ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

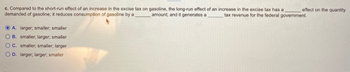

Transcribed Image Text:c. Compared to the short-run effect of an increase in the excise tax on gasoline, the long-run effect of an increase in the excise tax has a

demanded of gasoline; it reduces consumption of gasoline by a

tax revenue for the federal government.

amount, and it generates a

A. larger; smaller; smaller

OB. smaller, larger; smaller

C. smaller, smaller, larger

OD. larger; larger; smaller

effect on the quantity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- indicate whether you think the statement is true or false andexplain why. 9. Natural gas and coal are two fuels used for electricity generation and their cross-price elasticity is positive.10. A tax on gasoline will have a smaller deadweight loss if the demand for gas is inelasticthan if it is elastic.11. If the solar panel industry is competitive, the marginal firm makes zero profits in the longrun.12. The supply of goods depends on the vertical aggregation of individual demands.13. Applying dynamic efficiency to non-depletable renewable energy is not necessary becauseits quantity will not in the future.14. Given a competitive oil market and zero extraction cost, dynamic efficiency entails that thecurrent oil price equals the present discounted value of the future price.arrow_forward(Answer the E) Its is known that the demand function for a product is P = 24 - 1/2Q and the supply function Q = 4 + 2PIts is known that the demand function for a product is P = 24 - 1/2Q and the supply function Q = 4 + 2P If the government provides a subsidy for tge product of Rp 10/ unit of goods, what is the price and quantity of goods in balance new E. Calculate the amount of subsidy received by consumers and manufacturers , as well subsidies issued by the government *Rp : Indonesian currencyarrow_forwardThe market supply and demand for a product are shown in the diagram below. Now supose the government imposes a per-unit tax of $1 on producers. (i) What happens to total revenue received by producers after they pay the tax to the government? Explain. (ii) Will producer surplus increase, decrease, or stay the same? (iii) Will total surplus increase, decrease, or stay the same? Explain.arrow_forward

- 6) The following graph shows the effect of a per-ticket tax on plane tickets from Boston to Tampa. Use the graph to answer questions 5 to 10. O $10 $30 $40 Price (P) of airline tickets (in dollars per ticket) What is the amount of the tax per ticket from Boston to Tampa? $20 230 200 190 2850 3000 with tax D Sno tax Figure 14 Image author created Quantity (Q) of airline tickets (thousands per day)arrow_forwardHelparrow_forwardIf buyers pay more of a tax than do the sellers اختر أحد الخيارات a. demand is more elastic than supply O .b. supply is more elastic than demand O C. None of the above answers is correct O .d. the equilibrium price paid by buyers rises by less than half the amount of the tax „e. the amount of tax revenue collected by the government is almost zeroarrow_forward

- Government levied a tax on good A. The less elastic the demand is, the greater or the smaller the tax burden consumers bear? Also, is the after-tax equilibrium quantity the greater or smaller? Consumers’ tax burden: After-tax equilibrium quantity:arrow_forward5. Calculating tax incidence Suppose that the U.S. government decides to charge cola producers a tax. Before the tax, 25 million cases of cola were sold every month at a price of $7 per case. After the tax, 18 million cases of cola are sold every month; consumers pay $8 per case, and producers receive $5 per case (after paying the tax). The amount of the tax on a case of cola is $ per case. Of this amount, the burden that falls on consumers is $ per case, and the burden that falls on producers is $ per case. True or False: The effect of the tax on the quantity sold would have been smaller if the tax had been levied on consumers. O True O Falsearrow_forwardCan you explain why am I answer is wrong and what the correct one is. arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education