FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Caksundr

Bank Reconciation

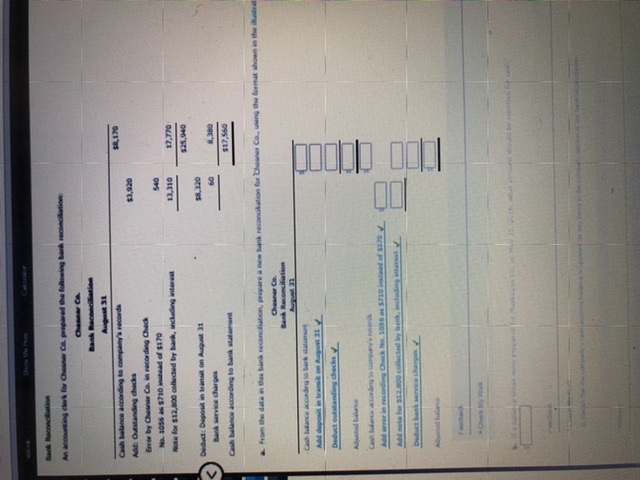

An accounting clerk for Chesner Co. prpared the following bank reconcilation

Chesner Ca

Bank Reconcilliation

S,170

Cash balance according to company's records

oze'ts

spp tupur O Y

Eror by Chener Co. in recording Check

Note for $12,a00 collected by bark, including interest

13,310

O6'sts

IE tny uo uen odeg prpeg

ozt's

Bank ervice charges

09

oer'

Cash balance according to bank sateent

09s'1s

a From the datan thes bank reconcution, pripare a new bank reconalation for Chener Co, useng the format showe in the urat

Chesner Co.

Bank Reconcilation

Add daposit in trait on August 31

Deduct outaanding checks

Allad balane

Aundam tupae

Add rror in rconding Chack No. 10 as S710 inted of s0

Add note for S12.00 collected by bank, indading ntart

Deduct bank ervice charges

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- The following data were gathered to use in reconciling the bank account of Reddan Company: Line Item Description Amount Balance per bank $ 18,050 Balance per company records 10,220 Bank service charges 40 Deposit in transit 4,000 Note collected by bank with $150 interest 5,500 Outstanding checks 6,370 Question Content Area a. What is the adjusted balance on the bank reconciliation?fill in the blank 1 of 1$ Feedback Area Feedback Question Content Area b. Journalize any necessary entries for Photo Op. Company based on the bank reconciliation. If an amount box does not require an entry, leave it blank. blank Account Debit Credit blankarrow_forwardRequlred Informetion [The following information applies to the questions displayed below.] The December bank statement and cash T-account for Stewart Company follow: BANK STATEMENT Checks Deposits Balance $ 48,000 40, 380 67,830 53,930 ৪9, 938 88,970 88,470 88,520 88,370 Date Other Dec. 1 $ 7,620 558 $28, 000 13,900 11 17 23 36, e00 26 960 30 NSF* $300 50 19, 200 19, e00 31 Interest earned 31 Service charge 150 NSF check from J. Left, a customer. Cash (A) Dec. 1 Balance 48, e00 Deposits Dec. 11 23 Checks written during December: 7,620 28, 800 36, ee0 19,e00 13,e00 550 30 13,900 960 31 150 19,200 4,500 Dec. 31 Balance 97,120 There were no deposits in transit or outstanding checks at November 30. Requlred: 1. Identify and list the deposits in transit at the end of December. (Select all that apply.) $28,000 $36,000 $19,000 $13,000 2. [dentify and list the outstanding checks at the end of December (Select all that apply.) $7,620 $550 $13,900 $880 $150 $19,200 $4,500 OOUIarrow_forwardThe following information has been extracted from the accounting records of the Simplicity Corporation: a. Cash on hand ( undeposited collections) P1,020 b. Certificates of deposit 25,000 c. Customer’s notes receivable 1,000 d. Reconciled balance in Uno Bank checking account (350) e. Reconciled balance in Trese Bank payroll account 9,350 f. Balance in Rural bank savings account 8,560 g. Customer’s postdated checks 1,350 h. Employee travel advances 1,600 i. Cash in bond sinking fund 1,200 j. Bond sinking fund investments 8,090 k. Postage stamps 430 Required:a. What is the adjusted cash balance?b. Discuss the treatment of the items not included as cash.arrow_forward

- From the give Problem 2, What is the adjusted cash in bank on December 31?arrow_forwardVinubhaiarrow_forwardBank Raconciliation The folowing data were accumudated for use in raconciling the bark account of Mathers Ca. for Juy: 1. Cash balance according to the company's records at July 31, $32,110. 2. Cash balance according to the bank statament at uly 31, $31,350. 3. Checks outstanding, $2,870. 4. Diposit in transik, not recorded by bank, $4,150. S. A check for $170 in payment of an accout was orroneously recorded in the check regite as $710. 6. Bank debit memo for service charges, $20. a Propare a bank reconcilation, uing the format shown in Exhibit 14. Hathers Co. Bark Raconciliation Cash balance according to bark satement Add deposit in transit, not recorded by bank Deduct outstanding chacks Adustad batance Cash balance acording to company's ncords Add error in recording check as $710 instead of $170 Daduct bank service charge Aduilad balane DEVZE Petack YCheck My Wuk . Sup twO u cre for th cRmpa MTUn ad he uher lor he bark bance n Delamne he wf b. If the balarka stdprepur x ott're Must…arrow_forward

- Bank reconcilationarrow_forwardAn accounting clerk for Chesner Co. prepared the following bank reconciliation: Chesner Co. Bank Reconciliation July 31, 20Y4 Cash balance according to company's records $7,150 Adjustments: Outstanding checks $3,430 Error by Chesner Co. in recording Check No. 1056 as $830 instead of $380 450 Note for $11,200 collected by bank, including interest 11,650 Deposit in transit on July 31 (7,280) Bank service charges (40) Total adjustments 8,210 Cash balance according to bank statement $15,360 a. From the data in this bank reconciliation, prepare a new bank reconciliation for Chesner Co., use the format shown in the Let’s Review section. For those boxes in which you must enter subtracted or negative numbers use a minus sign. Chesner Co. Bank Reconciliation July 31, 20Y4 Cash balance according to bank statement $fill in the blank acc4df036010fde_1 fill in the…arrow_forwardCurrent Attempt in Progress Identify whether each of the following items would be (a) added to the book balance, or (b) deducted from the book balance in a bank reconciliation. 1. 2 3. 4. 5. EFT transfer to a supplier. Bank service charge. Check printing charge. Error recording check # 214 which was written for $260 but recorded for $620. Collection of note and interest by the bank on the company's behalf.arrow_forward

- Prepare adjusting journal entries to reconcile the book and bank balancesarrow_forwardBank reconcjliation Instructions Chart of Accounts First Question Journal Instructions The following data were gathered to use in reconciling the bank account of Reddan Company: Balance per bank $17,350 Balance pir company records 10,035 Bank service charges 35 Deposit in transit 3,350 Note collected by bank with $190 interest 4,600 Outstanding checks 6,100 Instructions a. What is the adjusted balance on the bank reconciliation? b. Journalize any necessary entries for Reddan Company based on the bank reconciliation. Refer to the Chart of Accounts for exact wordina of Check My Workarrow_forwardBank reconciliation The following data were accumulated for use in reconciling the bank account of Creative Design Co. for August 20Y6: 1. Cash balance according to the company's records at August 31, $21,570. 2. Cash balance according to the bank statement at August 31, $22,760. 3. Checks outstanding, $4,380. 4. Deposit in transit not recorded by bank, $3,520. 5. A check for $480 in payment of an account was erroneously recorded in the check register as $840. 6. Bank debit memo for service charges, $30. a. Prepare a bank reconciliation, using the format shown in Exhibit 13. Creative Design Co. Bank Reconciliation August 31, 20Y6 Line Item Description Cash balance according to bank statement Amount Adjusted balance Cash balance according to company's records $ Adjusted balance b. If the balance sheet were prepared for Creative Design Co. on August 31, what amount should be reported for cash? c. Must a bank reconciliation always balance (reconcile)?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education