Database System Concepts

7th Edition

ISBN: 9780078022159

Author: Abraham Silberschatz Professor, Henry F. Korth, S. Sudarshan

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:BIRZEIT UNIVERSITY

COMP242 – Project# 2

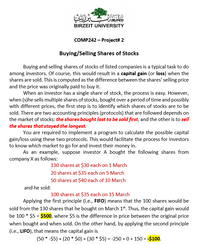

Buying/Selling Shares of Stocks

Buying and selling shares of stocks of listed companies is a typical task to do

among investors. Of course, this would result in a capital gain (or loss) when the

shares are sold. This is computed as the difference between the shares' selling price

and the price was originally paid to buy it.

When an investor has a single share of stock, the process is easy. However,

when (s)he sells multiple shares of stocks, bought over a period of time and possibly

with different prices, the first step is to identify which shares of stocks are to be

sold. There are two accounting principles (protocols) that are followed depends on

the market of stocks: the shares bought last to be sold first, and the other is to sell

the shares that stayed the longest.

You are required to implement a program to calculate the possible capital

gain/loss using these two protocols. This would facilitate the process for investors

to know which market to go for and invest their money in.

As an example, suppose investor A bought the following shares from

company X as follows:

130 shares at $30 each on 1 March

20 shares at $35 each on 5 March

50 shares at $40 each of 10 March

and he sold:

100 shares at $35 each on 15 March

Applying the first principle (i.e., FIFO) means that the 100 shares would be

sold from the 130 shares that he bought on March 1*. Thus, the capital gain would

be 100 * $5 = $500, where $5 is the difference in price between the original price

when bought and when sold. On the other hand, by applying the second principle

(i.e., LIFO), that means the capital gain is

(50 * -$5) + (20 * $0) + (30 * $5) = -250 + 0 + 150 = -$100.

Transcribed Image Text:In this project you need to build a Java graphical user interface using javaFX and include the

following functions:

Function 0: to select the accounting principle:

A. Sell old shares first

B. Sell new shares first

Function 1: this function will read a file that, if exists, will contain the currently held shares of the

investor: the number of shares, their buying dates, and the price of a single shares at the purchase

time, and the name of the company the shares belong to. The name of the file is (shares.txt) and

the input file format is specified as follows:

Number of shares, Price per share, Company, Date

Note: the file is sorted by date (oldest first).

According to the selected accounting principle in function 1, you need to store the data in a Stack

or Queue. (i.e., if you choose A, you need to store the data in a linked Queue. if you choose B,

you need to store the data in a linked Stack.)

Function 2: this function will allow the user to buy new shares by specifying the number of shares

to buy, and the name of the company the shares belong to. The daily price found in a file named

"dailyprice.txt". The shares entered should be updated and added to the shares currently held

in the queue or the stack.

Function 3: this function will allow the user to sell shares of stocks using any of the two principles

(i.e., A or B). Once the information (i.e., number of shares to sell, and the name of the company

the shares belong to) has been entered, the list of currently held shares should be updated, and

the total capital gain/loss should be updated. Note: capital gain/loss starts with 0;

Once the shares are sold, you should display the details of how the shares where profit/loss is

encountered. Of course, you have to specify the company you are selling their shares and apply

the logic only to its shares.

Function 4: this function will print the total capital gain/loss from all transactions that took place

in that session.

Function 5: to store the currently held shares back to the transactions file "shares.txt".

You may not use Arrays or ArrayList in this project

Good Luck!

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, computer-science and related others by exploring similar questions and additional content below.Similar questions

- (c) Students must register for 120 credits each year. (d) Students must take at least 90 credits of CS modules each year.arrow_forward6. Cryptography, the science of encrypting and deciphering messages written in secret codes, has played a vital role in securing information since ancient times. More recently, with millions of financial transactions conducted over the Internet daily, cryptography has become more important than ever. Companies has begun to make online transactions more secure by installing encryption software to prevent sensitive information such as credit card numbers from falling into the wrong hands. Cryptology is real-world application of matrix inverses and used to encode and decode secret messages. Solve the problem below using the application of matrices in cryptography. The ciphers that will be used is called Hill ciphers. Coding system Each letter is assigned a number based on its position. ABCDEFGHI JKLM 1 2 3 4 5 6 7 8 9 10 11 12 13 NOPQ RSTUVWXY Z 14 15 16 17 18 19 20 21 22 23 24 25 0 To get the numbers in the code range (0 to 25), reduce the numbers in the matrices to their equivalents mod…arrow_forwardFind two cases in the media (internet, TV, etc.) of a person (organization, etc.) attempting to describe and example of the process of Darwinian evolution but is incorrectly describing the evolution process using a Lamarckian approach to evolution. Give the following information for both cases: Source (Where you found it) In what ways are they mistakenly claiming that the evolutionary process is an example of Darwinian evolution? How do you know that they are really describing evolution through a Lamarckian process, not a Darwinian process? Case 1: Case 2:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Database System ConceptsComputer ScienceISBN:9780078022159Author:Abraham Silberschatz Professor, Henry F. Korth, S. SudarshanPublisher:McGraw-Hill Education

Database System ConceptsComputer ScienceISBN:9780078022159Author:Abraham Silberschatz Professor, Henry F. Korth, S. SudarshanPublisher:McGraw-Hill Education Starting Out with Python (4th Edition)Computer ScienceISBN:9780134444321Author:Tony GaddisPublisher:PEARSON

Starting Out with Python (4th Edition)Computer ScienceISBN:9780134444321Author:Tony GaddisPublisher:PEARSON Digital Fundamentals (11th Edition)Computer ScienceISBN:9780132737968Author:Thomas L. FloydPublisher:PEARSON

Digital Fundamentals (11th Edition)Computer ScienceISBN:9780132737968Author:Thomas L. FloydPublisher:PEARSON C How to Program (8th Edition)Computer ScienceISBN:9780133976892Author:Paul J. Deitel, Harvey DeitelPublisher:PEARSON

C How to Program (8th Edition)Computer ScienceISBN:9780133976892Author:Paul J. Deitel, Harvey DeitelPublisher:PEARSON Database Systems: Design, Implementation, & Manag...Computer ScienceISBN:9781337627900Author:Carlos Coronel, Steven MorrisPublisher:Cengage Learning

Database Systems: Design, Implementation, & Manag...Computer ScienceISBN:9781337627900Author:Carlos Coronel, Steven MorrisPublisher:Cengage Learning Programmable Logic ControllersComputer ScienceISBN:9780073373843Author:Frank D. PetruzellaPublisher:McGraw-Hill Education

Programmable Logic ControllersComputer ScienceISBN:9780073373843Author:Frank D. PetruzellaPublisher:McGraw-Hill Education

Database System Concepts

Computer Science

ISBN:9780078022159

Author:Abraham Silberschatz Professor, Henry F. Korth, S. Sudarshan

Publisher:McGraw-Hill Education

Starting Out with Python (4th Edition)

Computer Science

ISBN:9780134444321

Author:Tony Gaddis

Publisher:PEARSON

Digital Fundamentals (11th Edition)

Computer Science

ISBN:9780132737968

Author:Thomas L. Floyd

Publisher:PEARSON

C How to Program (8th Edition)

Computer Science

ISBN:9780133976892

Author:Paul J. Deitel, Harvey Deitel

Publisher:PEARSON

Database Systems: Design, Implementation, & Manag...

Computer Science

ISBN:9781337627900

Author:Carlos Coronel, Steven Morris

Publisher:Cengage Learning

Programmable Logic Controllers

Computer Science

ISBN:9780073373843

Author:Frank D. Petruzella

Publisher:McGraw-Hill Education