FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:%24

%24

%24

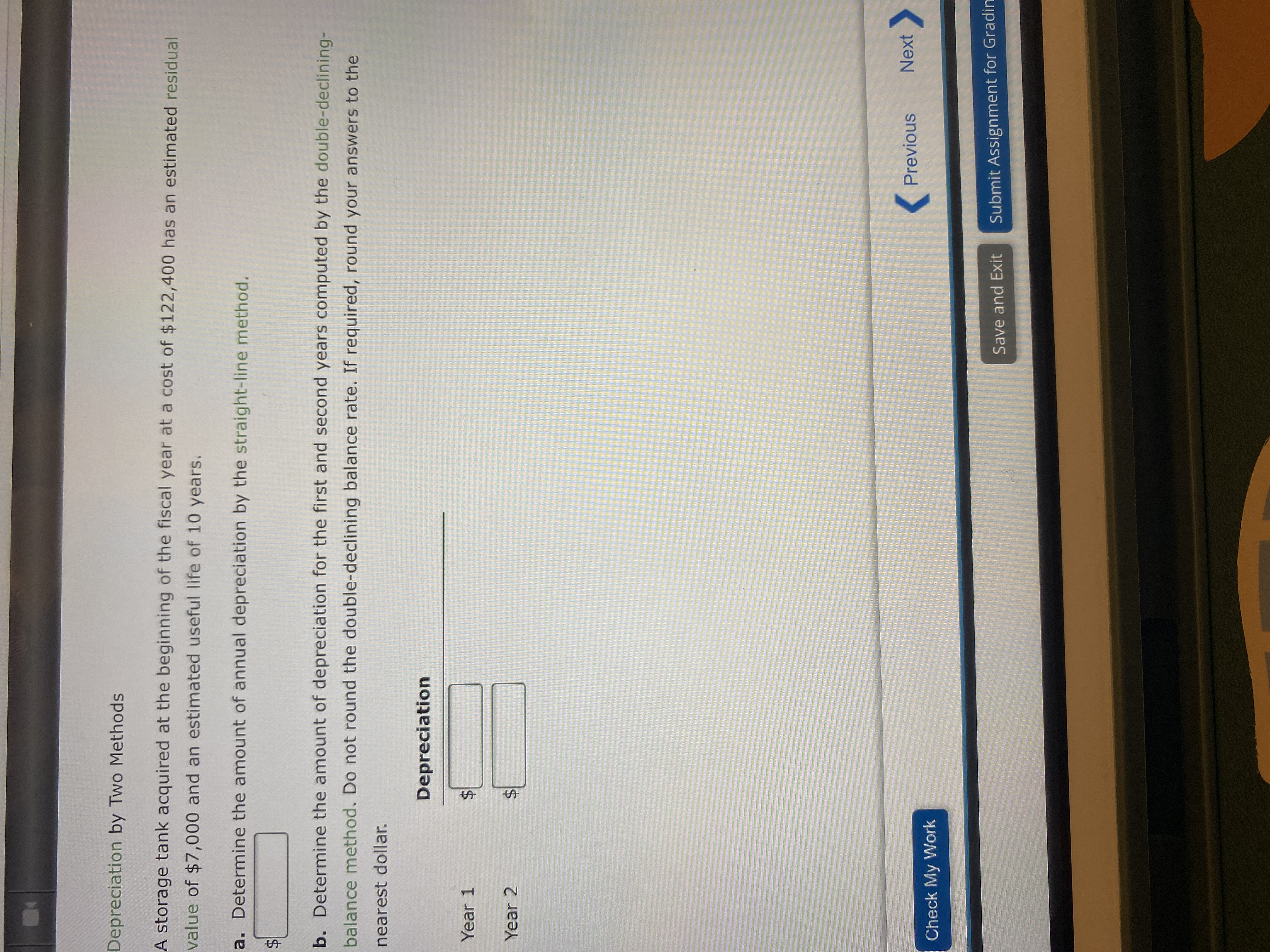

Depreciation by Two Methods

A storage tank acquired at the beginning of the fiscal year at a cost of $122,400 has an estimated residual

value of $7,000 and an estimated useful life of 10 years.

a. Determine the amount of annual depreciation by the straight-line method.

b. Determine the amount of depreciation for the first and second years computed by the double-declining-

balance method. Do not round the double-declining balance rate. If required, round your answers to the

nearest dollar.

Depreciation

Year 1

Year 2

( Previous

Next

Check My Work

Save and Exit

Submit Assignment for Gradin

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Includes step-by-step video

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- can you explain why the answer for the third part is option number 2 from the selection of answersarrow_forwardWhat is the formula used for the questions without using excel?arrow_forwardZina Manufacturing Company started and completed Job 501 in December with the following Job Cost Sheet and transferred it to the warehouse. Direct Materials Date Dec 17 Dec 30 Total Direct Labor Amount Date Amount $2,000 Dec 20 $4,000 8,000 Dec 30 3,800 Total Job Cost Sheet - Job No. 501 Total Cost The journal entry to record the transaction is A) WIP Inventory FG Inventory B) Cost of Goods Sold WIP Inventory C) FG Inventory WIP Inventory D) FG Inventory WIP Inventory Debit Credit 35,800 17,800 17,800 Manufacturing Overhead Date Amount Dec 24 $10,000 Dec 30 8,000 Total 35,800 35,800 17,800 17,800 35,800arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education