Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Calculate

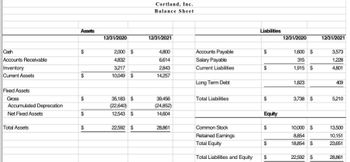

Transcribed Image Text:Cash

Accounts Receivable

Inventory

Current Assets

Fixed Assets

Gross

Accumulated Deprecation

Net Fixed Assets

Total Assets

Assets

$

$

$

$

$

12/31/2020

2,000 $

4,832

3,217

10,049 $

35,183 $

(22,640)

12,543 $

22,592 $

Cortland, Inc.

Balance Sheet

12/31/2021

4,800

6,614

2,843

14,257

39,456

(24,852)

14,604

28,861

Accounts Payable

Salary Payable

Current Liabilities

Long Term Debt

Total Liabilities

Common Stock

Retained Earnings

Total Equity

Total Liabilities and Equity

Liabilities

$

$

$

Equity

$

$

60

$

10

12/31/2020

1,600 $

315

1,915 $

1,823

3,738 $

10,000 $

8,854

18,854 $

22,592 $

12/31/2021

3,573

1,228

4,801

409

5,210

13,500

10,151

23,651

28,861

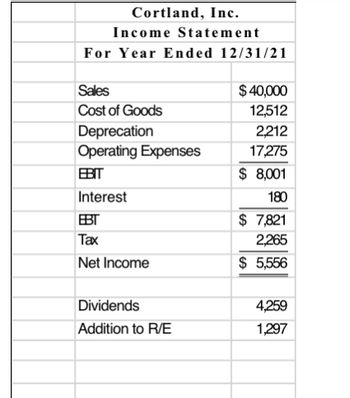

Transcribed Image Text:Cortland, Inc.

Income Statement

For Year Ended 12/31/21

Sales

Cost of Goods

Deprecation

Operating Expenses

EBIT

Interest

EBT

Tax

Net Income

Dividends

Addition to R/E

$ 40,000

12,512

2,212

17,275

$ 8,001

180

$ 7,821

2,265

$ 5,556

4,259

1,297

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You hold an equally-weighted Year 2018 2019 2020 (half invested in each) portfolio consisting of two stocks A and B, whose returns for the past three years are given below. Stock A Stock B 28% -14% -8% 22% 12% 2% What are the average return and standard deviation of your portfolio AB? Average return is Round your answer to a whole number, e.g., xor xx. (Hint: Think of portfolio return each year) %, standard deviation isarrow_forwardFinancearrow_forwardThe cost of equity and dividends are known to the picture.calculate the value of Ve, according to the multi-period dividend discount modelarrow_forward

- Using the value-to-book version of the residual income valuation approach, the value-to-book ratio is determined as a. one plus the present value of future residual ROCE. b. one plus the present value of future comprehensive income divided by book value of common equity. c. book value of common equity capital at the beginning of the period multiplied by the required rate of return on common equity capital. d. market value of common equity plus the present value of expected future residual income. A firm's value-to-book ratio might be greater than 1.0 due to fundamental reasons. An example of a fundamental reason that would cause the value-to-book ratio to increase is a. creating growth in profitable operations that generate ROCE that exceeds RE. b. increasing risk. c. being profitable. d. growth in shareholders' equity by issuing stock.arrow_forwardSuppose that the average income in 1954 was 1,050£. Suppose further that the CPI in 1954 was 35.3, and that the CPI in 2021 is 1,021.5. What is the 2020 value of the 1954 average income?arrow_forwardYou had the following rates of return for on your portfolio for the last four years: 2019: -10.1%2020: 15.4%2021: 7.3%2022: 12.8%Calculate the geometric average return on your portfolio. Enter your answer as a decimal, rounded to four decimal places.arrow_forward

- 9. 10. Use the information below and the P/E as an Earnings Multiplier Model to find this stock's intrinsic value and determine whether it's over or under valued if its current price is $71.32. 2020 2021 2022 2023 2024 61.57 39.25 60.93 73.70 9.70 4.56 26.68 6.80 1.34 16.52 4.30 7.00 .60 .70 .80 .65 39.55 45.00 95.00 93.00 97.19 15.0 Bold figures are 21 .86 Value Line estimates 1.1% 1.2% 50 .80 64 76.35 70.79 124.24 107.76 37.7 3.9 1.94 1.2% VALUE LINE PUB. LLC 77.95 Revenues per sh 11.70 "Cash Flow" per sh 8.50 Earnings per sh A .88 Div'ds Decl'd per sh C .65 Cap'l Spending per sh 51.35 Book Value per sh Common Shs Outst'g B Avg Ann'l P/E Ratio Relative P/E Ratio Avg Ann'l Div'd Yield A stock selling for $20 has an intrinsic value of $10. Is it over or under valued?arrow_forwardBy investing in a particular stock, a person can make a profit in one year of $3900 with probability 0.4 or take a loss of $800 with probability 0.6. What is this person's expected gain?arrow_forwardUse the dividend discount model to value a share of Toyota’s stock (ticker symbol: TM) as of December 31, 2021. In your application of this model, use the data provided on the most recent Toyota Value Line report to estimate the necessary dividend payment and the firm’s equity beta. Assume, that the expected growth rate of dividends in perpetuity (g) ranges from 2.5% to 3.5%/year.arrow_forward

- Quarterly Rates of return are calculated for all properties included in the index and are based on Which two distinct components of return?arrow_forwardAn analyst produces the following series of annual dividend forecasts for company D: Expected dividend (end of) year t+1 = 10 euros; Expected dividend (end of) year t+2 = 20 euros; Expected dividend (end of) year t+3 = 10 euros. The analyst further expects that company D dividend will grow indefinitely at a rate of 2 percent after year t+3. Company D cost of equity equals 10 percent. Under these assumptions, calculate the analysts estimate of company D equity value at the end of year t.arrow_forwardUse a dividend growth model to value a share with a next-period dividend of Euro 1.00 and expected dividend growth for the foreseeable future of 5 %. Assume a discount rate of 12%. a) 14.29b) 12.45c) 10.45d) 1.05arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education