ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

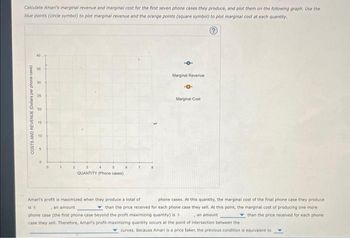

Transcribed Image Text:Calculate Amari's marginal revenue and marginal cost for the first seven phone cases they produce, and plot them on the following graph. Use the

blue points (circle symbol) to plot marginal revenue and the orange points (square symbol) to plot marginal cost at each quantity.

Ⓒ

9

8

COSTS AND REVENUE (Dollars per phone case)

30

25

20

15

10

A

2

QUANTITY (Phone cases)

Marginal Revenue

-0-

Marginal Cost

is s

Amari's profit is maximized when they produce a total of

phone cases. At this quantity, the marginal cost of the final phone case they produce.

an amount

than the price received for each phone case they sell. At this point, the marginal cost of producing one more

phone case (the first phone case beyond the profit maximizing quantity) is

an amount

than the price received for each phone

case they sell. Therefore, Amari's profit-maximizing quantity occurs at the point of intersection between the

curves. Because Amari is a price taker, the previous condition is equivalent to

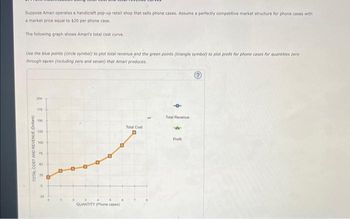

Transcribed Image Text:Suppose Amari operates a handicraft pop-up retail shop that sells phone cases. Assume a perfectly competitive market structure for phone cases with

a market price equal to $20 per phone case.

The following graph shows Amari's total cost curve.

Use the blue points (circle symbol) to plot total revenue and the green points (triangle symbol) to plot profit for phone cases for quantities zero

through seven (including zero and seven) that Amari produces.

TOTAL COST AND REVENUE (Dollars)

200

175

150

125

100

50

A

0

QUANTITY (Phone cases)

Total Cost

Total Revenue

Profit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A young Thomas Edison makes 20 light bulbs a week in his dorm room. The parts for each light bulb cost $2.25. He sells each light bulb for $5.25. General Electric offers Thomas an executive job that pays $55.00 a week. Thomas’s weekly economic profit from making light bulbs is equal to: Instructions: Enter your answer as a whole number. If you are entering a negative number include a minus sign. $arrow_forwardSuppose she runs a small business that manufactures teddy bears. Assume that the market for teddy bears is a competitive market, and the market price is $20 per teddy bear.arrow_forwardUSE THE GRAPH TO ANSWER THE FOLLOWING QUESTIONS: (IF REQUIRED, USE THE DISCREET NUMBER OF BARRELS). ANSWERS IN WHOLE NUMBER a. How many barrels of natural-organic oil reflect the lowest minimum average variable cost?b. How much is the price of the natural-organic oil per barrel?c. How much is the fixed cost to produce the natural-organic oil?d. How many barrels of natural-organic oil should the firm produce to maximize its profit?e. At what production level would the marginal cost exceed the average cost?arrow_forward

- Brody's firm produces trumpets in a perfectly competitive market. The table below shows Brody's total variable cost. He has a fixed cost of $240, and the price per trumpet is $60.-Calculate the average total cost of producing 6 trumpets. Show your work. -Calculate the marginal cost of producing the 11th trumpet. -What is Brody's profit-maximizing quantity? Use marginal analysis to explain your answer. -At the profit-maximizing quantity you determined in part (c), calculate Brody's profit or loss. Show your work. -Brody also produces saxophones at a loss in a perfectly competitive market. Draw a correctly labeled graph for Brody's firm showing the following at a market price of $200. -Brody's profit-maximizing quantity of saxophones -Brody's loss, completely shaded Quantity Total Variable cost 6 $120 7 $145 8 $165 9 $220 10 $290 11 $390arrow_forwardOn the graph input tool, change the number found in the Quantity Demanded field to determine the prices that correspond to the production of 0, 6, 12, 15, 18, 24, and 30 units of output. Calculate the total revenue for each of these production levels. Then, on the following graph, use the green points (triangle symbol) to plot the results. Calculate the total revenue if the firm produces 6 versus 5 units. Then, calculate the marginal revenue of the sixth unit produced. The marginal revenue of the sixth unit produced is________. Calculate the total revenue if the firm produces 12 versus 11 units. Then, calculate the marginal revenue of the 12th unit produced. The marginal revenue of the 12th unit produced is_________.arrow_forwardSuppose that the market for microwave ovens is a competitive market. The following graph shows the daily cost curves of a firm operating in this market. PRICE (Dollars per oven) 100 90 80 70 40 30 20 10 0 0 5 0 MC ATC AVC 10 15 20 25 30 35 QUANTITY (Thousands of ovens) 40 45 50 (?)arrow_forward

- Profit maximization using total cost and total revenue curves Suppose Caroline runs a small business that manufactures shirts. Assume that the market for shirts is a competitive market, and the market price is $20 per shirt. The following graph shows Caroline's total cost curve. Use the blue points (circle symbol) to plot total revenue and the green points (triangle symbol) to plot profit for shirts quantities zero through seven (inclusive) that Caroline produces. Caroline's profit is maximized when she produces______ shirts. When she does this, the marginal cost of the last shirt she produces is ______, which is (GREATER OR LESS) than the price Caroline receives for each shirt she sells. The marginal cost of producing an additional shirt (that is, one more shirt than would maximize her profit) is _____, which is (GREATER OR LESS) than the price Caroline receives for each shirt she sells. Therefore, Caroline's profit-maximizing quantity corresponds to the…arrow_forward9. Problems and Applications Q9 The market for apple pies in the city of Ectenia is competitive and has the following demand schedule: Each producer in the market has a fixed cost of $6 and the following marginal cost: Quantity Marginal Cost (Dollars) 1 1 2 3 4 5 6 Complete the following table by computing the total cost and average total cost for each quantity produced. Quantity Total Cost Average Total Cost (Ples) (Dollars) (Dollars) 1 2 3 4 3 8 10 12 14 The price of a pie is now $11. At a price of $11, making a profit of O True O Fal pies are sold in the market. Each producer makes True or False: The market is in long-run equilibrium. Suppose that in the long run there is free entry and exit. In the long run, each producer earns a profit of each producer makes pies, so there are The market price is producers operating. pies, so there are At this price, producers in this market, each pies are sold in this market, andarrow_forwardi need the answer quicklyarrow_forward

- The next 6 questions relate to the following table. Calculate total revenue at a quantity of 5 units. (The table gives you Quantity, Price, and Total Costs, leaving the Total Revenue and Profit for you to calculate.) Quantity Price Total Revenue Total Cost Profit 0 70 0 1 70 60 2 70 120 3 70 180 4 70 300 5 70 410 Calculate profit at an output of 4 units. What is the highest profit possible? What is the profit maximizing level of output What is the profit maximizing price? Can you tell if this is the short run or long run? Explain.arrow_forwardGiocattolo is a profit-maximizing firm producing toy cars, which it can produce and sell in its home country, Italy, and abroad in Spain. The average cost (AC) curve on the following graph represents Giocattolo's cost of producing toy cars within one factory, whether in Italy or in Spain. COST (Dollars per toy car) 20 18 16 14 12 10 8 4 2 0 0 10 20 30 40 50 60 70 80 QUANTITY (Thousands of toy cars) AC 90 100 Suppose that at the current market price of toy cars, the demand for Giocattolo's product is 10,000 toy cars per year in Italy and 20,000 toy cars per year in Spain. (Hint: Select each point on the previous graph to see its coordinates.) Based on Giocattolo's average cost curve, within one factory it can produce 20,000 toy cars at $ per toy car, and produce the total of 30,000 toy cars at $ per toy car. per car, produce 10,000 toy cars atarrow_forwardSuppose that the market for microwave ovens is a competitive market. The following graph shows the daily cost curves of a firm operating in this market. 100 90 80 ATC 70 60 50 40 30 AVC 20 10 MC 5 10 15 20 25 30 35 40 45 50 QUANTITY (Thousands of ovens) For each price in the following table, calculate the firm's optimal quantity of units to produce, and determine the profit or loss if it produces at that quantity, using the data from the graph to identify its total variable cost. Assume that if the firm is indifferent between producing and shutting down, it will produce. (Hint: You can select the purple points [diamond symbols] on the graph to see precise information on average variable cost.) Price Quantity Total Revenue Fixed Cost Variable Cost Profit (Dollars per oven) (Ovens) (Dollars) (Dollars) (Dollars) (Dollars) 25.00 1,600,000 70.00 1,600,000 $25.00 100.00 1,600,000 $35.00 If the firm shuts down, it must incur its fixed costs (FC) in the short run. In this case, the firm's…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education