Question

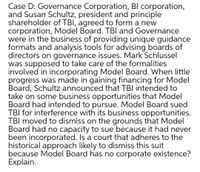

Transcribed Image Text:Case D: Governance Corporation, Bl corporation,

and Susan Schultz, president and principle

shareholder of TBI, agreed to form a new

corporation, Model Board. TBI and Governance

were in the business of providing unique guidance

formats and analysis tools for advising boards of

directors on governance issues. Mark Schlussel

was supposed to take care of the formalities

involved in incorporating Model Board. When little

progress was made in gaining financing for Model

Board, Schultz announced that TBI intended to

take on some business opportunities that Model

Board had intended to pursue. Model Board sued

TBI for interference with its business opportunities.

TBI moved to dismiss on the grounds that Model

Board had no capacity to sue because it had never

been incorporated. Is a court that adheres to the

historical approach likely to dismiss this suit

because Model Board has no corporate existence?

Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Discuss the legal responsibilities and liabilities of directors and officers in a corporation. What fiduciary duties do they owe to the company and its shareholders? What are the potential legal consequences for breaching these duties?arrow_forwardDescribe the differences between a sole proprietorship, a partnership, and a corporation as business entities, including their advantages and disadvantages from a legal perspective.arrow_forwardDiscuss the consequences of incorporation of a company and elaborate oh how different groups Such as shareholders creditors and diare affectedarrow_forward

- Subject - account Please help me. Thankyou.arrow_forwardWhich is true about a limited partnership (LP)? a. General partners are exposed to liability for all of the businesses’ debts, and limited partners are only exposed to the extent of their investment b. Limited partners are exposed to liability for all of the businesses’ debts, and general partners are only liable to the extent of their investment c. All partners, both general and limited, are exposed to liability for all of the businesses’ debts d. All partners are exposed to liability only to the extent of their investmentarrow_forwardHow exactly a limited partner can lose the limited partner status and become a general partner with unlimited liability? Can you think of any relevant case law? (accorning to canadian law)arrow_forward

- 1. Goldie and Hattie want to develop real estate and want to organize it under their state's Revised Uniform Limited Partnership Act. (a) Please advise Goldie and Hattie about what they will need to create and capitalize their partnership. (b) What advantages does the limited partnership business form offer to them over the general partnership? (c) What should Goldie and Hattie expect about their personal liability and tax situation?arrow_forwardBriefly explain the liability of:(a) A director of a private limited liability company.(b) A partner of a partnership.(c) A sole trader.(d) A private limited company.arrow_forwardShep and Gerald are nearing the end of the production of their new film, "It All Falls Sideways," and are seeking advice on how to end their limited partnership. Shep and Gerald have some outstanding bills and still expect some income as well. (a) What steps are necessary to end this limited partnership? (b) What would happen if Shep wanted to end the partnership, but Gerald wanted to continue making films? (c) What must Shep and Gerald do to wind up and distribute the remaining assets?arrow_forward

- 1. Exempt from the registration requirement of the Securities Act of 1933 are offerings of securities a. made to a small number of knowledgeable investors. b. issued by for-profit organizations. c. involving a large dollar amount. d. only for large organizations that are for-profit. 2. Global Investments is a foreign investor. With respect to the operations of a limited liability company in the United States, Global can a.not become a member but can participate. b. become a member and participate.c. not become a member or participate. d. Become a member but cannot otherwise participate. 3. Quorum requirements include _________ a. number of decision-makers that must be present before business can be conducted. b. how often decision-makers must meet each year. c. maximum number of shareholders allowed in for-profit companies. d. all other answer choices 4. Fiduciary duties of the directors and officers include a.duty of care b. duty of loyalty c.…arrow_forward24. When determining whether a partnership exists, which of the following factors would a court consider? Group of answer choices A. Whether the organization intended to make a profit B. Were the participants involved in the management of the business? C. Did the participants have an agreement? D. All of the abovearrow_forwardComplete the following table with either a yes or no regarding the attributes belonging to a sole proprietorship, partnership, corporation, or limited liability company (LLC). Attribute Present 1. Is a separate legal entity. 2. Is allowed to be owned by one person only. 3. Owner or owners are personally liable for debts of the business. 4. Is subject to an additional business income tax 5. Has an unlimited life Proprietorship Yes No Partnership Yes No Corporation Yes Yes Yes Yes LLCarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios