FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

do not give solution in image

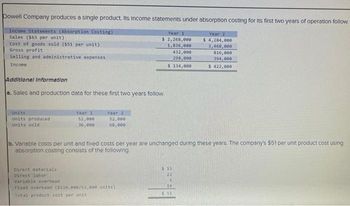

Transcribed Image Text:Dowell Company produces a single product. Its Income statements under absorption costing for its first two years of operation follow.

Income Statements (Absorption Costing)

Sales ($63 per unit)

Cost of goods sold ($51 per unit)

Year 2

$ 4,284,000

3,468,000

816,000

394,000

Gross profit

Selling and administrative expenses

Income

$ 422,000

Additional Information

a. Sales and production data for these first two years follow.

Units

Units produced

Units sold

Year 1

Direct materials:

Direct labori

52,000

36,000

Year 2

52,000

68,000

Year 1

$ 2,268,000

1,836,000

432,000

298,000

$ 134,000

b. Variable costs per unit and fixed costs per year are unchanged during these years. The company's $51 per unit product cost using

absorption costing consists of the following.

Variable overhead

Fixed overhead ($520,000/52,000 units)

Total product cost per unit

$ 15

22

4

10

$ 51

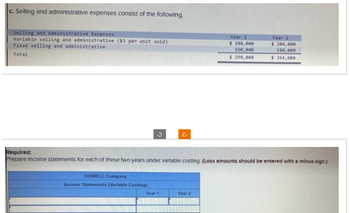

Transcribed Image Text:c. Selling and administrative expenses consist of the following.

Selling and Administrative Expenses

Variable selling and administrative ($3 per unit sold)

Fixed selling and administrative

Total

S

DOWELL Company

Income Statements (Variable Costing)

Ċ

Year 1

Required:

Prepare Income statements for each of these two years under variable costing. (Loss amounts should be entered with a minus sign.)

Year 1

$ 108,000

190,000

$ 298,000

Year 2

Year 2

$ 204,000

190,000

$ 394,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education