Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

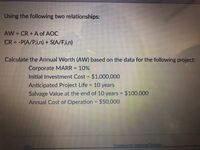

Transcribed Image Text:Using the following two relationships:

AW = CR + A of AOC

CR = -P(A/P,i,n) + S(A/F,i,n)

%3D

Calculate the Annual Worth (AW) based on the data for the following project:

Corporate MARR = 10%

Initial Investment Cost $1,000,000

Anticipated Project Life = 10 years

Salvage Value at the end of 10 years $100,000

Annual Cost of Operation

%3D

$50,000

10%

Compound Interest Factors

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Required information A company that manufactures magnetic flow meters expects to undertake a project that will have the cash flows estimated. First cost, $. Equipment replacement cost in year 2, $ Annual operating cost, $/year Salvage value, $ Life, years -870,000 -300,000 -920,000 250,000 4 At an interest rate of 10% per year, what is the equivalent annual cost of the project? Find the AW value using tabulated factors. The equivalent annual cost of the project is $-1arrow_forward24arrow_forwardNPV and EVA A project cost $2.3 million up front and will generate cash flows in perpetuity of $220,000. The firm's cost of capital is 9%. a. Calculate the project's NPV. b. Calculate the annual EVA in a typical year. c. Calculate the overall project EVA. a. The project's NPV is $ (Round to the nearest dollar.)arrow_forward

- Compare the Annual Worth of the two systems and identify the better option at MARR = 10% per year: Solar: First cost $1,500,000; AOC $-700,000; Salvage value $100,000; Life of 8 years Geothermal: First cost $2,250,000; AOC $-600,000; Salvage value $50,000; Life of 8 years Select the Geothermal System with a calculated AW of $-1,017,368 Select the Geothermal System with a calculated AW of $-727,591 Select the Solar System with a calculated AW of $-1,238, Select the Solar System with a calculated AW of $-972,416arrow_forwardCash Payback Period A project has estimated annual net cash flows of $37,500. It is estimated to cost $127,500. Determine the cash payback period. Round your answer to one decimal place. yearsarrow_forwardNPV and EVA A project cost $3.2 million up front and will generate cash flows in perpetuity of $270,000. The firm's cost of capital is 8%. a. Calculate the project's NPV. b. Calculate the annual EVA in a typical year. c. Calculate the overall project EVA. a. The project's NPV is $. (Round to the nearest dollar.) ibra culat ource Enter your answer in the answer box and then click Check Answer. Check Ans udy Clear All 2 parts remaining Lation Tools> pe here to searcharrow_forward

- Q1: For the machines indicated below. Consider i= 10% per year First cost Annual cost Salvage value Life duration Machine A 20,000 $ 5,000 $ 7,500 $ 3 Machine B 25,000 4,000 6,000 4 A- Draw cash flow diagram for each machine for one cycle of each project B- Draw cash flow diagram for each project considering the LCM life cycle (Hint: different project duration, need to have the LCM life cycle) C- Compare the machines to select best alternative one based on Present worth analysis method D- Repeat part B considering Future worth analysisarrow_forwardCash Payback Period A project has estimated annual net cash flows of $39,500. It is estimated to cost $201,450. Determine the cash payback period. Round your answer to one decimal place.arrow_forwardRequired information A company that manufactures magnetic flow meters expects to undertake a project that will have the cash flows estimated. First cost, $ Equipment replacement cost in year 2, $ Annual operating cost, $/year Salvage value, $ Life, years -880,000 -300,000 -930,000 250,000 14 At an interest rate of 10% per year, what is the equivalent annual cost of the project? Find the AW value using tabulated factors The equivalent annual cost of the project is $- 980,731.95arrow_forward

- please answer question belowarrow_forwardYou are considering the following project. What is the NPV of the project? WACC of the project: 0.10 Revenue growth rate: 0.05 Tax rate: 0.40 Revenue for year 1: 13,000 Fixed costs for year 1: 3,000 variable costs (% of revenue): 0.30 project life: 3 years Economic life of equipment: 3 years Cost of equipment: 20,000 Salvage value of equipment: 4,000 Initial investment in net working capital: 2,000arrow_forwardwhat is the NPV of the new construction equipment? Initial cost = $100k, Salvage Value in 6 yrs = $25K, Increase Yearly Net Sales = $25k, Bank Rate = 10%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education