FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

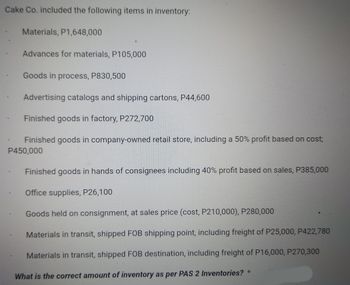

Transcribed Image Text:Cake Co. included the following items in inventory:

Materials, P1,648,000

Advances for materials, P105,000

Goods in process, P830,500

Advertising catalogs and shipping cartons, P44,600

Finished goods in factory, P272,700

Finished goods in company-owned retail store, including a 50% profit based on cost;

P450,000

Finished goods in hands of consignees including 40% profit based on sales, P385,000

Office supplies, P26,100

Goods held on consignment, at sales price (cost, P210,000), P280,000

Materials in transit, shipped FOB shipping point, including freight of P25,000, P422,780

Materials in transit, shipped FOB destination, including freight of P16,000, P270,300

What is the correct amount of inventory as per PAS 2 Inventories? *

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information is included below for Golden Gadgets: Raw Materials Inventory $7,500, COGS(Product) $42,140, Depreciation $11,253, Work-in-Process inventory $13,489, Cash $19,710, Revenues (Product) $105,328, SG&A $6,840, Finished Goods Inventory $18,190, Accounts Receivable $7,140. Compute the Gross Margin for Golden Gadgetsarrow_forwardABC Ltd. incurred the following costs while manufacturing its product. Property taxes on store 7500 Advertising expense 45000 Delivery expense 21000 Sales commissions 35000 Salaries paid to sales clerks 50000 Sales revenue 445000 Sales Discount 15000 COGS 337900 Work in process inventory was 12000 at January 1 and 15500 at December 31. Finished goods inventory was 60000 at January 1 and 45600 at December 31. Compute gross profit.Single line text.arrow_forwardA company had $270,000 in sales; $150,000 in goods available for sale; ending finished goods inventory of $30,000, and selling and administrative expenses of $65,000. Which of the following statements is true? 1. Net income was 28% of sales 2. The costs of goods sold was $137,000 3. The beginning finished goods inventory is not determinable. 4. The gross income was $93,000arrow_forward

- Parker Corp. included the following items under its inventory account: Raw materials.. .P 1,400,000 200,000 650,000 60,000 150,000 2,000,000 Advances for materials ordered. Work in process.. Unexpired inventory insurance.. Advertising catalogs and packaging cartons. Finished goods inventory in the warehouse... Finished goods in the company owned retail store, stated at 50% mark-up on its cost... Finished goods in the hands of consignees including 40% profit on sales.... Finished goods in transit to customers, Shipped at FOB-Destination 750,000 400,000 stated at cost... 250,000 100,000 50,000 40,000 Finished goods out on customers' approval, at cost. Unsalable finished goods, at cost. Office stationeries and supplies. Materials in transit, shipped FOB-Shipping point, excluding P 30,000 freight cost... Goods held on consignment, at sales price, cost, P 150,000.. What is the correct amount of inventory? A. P5,375,000 330,000 200,000 В. Р 5,500,000 C. P5,540,000 D. P5,250,000arrow_forwardSims company reports beginning raw materials inventory of $900 and ending raw materials inventory of $1,100. Assume the company purchased $5,200 of raw materials and used $5,000 of raw materials during the year. Compute raw materials inventory turnover and the number of days' sales in raw materials inventory. Complete this question by entering your answers in the tabs below. Raw Materials Days Sales In Raw Materials Inventory Inventory turnover Compute the number of days' sales in raw materials inventory. Numerator: Days' Sales In Raw Materials Inventory. 1 Denominator: 1arrow_forwardBijoux Company has sales of $40,000, beginning inventory of $5,000, purchases of $25,000, and ending inventory of $7,000. The cost of goods sold is: A) $23,000 B) $30,000 C) $40,000 D) $17,000arrow_forward

- The home office ships merchandise to its branch at 20% above cost. The balance before closing in the Intra-company Inventory profit account is P132,000 and Shipments from Home Office amounted to P600,000.The cost of the branch beginning inventory is 60,000 128,000 160,000 192,000arrow_forwardThe following is the year ended data for Tiger Company: Sales Revenue $58,000 Cost of Goods Manufactured 21,000 Beginning Finished Goods Inventory 1,100 Ending Finished Goods Inventory 2,200 Selling Expenses 15,000 Administrative Expenses 3,900 What is the gross profit? A. $22,100 B. $38,100 C. $19,200 D.arrow_forwardVishnuarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education