FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

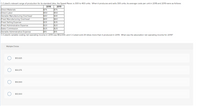

Transcribed Image Text:C-Cubed's relevant range of production for its standard bike, the Speed Racer, is 300 to 400 units. When it produces and sells 300 units, its average costs per unit in 2018 and 2019 were as follows:

2018

2019

Direct Materials

$75

$75

$50

Direct Labor

$50

Variable Manufacturing Overhead

Fixed Manufacturing Overhead

Fixed Selling Expense

Fixed Administrative Expense

$40

$40

$65

$35

$60

$35

$20

$20

$25

Sales Commission

$25

Variable Administrative Expense

$15

$15

C-Cubed's variable costing net operating income in 2019 was $52,000, and C-Cubed sold 25 bikes more than it produced in 2019. What was the absorption net operating income for 2019?

Multiple Choice

$53,625

$50.375

$50,500

$53,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jarvis Company uses the total cost concept of applying the cost-plus approach to product pricing. The costs and expenses of producing and selling 35,000 units of Product E are as follows: Variable costs: Direct materials $3.00 Direct labor 1.25 Factory overhead 0.75 Selling and administrative expenses 3.00 Total $8.00 Fixed costs: Factory overhead $50,000 Selling and administrative expenses 20,000 Jarvis desires a profit equal to a 14% rate of return on invested assets of $450,000. a. Determine the amount of desired profit from the production and sale of Product E. $ 63,000 b. Determine the total costs and the cost amount per unit for the production and sale of 35,000 units of Product E. Total manufacturing costs 350,000 V Cost amount per unit 10 c. Determine the markup percentage for Product E. 18 V % d. Determine the selling price of Product E. Round your answer to two decimal places.arrow_forwardVandenberg, Inc., produces and sells two products: a ceiling fan and a table fan. Vandenberg plans to sell 40,000 ceiling fans and 70,000 table fans in the coming year. Product price and cost information includes: Ceiling Fan Table Fan Price $56 $17 Unit variable cost $13 $8 Direct fixed cost $21,200 $43,000 Common fixed selling and administrative expenses total $98,000. Required: 1. What is the sales mix estimated for next year (calculated to the lowest whole number for each product)?Sales mix of ceiling fans to table fans = ______ : _____ 2. Using the sales mix from Requirement 1, form a package of ceiling fans and table fans. How many ceiling fans and table fans are sold at break-even? Round your intermediate calculations and final answers to the nearest whole number. Break-even ceiling fans ______ Break-even table fans ______ 3. Prepare a contribution-margin-based income statement for Vandenberg, Inc., based on the unit sales calculated in Requirement 2. If…arrow_forward1. If the company uses absorption costing ,variable costing and super-variable costing What is the product cost per unit for 2020? . What is the 2020 net operating income? Please answer all the three methodsarrow_forward

- Sako Company’s Audio Division produces a speaker that is used by manufacturers of various audio products. Sales and cost data on the speaker follow:Selling price per unit on the intermediate market $ 80Variable costs per unit $ 62Fixed costs per unit (based on capacity) $ 8Capacity in units 25,000 Sako Company has a Hi-Fi Division that could use this speaker in one of its products. The Hi-Fi Division will need 5,000 speakers per year. It has received a quote of $77 per speaker from another manufacturer. Sako Company evaluates division managers on the basis of divisional profits.Required: 1. Assume the Audio Division is selling 22,500 speakers per year to outside customers. A. From the standpoint of the Audio Division, what is the lowest acceptable transfer price for speakers sold to the Hi-Fi Division? B. From the standpoint of the Hi-Fi Division, what is the highest acceptable transfer price for speakers acquired from the Audio Division? C. What is the…arrow_forwardHead-First Company plans to sell 4,400 bicycle helmets at $84 each in the coming year. Product costs include: Direct materials per helmet $ 30 Direct labor per helmet 5.50 Variable factory overhead per helmet 2.00 Total fixed factory overhead 20,000 Variable selling expense is a commission of $2.90 per helmet; fixed selling and administrative expense totals $29,500. Required: 1. Calculate the total variable cost per unit. 2. Calculate the total fixed expense for the year. 3. Prepare a contribution margin income statement for Head-First Company for the coming year.arrow_forwardLaser Cast Inc. manufactures color laser printers. Model J20 presently sells for $325 and has a product cost of $260, as follows: Line Item Description Amount Direct materials $190 Direct labor 50 Factory overhead 20 Total $260 It is estimated that the competitive selling price for color laser printers of this type will drop to $310 next year. Laser Cast has established a target cost to maintain its historical markup percentage on product cost. Engineers have provided the following cost-reduction ideas: 1. Purchase a plastic printer cover with snap-on assembly, rather than with screws. This will reduce the amount of direct labor by 9 minutes per unit.2. Add an inspection step that will add six minutes per unit of direct labor but reduce the materials cost by $7 per unit.3. Decrease the cycle time of the injection molding machine from four minutes to three minutes per part. Thirty percent of the direct labor and 45% of the factory overhead are related to running injection…arrow_forward

- Steel Metals Ltd manufactures and sells iron rods that is used in the construction of roads. The product is manufactured and sold in 20' long rods. The product is generally produced and sold to match customer demand, and there is not a significant amount of finished goods inventory at any point in time. Summary information for 2020 is as follows: Sales were $20,000,000, consisting of 5,000,000 rods. Total variable costs were $11,000,000. Total fixed costs were $8,000,000. Net income was $1,000,000. The general economic conditions appear to be deteriorating heading into 2021, and there is some concern about a reduction in sales volume. The following questions should each be answered independent of one another. Required: a) What is the company's break-even point in 20' long rods? b) Can the company sustain a 30% reduction in total volume, and remain profitable? c) The company's sole shareholder, Pant Sharma, generally lives off dividends paid by the business. The business typically…arrow_forwardVandenberg, Inc., produces and sells two products: a ceiling fan and a table fan. Vandenberg plans to sell 40,000 ceiling fans and 60,000 table fans in the coming year. Product price and cost information includes: Ceiling Fan Table Fan Price $54 $12 Unit variable cost $11 $9 Direct fixed cost $20,800 $41,000 Common fixed selling and administrative expenses total $84,000. Required: 1. What is the sales mix estimated for next year (calculated to the lowest whole number for each product)?Sales mix of ceiling fans to table fans = _______ : __________ 2. Using the sales mix from Requirement 1, form a package of ceiling fans and table fans. How many ceiling fans and table fans are sold at break-even? Round your intermediate calculations and final answers to the nearest whole number. Break-even ceiling fans ______ Break-even table fans _______ 3. Prepare a contribution-margin-based income statement for Vandenberg, Inc., based on the unit sales…arrow_forwardDewey Manufacturing has been approached by a new customer with an offer to purchase 500 units of its hands-free automotive model SMAK at a price of $15,000 per unit. Existing sales would not be affected, and Dewey has sufficient capacity to produce the special order. Fixed overhead will not change if Dewey accepts the order or not. Unit cost data is: Per Unit: Direct Materials $6,000 Direct Labor $2,500 Variable OVHD $3,500 Fixed OVHD $10,000 $22,000 Normal sales price is $27,000. Assume Dewey decides to accept the order. How much will their operating income change? Should they have accepted the orderarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education