FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

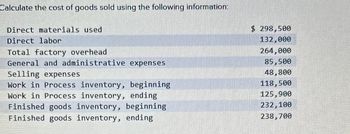

Transcribed Image Text:Calculate the cost of goods sold using the following information:

Direct materials used

$ 298,500

Direct labor

132,000

Total factory overhead

264,000

General and administrative expenses

85,500

Selling expenses

48,800

Work in Process inventory, beginning

118,500

Work in Process inventory, ending

Finished goods inventory, beginning

Finished goods inventory, ending

125,900

232,100

238,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Here is selected data for Lori Corporation: Cost of raw material purchased Cost of requisitioned direct materials Cost of requisitioned indirect materials Direct labor Manufacturing overhead incurred Cost of goods completed Cost of goods sold $77,000 43,000 3,000 80,000 100,000 233,500 OA. credit to Work-in- Process Inventory account for $237,500 OB. debit to Finished Goods Inventory account for $237,500 OC. debit to Finished Goods account for $233,500 OD. debit to Work-in-Process Inventory account for $233,500 142,000 17,000 32,000 35,000 130% Beginning raw materials inventory Beginning work in process inventory Beginning finished goods inventory Manufacturing overhead allocation rate (based on direct labor) The journal entry to transfer completed goods to the finished goods inventory account would include aarrow_forwardCost of Goods Sold, Cost of Goods Manufactured Princeton 3 Company has the following information for May: Cost of direct materials used in production $66,000 Direct labor 73,000 Factory overhead 37,000 Work in process inventory, May 1 59,000 Work in process inventory, May 31 58,750 Finished goods inventory, May 1 25,000 Finished goods inventory, May 31 19,000 Question Content Area a. For May, using the data given, prepare a statement of Cost of Goods Manufactured. Princeton 3 CompanyStatement of Cost of Goods Manufacturedblank $- Select - $- Select - - Select - - Select - Total manufacturing costs incurred during May fill in the blank 47477f001f8204f_9 Total manufacturing costs $fill in the blank 47477f001f8204f_10 - Select - Cost of goods manufactured $fill in the blank 47477f001f8204f_13 Question Content Area b. For May, using the data given, prepare a statement of Cost of Goods…arrow_forwardCost of Goods Sold, Cost of Goods Manufactured Princeton 3 Company has the following information for May: Cost of direct materials used in production $17,300 Direct labor 44,700 Factory overhead 28,800 Work in process inventory, May 1 72,100 Work in process inventory, May 31 76,400 Finished goods inventory, May 1 30,300 Finished goods inventory, May 31 34,600 Question Content Area a. For May, using the data given, prepare a statement of Cost of Goods Manufactured. Princeton 3 CompanyStatement of Cost of Goods Manufacturedblank $- Select - $- Select - - Select - - Select - Total manufacturing costs incurred during May fill in the blank 22653a05d041061_9 Total manufacturing costs $fill in the blank 22653a05d041061_10 - Select - Cost of goods manufactured $fill in the blank 22653a05d041061_13 Question Content Area b. For May, using the data given, prepare a statement of Cost of Goods…arrow_forward

- Please help me with show calculation thankuarrow_forwardKeeton Company had the following data: Cost of materials used $60,000 Direct labor costs 58,000 Factory overhead 33,000 Work in process inventory, beginning 29,000 Work in process inventory, ending 18,000 Finished goods inventory, beginning 32,000 Finished goods inventory, ending 18,000 Determine the cost of goods sold.$fill in the blank 1arrow_forwardUse the cost information below for ABC Corporation to find the cost of goods manufactured (COGM) for the current year: Direct materials used Direct labor Total factory overhead Work in process inventory, beginning Work in process inventory, ending Multiple Choice $24,500. $15,200. $18,400. $19,300. $ 6,600 8,600 6,700 4,600 7,200arrow_forward

- Here are selected data for Ramalingagowda Company: Cost of goods manufactured $320,000 Work in process inventory, beginning 109,000 Work in process inventory, ending 104,000 Direct materials used 73,000 Manufacturing overhead is allocated at 50% of direct labor cost. What was the approximate amount of manufacturing overhead costs? Select one: a. $161,333 b. $80,667 c. $242,000 d. $78,000 e. $151,250arrow_forwardCost of Goods Sold, Cost of Goods Manifactured Glenville Company has the following information for April; Cost of direct materials used in production $41,000 Direct labor 55,000 Factory overhead 30, 000 Work in process inventory, April 1, 25,000 Work in process inventory, April 30, 41, 000 Finished goods mventory, April 1, 21,000 Finished goods inventory, Apnt 30, 17, 000 a. For April, determine the cost of goods manufactured. Using the data given, prepare a statement of Cost of Goods Manufactured. Glenville Company Statement of Cost of Goods Manufactured Total manufacturing costs incurred in April Total manufacturing costsarrow_forwardGiven the following information, determine the cost of goods manufactured. Direct Labor Incurred $64,000 180,000 Manufacturing Overhead Incurred Direct Materials Used 155,000 197,000 98,000 220,500 110,000 Finished Goods Inventory, Jan. 1 Finished Goods Inventory, Dec. 31 Work-in - Process Inventory, Jan. 1 Work-in - Process Inventory, Dec. 31 O A. $185,000 B. $509,500 OC. $289,000 O D. $399,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education