ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

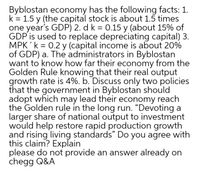

Transcribed Image Text:Byblostan economy has the following facts: 1.

k = 1.5 y (the capital stock is about 1.5 times

one year's GDP) 2. d k = 0.15 y (about 15% of

GDP is used to replace depreciating capital) 3.

MPK 'k = 0.2 y (capital income is about 20%

of GDP) a. The administrators in Byblostan

want to know how far their economy from the

Golden Rule knowing that their real output

growth rate is 4%. b. Discuss only two policies

that the government in Byblostan should

adopt which may lead their economy reach

the Golden rule in the long run. “Devoting a

larger share of national output to investment

would help restore rapid production growth

and rising living standards" Do you agree with

this claim? Explain

please do not provide an answer already on

chegg Q&A

%3|

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Use the Solow model below to answer the question. Y Y3 Y₂ Y₁ K₁₁ K₂ K3 Y = Af(K,H) dk SY K Suppose that Y₁ is 1,475, Y₂ is 6,184, and Y3 is 10,992. The savings rate for this economy is 30% and the depreciation rate is 8.2%. If this economy is currently at a GDP of 1,475, what is the smallest amount of foreign aid which would move the economy up to a GDP of 10,992? Assume that all foreign aid becomes investment. Round your final answer to two decimal places.arrow_forwardPlease answer the correct answer ASAP please Don't answer by pen paper please Respond to the following questions: 1. Compare the six countries, analyze what the differences are, and what your conclusions are regarding the policies of these countries and the social results.arrow_forwardIn 1980, Denmark had a GDP of $90 billion (measured in US dollars) and a population of 6.1 million. In 2000, Denmark had a GDP of $150 billion (measured in US dollars) and a population of 6.2 million. By what percentage did Denmark's GDP per capita rise between 1980 and 2000? Question 23 options: 205% 144% 64% 120%arrow_forward

- Assume there is a second economy ( country B ) with everything identical to country A except for the rate of population growth , which is 2 percent . Answer the following questions for country B. Assume both countries start a k = 0 , which country grows more in the short run ( before steady state is reached ) , as given by the rate of growth of output per worker ? ( hint : the further away from steady state , the faster the growth towards it ). O. Country A O. Same for both O. Country Barrow_forwardExercise 4: Growth and capital over-accumulation = Suppose two countries, A and B, with the same production function Y KaL¹-a. The value of a is 0.30, the growth rate of population is 2% and the depreciation rate is 5%. a) Show that with price-taking firms the share of labor must be 1 a. b) Compute the stock of capital, output and consumption per unit of labor in the steady state if the savings rates were 25% for country A and 35% for country B. c) Compare both economies to the Golden Rule. d) Explain what would happen to both countries if suddenly their savings rate became the Golden Rule savings rate.arrow_forwardName the type of institution that is responsible for promoting a stable environment for the economy in each of the following situations. a. Someone steals your car, but is caught: (Environment Canada / Police department / Court system.) b. You claim that your employer violated the terms of your employment contract: (Court system / Environment Canada / Police department)arrow_forward

- Which of the following are myths about the U.S. economy? Check all that apply. A. The United States is a relatively closed economy. B. Chinese imports account for less than 20% of all imports into the United States. C. Federal government jobs have grown rapidly over the past few decades. D. Business profits account for roughly one-third of the price Americans pay for typical goods and services.arrow_forwardQUESTION 11 Two countries (A and B) report to have the same value of real GDP, even after adjusting for prices. In country A, however, the government produces a much larger share of goods and services than the government in country B. Given this information and assuming that the government's quality of output is equal to that of the private sector, which country is likely to, in fact, have a higher output? OA. Country A O B. Country B OC. They are both the same O D. Unknownarrow_forwardSuppose Westeros produces output according to the production function: Y = √K The fraction of output that is saved and invested in new capital is 20%. The depreciation rate is 5%. Use this information to answer the following questions. Macmillan Learning a. What is the steady-state amount of capital (K) in Westeros? b. What is the steady-state amount of output (Y*) in Westeros? c. If Westeros had started out with 25 units of capital, what would the Solow model predict would happen to its output in the long run? O It will decrease, since that is above its steady state level of output of 4 It will decrease, since that is above its steady state level of output of 16 It will increase, since that is below its steady state level of output of 16 It will increase, since that is above its steady state level of output of 41 It will remain at 25, since that is its steady state level of outputarrow_forward

- Government stability and a well-functioning financial system are examples of what? Extractive Institutions. Capitalism. Inclusive Institutions. Competitive financial market.arrow_forwardConsider the economy of the planet Navarro. In Navarro, domestic investment of 400 million imperial credits earned 15 million in capital gains during the year. In addition, Navarro purchased $160 million in new foreign assets and foreigners purchased $10 million in Navarro assets. Assume that the valuation effects total $5 million in capital gains. a. Compute the change in domestic wealth in Navarro. b. Compute the change in external wealth for Navarro. c. Compute the total change in wealth for Navarro. d. Compute domestic savings for Navarro. e. Compute Navarro’s current account. Is the CA in deficit or surplus? f. Explain the intuition for the CA deficit/surplus in terms of savings in Navarro, financial flows, and its domestic/external wealth position. g. How would an appreciation in Navarro’s currency (the imperial credits) affect its domestic, external, and total wealth? Assume that foreign assets owned by Navarroans are denominated in foreign currency.arrow_forwardSuppose some of the country's capital is suddenly destroyed. If the depreciation rate, savings rate, and production function remain unchanged, then the real growth rate will _____ in the short run and the steady-state level of capital will _____ increase, decrease, or stay the same?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education