FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:ccounting | Spring 2023

uiz

Course Home - kar X

K

Chapter 9 Quiz

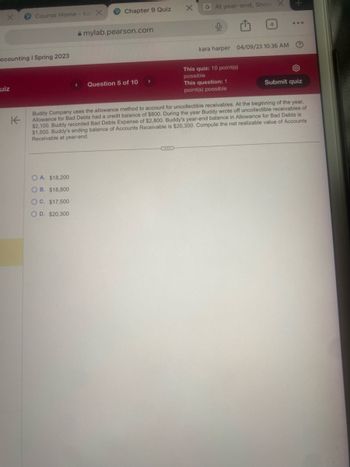

OA. $18,200

OB. $18,800

OC. $17,500

O D. $20,300

mylab.pearson.com

Question 5 of 10

X G At year-end, Snow

0

4

kara harper 04/09/23 10:36 AM

This quiz: 10 point(s)

possible

This question: 1

point(s) possible

?

Submit quiz

Buddy Company uses the allowance method to account for uncollectible receivables. At the beginning of the year,

Allowance for Bad Debts had a credit balance of $800. During the year Buddy wrote off uncollectible receivables of

$2,100. Buddy recorded Bad Debts Expense of $2,800. Buddy's year-end balance in Allowance for Bad Debts is

$1,500. Buddy's ending balance of Accounts Receivable is $20,300. Compute the net realizable value of Accounts

Receivable at year-end.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Craigmont uses the allowance method to account for uncollectible accounts. Its year-end unadjusted trial balance shows Accounts Receivable of $126,500, allowance for doubtful accounts of $885 (credit) and sales of $1,035,000. If uncollectible accounts are estimated to be 0.6% of sales, what is the amount of the bad debts expense adjusting entry? Multiple Choice $6,210 $5,325 $7,095arrow_forwardCrane Co. uses the percentage-of-receivables basis to record bad debt expense. It estimates that 3% of accounts receivable will become uncollectible. Accounts receivable are $549,000 at the end of the year, and the allowance for doubtful accounts has a credit balance of $1,880. (a) Prepare the adjusting journal entry to record bad debt expense for the year. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation eTextbook and Media List of Accounts Save for Later Debit Credit (b) The parts of this question must be completed in order. This part will be available when you complete the part above.arrow_forwardDorothy Company uses the percentage-of-receivables method for recording bad debt expense. The Accounts Receivable balance is $250,000 and credit sales are $1,000,000. Management estimates that 6% of accounts receivable will be uncollectible. What adjusting entry will Dorothy Company make if the Allowance for Doubtful Accounts has a credit balance of $2,500 before adjustment?arrow_forward

- At the end of the current year, Accounts Receivable has a balance of $675,000; Allowance for Doubtful Accounts has a debit balance of $5,400; and credit sales for the year total $3,000,000. An analysis of the receivables indicates that uncollectible receivables are estimated to be $45,000. a. Determine the amount of the adjusting entry for bad debt expense.fill in the blank 1 of 2$ b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Line Item Description Adjusted Balance Accounts Receivable $fill in the blank 2 Allowance for Doubtful Accounts fill in the blank 3 Bad Debt Expense fill in the blank 4 c. Determine the net realizable value of accounts receivable.fill in the blank 2 of 2$arrow_forwardK Blended Corporation uses the allowance method to account for uncollectible receivables. At the beginning of the year, Allowance for Bad Debts had a credit balance of $1,000. During the year Blended wrote off uncollectible receivables of $2,200. Blended recorded Bad Debts Expense of $3,300. What is Blended's year-end balance in Allowance for Bad Debts? OA. $5,500 OB. $1,100 C. $2,100 OD. $4,300 1arrow_forwardJefferson uses the percent of sales method of estimating uncollectible receivables. Based on past history, 2% of credit sales are expected to be uncollectible. Sales for the current year are $5,550,000. Which of the following is correct regarding the entry to record estimated uncollectible receivables? a.Bad Debt Expense will be credited. b.Cash will be debited. c.Accounts Receivable will be debited. d.Allowance for Doubtful Accounts will be credited.arrow_forward

- Banning Company uses the alowance method to account for uncolectible receivables. At the beginning of the year. Allowance for Bad Debts had a credit balance of $1,400 During the year Banning wrote off uncollectible recevabies of $2.300. Barning recorded Bad Debts Expense of $2,700 What is Barning's year-end balance in Alowance for Bad Debts? OA $1,800 OB $400 OC $4,100 OD $5,000 Time Remaining: 01:17:13 Nextarrow_forwardCompany I had the following balances at the end of the year: Accounts receivable: $50,000 Allowance for doubtful accounts: $2,000 (credit balance) The company estimates that 2% of accounts receivable will be uncollectible. Record the journal entry to adjust the allowance for doubtful accounts.arrow_forwardAt year-end (December 31), Chan Company estimates its bad debts as 1% of its annual credit sales of $487,500. Chan records its Bad Debts Expense for that estimate. On the following February 1, Chan decides that the $580 account of P. Park is uncollectible and writes it off as a bad debt. On June 5, Park unexpectedly pays the amount previously written off. Prepare Chan's journal entries for the transactions. View transaction list Journal entry worksheet 1 2 3 4 Record the estimated bad debts expense. Note: Enter debits before credits. Debit Date General Journal Credit Dec 31arrow_forward

- Craigmont uses the allowance method to account for uncollectible accounts. Its year-end unadjusted trial balance shows Accounts Receivable of $128,500, allowance for doubtful accounts of $905 (credit) and sales of $1,045,000. If uncollectible accounts are estimated to be 0.7% of sales, what is the amount of the bad debts expense adjusting entry?arrow_forwardThe following accounts were found in the ledger of DanDan Co. on December 31 of the current year: Dr. Accounts Receivable - P300,000; Cr. Allowance for bad debts - P8,000; Cr. Cash Sales - P900,000; Cr. Credit Sales - P1,000,000. Analysis indicates that 5% of the outstanding accounts receivable will not be collected. How much will be adjustment necessary on December 31 for Allowance for bad debts?arrow_forwardAt January 1, 2024, ABC Company reported an allowance for bad debts with a $7,190 credit balance. During 2024, ABC wrote-off as uncollectible accounts receivable totaling $12,530. At December 31, 2024, ABC Company had accounts receivable totaling $325,000 and prepared the following aging schedule: Accounts Receivable not past due 1-39 days past due 40-79 days past due 80-119 days past due over 119 days past due total $167,000 $ 52,000 $ 69,000 $ 26,000 $ 11,000 $325,000 % Uncollectible 2% 8% 14% 22% 45% Calculate the net realizable value of ABC Company's accounts receivable at December 31, 2024.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education