FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

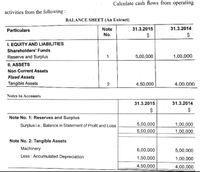

Transcribed Image Text:Calculate cash flows from operating

activities from the following :

BALANCE SHEET (An Extract)

Particulars

Note

31.3.2015

31.3.2014

No.

$

I. EQUITY AND LIABILITIES

Shareholders' Funds

Reserve and Surplus

1

5,00,000

1,00,000

II. ASSETS

Non Current Assets

Fixed Assets

Tangible Assets

2

4.50,000

4,00.000

Notes to Accounts

31.3.2015

31.3.2014

$

Note No. 1: Reserves and Surplus

Surplus i.e., Balance in Statement of Profit and Loss

5,00,000

1,00,000

1,00,000

5,00,000

Note No. 2: Tangible Assets

Machinery

6,00,000

5,00,000

Less : Accumulated Depreciation

1,50,000

1,00,000

4,50,000

4,00,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information Exercise 12-12 (Algo) Indirect: Preparing statement of cash flows LO P2, P3, A1 [The following information applies to the questions displayed below.) The following financial statements and additional information are reported. IKIBAN INCORPORATED Comparative Balance Sheets At June 30 Assets Cash Accounts receivable, net Prepaid expenses Inventory Total current assets Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable Wages payable Income taxes payable Total current liabilities Notes payable (long term) Total liabilities Equity Common stock, $5 par value Retained earnings Total liabilities and equity 2021 2020 $ 95,500 95,000 $ 64,000 83,800 71,000 116,500 6,400 9,400 280,700 260,900 144,000 (37,000) $ 387,700 $ 45,000 8,000 135,000 (19,000) $ 376,900 $ 60,000 19,000 7,800 5,400 58,400 86,800 50,000 80,000 108,400 166,800 260,000 180,000 19,300 30,100 $ 387,700 $ 376,900 Sales IKIBAN INCORPORATED Income Statement For…arrow_forwardA comparative balance sheet and an income statement for Burgess Company are given below: Burgess Company Comparative Balance Sheet (dollars in millions) Assets Current assets: Cash and cash equivalents Accounts receivable. Inventory Total current assets Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment. Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Accrued liabilities. Income taxes payable Total current liabilities Bonds payable Total liabilities. Stockholders' equity: Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Burgess Company Income Statement (dollars in millions) Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income. Nonoperating items: Gain on sale of equipment Income before taxes. Income taxes Net income Burgess also provided the following information: $ 4,180 2,860 1,320 912 408 2 410 144 $ 266…arrow_forwardProblem 21-4 (Algo) Statement of cash flows; direct method [LO21-3, 21-8] The comparative balance sheets for 2021 and 2020 and the statement of income for 2021 are given below for Dux Company. Additional information from Dux's accounting records is provided also. DUX COMPANYComparative Balance SheetsDecember 31, 2021 and 2020($ in thousands) 2021 2020 Assets Cash $ 72 $ 27 Accounts receivable 41 56 Less: Allowance for uncollectible accounts (3 ) (2 ) Dividends receivable 6 5 Inventory 95 90 Long-term investment 27 24 Land 95 75 Buildings and equipment 194 220 Less: Accumulated depreciation (34 ) (60 ) $ 493 $ 435 Liabilities Accounts payable $ 76 $ 83 Salaries payable 7 10 Interest payable 10 5 Income tax payable 5 7 Notes payable 20 0 Bonds…arrow_forward

- PB4. LO 16.3 Use the following information from Isthmus Company's financial statements to prepare the operating activities section of the statement of cash flows (indirect method) for the year 2018. Dec. 31, 2018 Dec. 31, 2017 Cash Account Receivable Inventory Accounts Payable Salaries Payable $295,000 45,300 92,200 23,000 1,700 $259,000 48,700 91,000 26,300 1,500 Additional information: Net income 45,200 33,300 Depreciation expensearrow_forwardHighlight the Net cash provided by Operating Activities for the Statement of Cash Flows Highlight the Net cash provided by Financing Activities for the Statement of Cash Flows Highlight the net change in cash for the period on the Statement of Cash Flowsarrow_forwardTrent Co. reports the following information: Net cash provided by operating activities Average current liabilities Average long-term liabilities Dividends paid Capital expenditures Purchase of treasury stock Payments of debt Trent's free cash flow is O $20000. O $90000. O $210000. O $310000. $430000 300000 200000 120000 220000 22000 70000-arrow_forward

- Question Content Area Comprehensive: Balance Sheet from Statement of Cash Flows Mills Company prepared the following balance sheet at the beginning of 2016: Balance SheetJanuary 1, 2016 Assets Liabilities and Shareholders' Equity Cash $ 1,000 Accounts payable $ 4,000 Accounts receivable (net) 3,900 Salaries payable 1,100 Inventory 4,700 Total Liabilities $ 5,100 Land 9,800 Common stock, $10 par 13,500 Buildings and equipment 68,900 Additional paid-in capital 11,200 Less: Accumulated depreciation (14,100) Retained earnings 44,400 Total Assets $ 74,200 Total Liabilities and Shareholders' Equity $74,200 At the end of 2016, Mills prepared the following statement of cash flows: Statement of Cash FlowsFor Year Ended December 31, 2016 Operating Activities: Net income $ 5,400 Adjustments for differences between income flowsand cash flows from operating activities: Add: Depreciation expense 1,900 Decrease in…arrow_forwardExercise 12-12 (Algo) Indirect: Preparing statement of cash flows LO P2, P3, A1 The following financial statements and additional information are reported. IKIBAN INCORPORATED Comparative Balance Sheets At June 30 2021 2020 Assets Cash $ 102,700 $ 52,000 Accounts receivable, net 77,000 59,000 Inventory 71,800 98,500 Prepaid expenses 5,200 7,000 Total current assets 256,700 216,500 Equipment 132,000 123,000 Accumulated depreciation—Equipment (31,000) (13,000) Total assets $ 357,700 $ 326,500 Liabilities and Equity Accounts payable $ 33,000 $ 42,000 Wages payable 6,800 16,600 Income taxes payable 4,200 5,400 Total current liabilities 44,000 64,000 Notes payable (long term) 38,000 68,000 Total liabilities 82,000 132,000 Equity Common stock, $5 par value 236,000 168,000 Retained earnings 39,700 26,500 Total liabilities and equity $ 357,700 $ 326,500 IKIBAN INCORPORATED Income Statement For Year Ended June 30, 2021 Sales…arrow_forwardRequired Information Exercise 12-12 (Static) Indirect: Preparing statement of cash flows LO P2, P3, A1 [The following information applies to the questions displayed below.] The following financial statements and additional information are reported. IKIBAN INCORPORATED Comparative Balance Sheets 2021 2020 $ 87,500 65,000 $ 44,000 51,000 86,500 At June 30 Assets Cash Accounts receivable, net Inventory Prepaid expenses Total current assets Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable Wages payable Income taxes payable Total current liabilities Notes payable (long term) Total liabilities Equity Common stock, $5 par value Retained earnings Total liabilities and equity Sales Cost of goods sold IKIBAN INCORPORATED Income Statement 63,800 4,400 5,400 220,700 186,900 124,000 (27,000) $ 317,700 $ 25,000 115,000 (9,000) $292,900 $ 30,000 15,000 3,800 6,000 3,400 34,400 48,800 30,000 60,000 64,400 108,800 220,000 160,000 33,300 $317,700 24,100…arrow_forward

- Using the information given below calculate the cash flow from financing for Year 2. Year 1 Year 2 Cash 10.0 20.0 Receivables 30.0 35.0 Net property plant and equipment 50.0 60.0 Total assets 90.0 115.0 Payables 10.0 20.0 Debt 30.0 10.0 Common stock 5.0 15.0 Retained earnings 45.0 70.0 Total liabilities and equity 90.0 115.0 Net income 32.0 48.0 Select one: (53.0) (33.0) 13.0 (13.0)arrow_forwardSunland Co. reports the following information: Net cash provided by operating activities Average current liabilities Average long-term liabilities Dividends paid Capital expenditures Purchase of treasury stock Payments of debt Sunland's free cash flow is $192000. $292000. $62000. O $16000. $422000 314000 214000 130000 230000 23000 72000arrow_forwardCash received from long-term notes payable Purchase of investments Cash dividends paid Interest paid Financing Activities $ 56,000 14, 200 Compute cash flows from financing activities using the above company information. Note: Amounts to be deducted should be indicated by a minus sign. $ 45,600 22,800 0arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education