Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

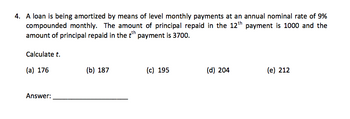

Transcribed Image Text:4. A loan is being amortized by means of level monthly payments at an annual nominal rate of 9%

compounded monthly. The amount of principal repaid in the 12th payment is 1000 and the

amount of principal repaid in the tth payment is 3700.

Calculate t.

(a) 176

Answer:

(b) 187

(c) 195

(d) 204

(e) 212

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- what are 5 types of assets not included ob balance sheet?arrow_forwardHambelton Ltd. issued $5,000,000 of 5% bonds payable on 1 September 20X9 to yield 4%. Interest on the bonds is paid semi-annually and is payable each 28 February and 31 August. The bonds were dated 1 March 20X8, and had an original term of five years. The accounting period ends on 31 December. The effective-interest method is used. (PV of $1, PVA of $1, and PVAD of $1.) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the price at which the bonds were issued. (Round time value factor to 5 decimal places. Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount.) Price of Bond 2. Prepare a bond amortization table for the life of the bond. (Round time value factor to 5 decimal places. Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no cells blank - be certain to enter "O" wherever required.) Interest Interest Premium Unamortized Net Bond Date Payment Expense…arrow_forwardbdhdhdjdjdjjdis plz dont answer current ration in the following: Current Asset $20000., Current Liability $20000arrow_forward

- FV(Quar.) = $100(1.03)20 = $arrow_forward9. What is the capital balance of Tak at December 31, 20x2? 28 A a. P180,000 b. P170,000 c. P165,000 d. Not given SIXOS mot and 100 to stile si 10. What is the capital balance of Gu at December 31, 20x2? a. P220,000 b. P215,000 c. P200,000 d. Not given 007 0902 3 nevig Vo ordub juongoro att mi to side odd ei four we 17 000.08 I s 000.079 000/03/1 8arrow_forwardCalculate: 이니 D where D=3.54, and r=0.135arrow_forward

- A direct quote of €0.1256/Dkr is equivalent to an indirect quote of a . Dkr 7.962/€ b . Dkr 7.8654/€ c . Dkr 0.8654/€ d . Dkr 1.1345/€arrow_forwardThe answer is 1,130.55arrow_forwardWhich of the following is true?a. FASB creates SEC.b. GAAP creates FASB.c. SEC creates CPA.d. FASB creates GAAP.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education