FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

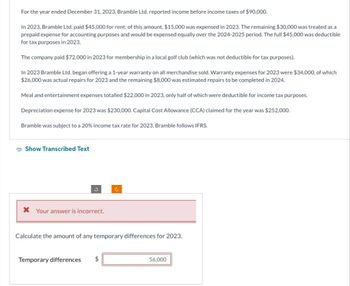

Transcribed Image Text:For the year ended December 31, 2023, Bramble Ltd. reported income before income taxes of $90,000.

In 2023, Bramble Ltd. paid $45,000 for rent; of this amount, $15,000 was expensed in 2023. The remaining $30,000 was treated as a

prepaid expense for accounting purposes and would be expensed equally over the 2024-2025 period. The full $45,000 was deductible

for tax purposes in 2023.

The company paid $72,000 in 2023 for membership in a local golf club (which was not deductible for tax purposes).

In 2023 Bramble Ltd. began offering a 1-year warranty on all merchandise sold. Warranty expenses for 2023 were $34,000, of which

$26,000 was actual repairs for 2023 and the remaining $8,000 was estimated repairs to be completed in 2024.

Meal and entertainment expenses totalled $22,000 in 2023, only half of which were deductible for income tax purposes.

Depreciation expense for 2023 was $230,000. Capital Cost Allowance (CCA) claimed for the year was $252,000.

Bramble was subject to a 20% income tax rate for 2023. Bramble follows IFRS.

Show Transcribed Text

S

* Your answer is incorrect.

Temporary differences

Calculate the amount of any temporary differences for 2023.

C

$

56,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- For the break of Thanksgiving to Christmas On June 1 2023 Cost of trip $5,000 Sweeden On June 1 2025 and June 1 2026 & June 1 2027 and June 1 2032 Cost for each trip is $7,000 June 1 2037 cost of trip $4,500 and $4950. Assume 8% annual interest rate through out What are the investment rents that need to make on 6/1/2021 and 6/1/2022 if they need to have $30,000 saved on 6/1/2023 to fund future trips? Thank you Brendaarrow_forward3 The forward rate is 0.8500-0.8650 euros to the 1$ What will a euro 2,000 receipt be converted to at the forward rate? A.$1,730 B.$2,312 C.$2,353 D. $1,700arrow_forwardInterest coverage Ratio 2018 AGL Energy 17.98 Origin Energy Energy Australia 2019 2020 2021 2022 14.82 18.75 -16.41 23.08 4.80 2.59 14.03 -5.80 12.87 Please analyse AGL energy interest coverage ratio compare to its competitors 1.71 -5.53 2.19 -1.61arrow_forward

- how to we solve thisarrow_forwardparesharrow_forwardHere are direct spot and forward markets quotes for EUR over three points in time: now (1/1/XX), one month later (2/1/XX), three months later (4/1/XX), and six months later (7/1/XX). 1/1/XX 2/1/XX 4/1/XX 7/1/XX EUR Spot 1.3075 1.3006 1.3605 1.3296 1 Month Forward 1.3271 1.3201 1.3809 1.3496 3 Month Forward 1.3470 1.3399 1.4016 1.3698 6 Month Forward 1.3672 1.3600 1.4226 1.3904 On 1/1/XX, Dell sold a 6 month forward contract of EUR 1,000,000 to Chase. As a result IBM will incur a when the contract expires: O Loss of $37,600 O Profit of $37,600 O Loss of $23,00 O Profit of $23,000arrow_forward

- Use the information below to answer the questions that follow. Japanese yen Japanese yen 6 month Australian dollar Australian dollar 3 month U.S. $ EQUIVALENT .00916 .00899 .7748 .7751 a. Yen b. Australian dollar c. Dollar relative to yen d. Dollar relative to A$ CURRENCY PER U.S. $ 109.20 111.21 1.2907 1.2902 a. Is the yen selling at a premium or a discount? b. Is the Australian dollar selling at a premium or a discount? c. Do you expect the value of the dollar to increase or decrease relative to the value of the yen? d. Do you expect the value of the dollar to increase or decrease relative to the value of the Australian dollar?arrow_forwardPlease answer two question. I will give upvotearrow_forwardThe EUR/USD quotes 1.1295-1.1305 and you implement a long position for 100,000 €. 2 days later the EUR/USD shows 1.1431-1.1441. What is your P&L? a)1260 $ b)1460 $ c)1260 € d)1460 €arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education