FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Preparing a Classified Balance Sheet .

The following financial data for Marshall Corporation was collected as December 31, 2016. All accounts have normal balances.

Transcribed Image Text:←

D

Business Course

Return to

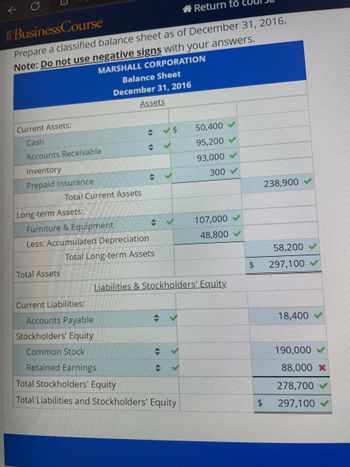

Prepare a classified balance sheet as of December 31, 2016.

Note: Do not use negative signs with your answers.

MARSHALL CORPORATION

Current Assets:

Cash

Accounts Receivable

Inventory

Prepaid Insurance

Long-term Assets:

Total Assets

Total Current Assets

Balance Sheet

December 31, 2016

Current Liabilities:

Assets

Accounts Payable

Stockholders' Equity

Common Stock

Retained Earnings

→

Furniture & Equipment

Less: Accumulated Depreciation

Total Long-term Assets

+

-

✔$

S

50,400

95,200✔

Total Stockholders' Equity

Total Liabilities and Stockholders' Equity

93,000

300

Liabilities & Stockholders' Equity

107,000✔

48,800

$

$

238,900

58,200

297,100

18,400

190,000

88,000 *

278,700

297,100

Transcribed Image Text:Business Course

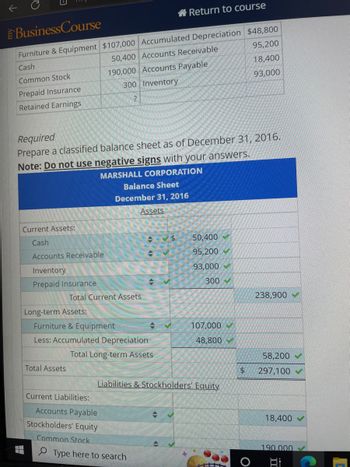

Furniture & Equipment $107,000 Accumulated Depreciation $48,800

95,200

50,400 Accounts Receivable

Cash

Common Stock

18,400

190,000 Accounts Payable

300 Inventory

Prepaid Insurance

93,000

Retained Earnings

?

Required

Prepare a classified balance sheet as of December 31, 2016.

Note: Do not use negative signs with your answers.

MARSHALL CORPORATION

Current Assets:

Cash

Accounts Receivable

Inventory

Prepaid Insurance

Long-term Assets:

Total Current Assets

Total Assets

Furniture & Equipment

Less: Accumulated Depreciation

Total Long-term Assets

Balance Sheet

December 31, 2016

Assets

Current Liabilities:

Accounts Payable

Stockholders' Equity

Common Stock

Return to course

$

Type here to search

Liabilities & Stockholders' Equity

+

50,400✔

95,200

93,000

300

107,000

48,800

$

238,900

58,200

297,100

18,400

190.000

Bi

Expert Solution

arrow_forward

Step 1: Step 1 Description

According to the given question, we are required to prepare the classified balance sheet for the year ending on December 31, 2016.

Classified balance sheet:

A classified balance sheet refers to the balance sheet which shows the information about an entity's assets, liabilities, and shareholders' equity that is aggregated into different heads of accounts. The standard classification of items on the balance sheet is as follows:

Current assets, non-current assets, current liabilities, long-term liabilities, and shareholders' equity.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- can you please explain how they got the answers of these three questions?arrow_forwardBelow are the titles of a number of debit and credit accounts as they might appear on the statement of financial position of Hayduke ASA as of October 31, 2022. Select the Current Asset, Current Liability, Borderline, and Not a Current Item from among these debit and credit accounts. Debit Interest Accrued on Government Securities Notes Receivable Petty Cash Fund Government Securities Treasury Shares Current Asset Current Liability Borderline Not a Current Item Credit Share Capital-Preference 6% First Mortgage Bonds, due in 2029 Preference Dividend, payable Nov. 1,2022 Allowance for Doubtful Accounts Customers' Advances (on contracts to be completed next year)arrow_forwardPrepare the balance sheet and income statement by rearranging the above items. Note: Be sure to list the assets and liabilities in order of their liquidity. Enter all amounts as positive values. Cash Receivables Inventories BALANCE SHEET Assets Liabilities and Shareholders' Equity $ 15 Payables $ 35 35 Debt due for repayment 25 50 Total current assets $ 100 Total current liabilities $ 60 Property, plant, and equipment 520 Long-term debt Total liabilities 350 $ 410 Net fixed assets Total assets $ 520 Shareholders' equity 90 $ 620 Total liabilities and shareholders' equity $ 500arrow_forward

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardThe December 31, Year 4, balance sheet for Finch Corporation is presented here. These are the only accounts on Finch's balance sheet. Amounts indicated by question marks (?) can be calculated using the following additional information: Assets Cash FINCH CORPORATION Balance Sheet As of December 31, Year 4 Accounts receivable (net) Inventory Property, plant, and equipment (net) Liabilities and Stockholders' Equity Accounts payable (trade) Income taxes payable (current) Long-term debt Common stock Retained earnings Additional Information Current ratio (at year end) Total liabilities + Total stockholders' equity Gross margin percentage $35,000 a. Accounts payable b. Retained earnings Inventory C. 292,000 $442,000 $ ? P $ P 35,000 298,000 Inventory turnover (Cost of goods sold + Ending inventory) Gross margin for Year 4 12 1.6 to 1.0 70% 40% 9.6 times Required a. Compute the balance in trade accounts payable as of December 31, Year 4. b. Compute the balance in retained earnings as of…arrow_forwardThe following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Line Item Description Current Year Previous Year Current assets: Cash $417,200 $318,000 Marketable securities 483,100 357,800 Accounts and notes receivable (net) 197,700 119,200 Inventories 1,167,500 905,200 Prepaid expenses 601,500 578,800 Total current assets $2,867,000 $2,279,000 Current liabilities: Accounts and notes payable (short-term) $353,800 $371,000 Accrued liabilities 256,200 159,000 Total current liabilities $610,000 $530,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Line Item Description Current Year Previous Year 1. Working capital ? ? 2. Current ratio ? ? 3. Quick ratio ? ? from the preceding year to the current year. The working capital, current ratio, and quick…arrow_forward

- The bookkeeper for Geronimo Company has prepared the following balance sheet at 31/12/2007 Balance sheet for (Geronimo Company) at 31/12/2007 liabilities and owner equity Assets ID ID Current assets: Short-term liabilities: Bills payable 40625 Account payable (A/P) 28000 Long-Term Liabilities: bonds payable 82350 Long-term notes payable. Owners' Equity: Cash 22000 22000 Account receivable(A/R) Ending inventory Fixed assets: 35000 Machinery and equipment Intangible assets: Patents 40000 54900 Capital 155500 Total Total 274500 If you know Current assets 50% from total assets, fixed assets 30% from total assets, Intangible assets 20% from total assets, Cash 50% from Current assets R/ Complete the balance sheetarrow_forwardhow to creat a balance sheet using the following information? Balance sheet Given the following information about Elkridge Sporting Goods, Inc., construct a balance sheet for June 30, 2017. On that date the firm had cash and marketable securities of $25,135, accounts receivables of $43,758, inventory of $167,112, net fixed assets of $325,422, and other assets of $13,125. It had accounts payables of $67,855, notes payables of $36,454, long-term debt of $223,125, and common stock of $150,000. How much retained earnings did the firm have?arrow_forwardAccountingarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education