

(257,250)

(128,625)

(257,250)

(1,215,506)

$ 553,088

2002

$ 900,375

1,382,719

1,672,125

1,218,281

1,707,813

$6,881,313

$2,701,125

300,000

803,906

192,938

1,125,469

1,757,875

$6,881,313

2002

$ 8,000,000

(5,042,100)

2,957,900

(418,031)

(328,251)

(144,703)

(192,938)

(1,028,743)

$ 845,234

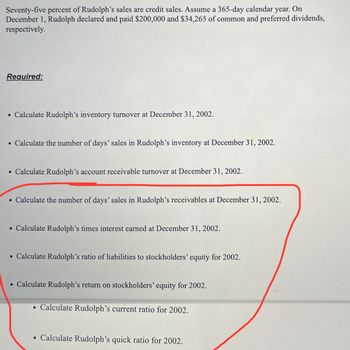

Transcribed Image Text:Seventy-five percent of Rudolph's sales are credit sales. Assume a 365-day calendar year. On

December 1, Rudolph declared and paid $200,000 and $34,265 of common and preferred dividends,

respectively.

Required:

• Calculate Rudolph's inventory turnover at December 31, 2002.

• Calculate the number of days' sales in Rudolph's inventory at December 31, 2002.

• Calculate Rudolph's account receivable turnover at December 31, 2002.

• Calculate the number of days' sales in Rudolph's receivables at December 31, 2002.

• Calculate Rudolph's times interest earned at December 31, 2002.

• Calculate Rudolph's ratio of liabilities to stockholders' equity for 2002.

• Calculate Rudolph's return on stockholders' equity for 2002.

• Calculate Rudolph's current ratio for 2002.

• Calculate Rudolph's quick ratio for 2002.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1) Where is the Standard Balance Sheet located in QuickBooks? 2) What is the purpose of a comparative balance sheet? 3) How is a balance sheet modified?arrow_forwardComplete the balance sheet with the data provided in the pictures. 1. Prepare Asset section (left side) List asset accounts and account balances Total asset amounts 2. Prepare Liabilities section (right side) List liability accounts and account balances Total liability amounts 3. Prepare Owner's Equity section (right side below liabilities) List owner's Capital and ENDING account balance 4. Total liabilities and owner's equity on same row as total assets. Do Assets = Liabilities + Owner's Equity?arrow_forwardBuild a T-account for each part of the expanded accounting equation. (1) Drag the debit "DR" and credit "CR" labels to the appropriate sides of the T-account. (2) Drag the normal balance label to the correct side of the T- account. (3) Label which side of the t-account increases "+" and decreases "" that account. view drag.and drop keyboard instructions Debit Normal Credit Balance Land Common Stock Dividends Depreciation Expense- Equipmerit Unearnied Revenue Service Revenuearrow_forward

- Don't write if you don't know and don't use ai otherwise I will give you multiple downvotes What are the main sections on a balance sheet? Assets, liabilities, income Assets, liabilities, equity Assets, liabilities, expenses Assets, gains, revenuearrow_forwardPlease provide the following formulas: 1. The Fundamental Accounting Equation 2. The Formula for Computing Net Income 3. The Formula for the Balance Sheet Part 3 Please give one or two examples of accounts in the following categories: Assets Liabilities Owner's Equity (provide only one example for this account) Revenue Expenses Please make sure that your initial post contains a properly cited reference. Please use APA style. You should cite your text as a minimum.arrow_forwardIn a T-account credits appear Group of answer choices A. on the left under assets but on the right under liabilities and stockholders’ equity. B. an the right under assets but on the left under liabilities and stockholders’ equity. C. always on the right. D. always on the left.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education