Understanding Business

12th Edition

ISBN: 9781259929434

Author: William Nickels

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Question

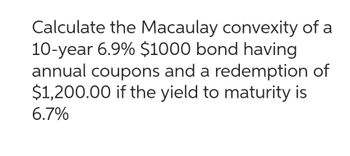

Transcribed Image Text:Calculate the Macaulay convexity of a

10-year 6.9% $1000 bond having

annual coupons and a redemption of

$1,200.00 if the yield to maturity is

6.7%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Similar questions

- What information is contained in a payoff table?arrow_forwardThe buyer and seller are scheduled to close the sales transaction on Wednesday, June 14. The taxes for the year were $3,500 and were paid in arrears. How would this appear on a closing statement? O A credit and debit to the seller. O A credit to the buyer and a debit to the seller. O A credit to the seller and a debit to the buver. • A credit and debit to the buyer.arrow_forwardKayla took out an amortized loan of $240,000 with a 5% interest rate. Her monthly payment is $1,288.37. How much will she pay in interest on her first monthly payment? $900 $1.200 $1,150 $1.000arrow_forward

- In 2019 Lisa and Fred a married couple had taxable income of $312000, if they were to file seperate returns Lisa would have reported taxable income of $129,000 and Fred would have reported taxable income of 183,000. What is the couple's marriage penaty or benefit?arrow_forwardAn industrial property’s first year annual NOI is projected to be $777,000, the property’s acquisition cap rate is 7.0%, and the lender’s maximum LTV is 70% of the purchase price. What is the maximum loan amount that can be borrowed against the property? Group of answer choices $11,100,000 $7,770,000 $3,330,000 $15,857,143arrow_forwardWhat are the interest cost and the total amount due on a six-month loan of $1,500 at 11.1 percent simple annual interest?arrow_forward

- Bill Matthews is investing $13,200 in the Washington Mutual fund. The fund charges a 5.75 percent commission when shares are purchased. Calculate the amount of commission Bill must pay.arrow_forwardLast year, Martina opened an investment account with $7200 . At the end of the year, the amount in the account had decreased by 24.5% . How much is this decrease in dollars? How much money was in her account at the end of last year? Decrease in amount: $ Year-end amount: $arrow_forwardYou deposited $540 in a saving account paying 2.8% simple interest. How much intrest will you earn in 7 years? Hou much is the account at the end of 7 years?arrow_forward

- Please don't hand writing suliutioarrow_forwardA new housing development has lots of packed earth and weeds, but no grass. Two neighbors make a wager on who will be the first to have a lush lawn. Mr. Furious knows that a lawn will not grow without grass seed, so he immediately buys the most expensive seed he can find because everyone knows that quality improves with price. Besides, he will recover the cost of the seed through his wager. Next, he stands knee deep in his weeds and tosses the seed around his yard. Confident that he has a headstart on his neighbor, who is not making much visible progress, he begins his next project. Ms. Slo N. Steady, having grown up in the country, proceeds to clear the lot, till the soil, and even alter the slope of the terrain to provide better drainage. She checks the soil’s pH, applies weed killer and fertilizer, and then distributes the grass seed evenly with a spreader. She applies a mulch cover and waters the lawn appropriately. She finishes several days after her neighbor, who asks if she…arrow_forward27.Options buyers who are delta-hedging (riskless hedge) would do which of the following in the underlying (asset) market. A. buy when the underlying market is falling and sell when it is rising. B. sell when the underlying market is falling and buy when it is rising. C. buy whether the underlying market is falling or rising. D. sell whether the underlying market is falling or rising.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON

Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning

Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON

Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON

Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Understanding Business

Management

ISBN:9781259929434

Author:William Nickels

Publisher:McGraw-Hill Education

Management (14th Edition)

Management

ISBN:9780134527604

Author:Stephen P. Robbins, Mary A. Coulter

Publisher:PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract...

Management

ISBN:9781305947412

Author:Cliff Ragsdale

Publisher:Cengage Learning

Management Information Systems: Managing The Digi...

Management

ISBN:9780135191798

Author:Kenneth C. Laudon, Jane P. Laudon

Publisher:PEARSON

Business Essentials (12th Edition) (What's New in...

Management

ISBN:9780134728391

Author:Ronald J. Ebert, Ricky W. Griffin

Publisher:PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:9780134237473

Author:Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:PEARSON