Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

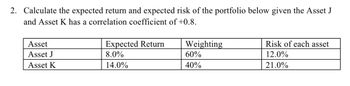

Transcribed Image Text:2. Calculate the expected return and expected risk of the portfolio below given the Asset J

and Asset K has a correlation coefficient of +0.8.

Asset

Asset J

Asset K

Expected Return

8.0%

14.0%

Weighting

60%

40%

Risk of each asset

12.0%

21.0%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider the information for assets A, B, and C below: Probability Return on A 0.2 0.4 0.4 State Boom Average Bust 0.3 0.2 0.1 Return on B Return on C 0.05 9.15 0.2 0.1 0.25 0.3 Consider Portfolio (Y) comprising 60% Asset A and 40% Asset C. What is the variance of portfolio Y™?arrow_forward1. The return over the risk free rate of 3.4% A. Real return B. Average return C. Risk premium D. Required return E. Inflation premiumarrow_forwardhf.3arrow_forward

- An asset has normally-distributed returns, with mean of 10.6% and standard deviation of 14.8%. What is the 2% VaR (value at risk) return? Enter answer in percents.arrow_forwardConsider the case of two financial assets and three market conditions (states). The tablebelow gives the respective probability for each market condition and the return of each assetin each one of them. Market Conditions State Recession Normal Expansion Probability of state 30% 40% 30% Return of asset A -30% 20% 55% Return of asset B -10% 70% 0% Consider the portfolio with 50% investment in each of the two assets above. Calculatethe expected return and the standard deviation of the portfolio.arrow_forwardRequired Return If the risk-free rate is 10.2 percent and the market risk premium is 4.4 percent, what is the required return for the market? Multiple Choice A. 5.8% B. 4.4% C. 14.6% D. 10.2%arrow_forward

- What is the standard deviation of the portfolio that invests equally in all three assets M, N, and O?arrow_forwardExpected return (Kj)arrow_forwardAsset Y has a beta of 1.2. The risk-free rate of return is 6 percent, while the return on the market portfolio of assets is 12 percent. The asset's market risk premium isarrow_forward

- WHAT IS ECONOMIC LIFE OF ASSET?arrow_forwardWhat is the expected return on asset A if the expected return on the market is 8%, the risk-free rate is 4%, and the Beta of asset A is 2? You want to use Capital Asset Pricing Model (CAPM) Group of answer choices A) 12% B) 20% C) 16%arrow_forward2. Assuming the following: Average Return (Risky Portfolio) 3.86% Standard Dev (Risky Portfolio) 10.56% Average Risk Free Rate 2.18% Return on Risk Free Asset Avg 4.15% Using the formula: E(rc)=rf + y* (E(rp) - rf) Solve for: 1. % of Risky Assets (y): 2. % of Risk Free Assets (1-y): Note: You wish to generate a 7% return for your complete portfolio E(rc)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education