FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

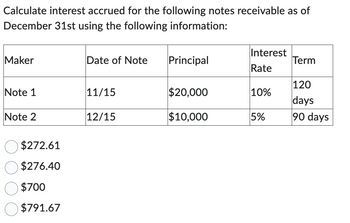

Transcribed Image Text:Calculate interest accrued for the following notes receivable as of

December 31st using the following information:

Maker

Note 1

Note 2

$272.61

$276.40

$700

$791.67

Date of Note

11/15

12/15

Principal

$20,000

$10,000

Interest

Rate

10%

5%

Term

120

days

90 days

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Determine Due Date and Interest on Notes Determine the due date and the amount of interest due at maturity on the following notes: Date of Note Face Amount Interest Rate Term of Note a. January 10* $40,000 5% 90 days b. March 19 18,000 8. 180 days C. June 5 90,000 7 30 days d. September 8 36,000 3 90 days November 20 27,000 60 days е. *Assume that February has 28 days. Assume 360-days in a year when computing the interest. Note Due Date Interest a. С. d. е. II b.arrow_forwardAccrued Interest Receivable The following is a list of outstanding notes receivable as of December 31, 20--: Maker Date of Note Principal Interest Term No. of Days K. Savelin 12/15/-- $1,500 5% 60 days 16 R. Hillier 12/3/-- 4,800 6 90 28 B. Miranda 11/30/-- 3,200 8 90 31 R. Hansen 11/18/-- 7,300 7 120 43 Required: Question Content Area 1. Compute the accrued interest at the end of the year. Round interim calculations and final answer to the nearest cent. Assume 360 days in a year.arrow_forward4. AB company receives $10,000 for a 6 month, 8% note on 11/1/20. Prepare the journal entry for the receipt. Account Debit Credit 5. Prepare the journal entry to accrue interest on the above note at 12/31/20. Account Debit Credit 6. Prepare the entry to record payment of the above note in full on it's due date of 5/1/21. Account Debit Credit 7. AB Company purchases a truck in the amount of $15,000. Additional costs include sales tax of $1500, painting of $2500, license of $150 and a 1 year auto insurance policy of $1200. Complete the journal entry for the auto purchase. Account Debit Creditarrow_forward

- Accrued Interest PayableCompute the interest accrued on each of the following notes payable owed by Northland, Inc., on December 31:Use 360 days for calculations and round the nearest dollar. Lender Date of Note Principal Interest Rate (%) Term Maple 11/21 $18,000 10 120 days Wyman 12/13 5,000 8 90 days Nahn 12/10 16,000 12 60 days Lender Accrued Interest Maple Answer Wyman Answer Nahn Answerarrow_forwardDetermine the due date and the amount of interest due at maturity on the following notes: Date of note Face amount Interest Rate Term of Note a. January 6 b. March 23 40,000 9,000 9% 45 days 10 60 days c. May 30 12,000 12 90 days d. August 30 18,000 10 120 days e. October 1 10,500 8 60 days Due Date Interest a. Feb. 20 b. May 22 c. Aug. 28 d. Dec. 28 e. Nov. 30arrow_forwardMaturity Dates of Notes Receivable Determine the maturity date and compute the interest for each of the following notes: (Round to the nearest dollar.)\table[[,\table[[Date of], [Note]], Interest,], [a., August 5, $12,000,9%, 120 days], [b., May 10, 33,600,7%, 90 days ], [c., October 20, 48,000, 12%, 45 days], [d., July 16,9,000, 10%, 60 days], [e., September 15, 19,000,7%,75 days]]arrow_forward

- please make the answer look goodarrow_forwardPlease provide an answer as per the possibilityarrow_forwardCalculate the due date, interest due, and maturity value of the following notes: Date of Note Face Amount Interest Rate Term of Note Due Date Interest Due Maturity Value a. 24-Apr $70,000 3% 60 days b. 13-Jul 30,000 5% 120 days c. 9-Aug 40,000 4% 45 days d. 12-Sep 60,000 8% 90 days e. 5-Nov 50,000 6% 30 daysarrow_forward

- please answer do not image formatarrow_forwardThe maturity value of a $183,600, 11%, 40-day note receivable dated July 3 is a.$185,844 b.$183,600 c.$192,576 d.$203,796arrow_forwardInterest on note: $1,137.50interest rate: 10%Note dated: 3/17/2024Note due date: 10/13/2024Days in year (ordinary interest) 3601.What is the term of the loan (in days)?2. What is the principal in on the note?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education