EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Answer this cost accounting question

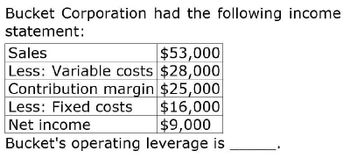

Transcribed Image Text:Bucket Corporation had the following income

statement:

Sales

$53,000

Less: Variable costs $28,000

Contribution margin $25,000

Less: Fixed costs

$16,000

Net income

$9,000

Bucket's operating leverage is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Can you please solve this accounting question?arrow_forwardTom Company reports the following data: Sales Variable costs Fixed costs Determine Tom Company's operating leverage. Round your answer to one decimal place. $156,332 81,532 30,800arrow_forwardFrontier Corp. has a contribution margin of $1,682,000 and profit of $336,400. What is its degree of operating leverage? Multiple Choice 0.20 5.80 14.50 5.00arrow_forward

- What is the operating leverage for this general accounting question?arrow_forwardOperating Leverage Income statements for two different companies in the same industry are as follows: Trimax, Inc. Quintex, Inc. $400,000 $562,500 200,000 112,500 $200,000 $450,000 150,000 400,000 $50,000 $50,000 Sales Less: Variable costs Contribution margin Less: Fixed costs Operating income Required: 1. Compute the degree of operating leverage for each company. Trimax Quintex 2. Compute the break-even point in dollars for each company. Trimax, Inc. Quintex, Inc. Why is the break-even point for Quintex, Inc., higher? 3. Suppose that both companies experience a 40 percent increase in revenues. Compute the percentage change in profits for each company, Trimax Quintexarrow_forwardAsha Inc. and Samir Inc. have the following operating data: Sales Variable costs Contribution margin Fixed costs Asha Inc. $2,500,000 (1,500,000) $1,000,000 (800,000) $200,000 Asha Inc. Samir Inc. Samir Inc. $4,000,000 (2,500,000) $1,500,000 (900,000) $600,000 Operating income a. Compute the operating leverage for Asha Inc. and Samir Inc. If required, round to one decimal place. Asha Inc. 150 75 Samir Inc. b. How much would operating income increase for each company if the sales of each increased by 30%? Dollars Percentage 30 % 30 % c. The difference in the increases of operating income is due to the difference in the operating leverages. Asha Inc.'s higher operating leverage means that its fixed costs are a smaller Inc.'s. percentage of contribution margin than are Samirarrow_forward

- Beck Inc. and Bryant Inc. have the following operating data: Beck Inc. Bryant Inc. Sales $1,250,000 $2,000,000 Variable costs 750,000 1,250,000 Contribution margin $500,000 $750,000 Fixed costs 400,000 450,000 Income from operations $100,000 $300,000 a. Compute the operating leverage for Beck Inc. and Bryant Inc. If required, round to one decimal place. b. How much would income from operations increase for each company if the sales of each increased by 20%? If required, round answers to nearest whole number.arrow_forwardgenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Lo... r Operating Leverage Teague Co. reports the following data: Sales Variable costs Contribution margin Fixed costs $480,000 264,000 $216,000 175,200 $40,800 Income from operations Determine Teague Co.'s operating leverage. Round your answer to one decimal place.arrow_forwardFor a certain company, the cost function for producing x items is C(x)=40x+200, and the revenue function for selling x items in R(x)=−0.5(x−80)2+3,200. The maximum capacity of the company is 110 items. The profit function P(x) is the revenue function R(x) (how much it takes in) minus the cost function C(x) (how much it spends). In economic models, one typically assumes that a company wants to maximize its profit, or at least make a profit!Assuming that the company sells all that it produces, what is the profit function?P(x)= Preview Change entry mode . Hint: Profit = Revenue - Cost as we examined in Discussion 3. What is the domain of P(x)?Hint: Does calculating P(x) make sense when x=−10 or x=1,000? The company can choose to produce either 40 or 50 items. What is their profit for each case, and which level of production should they choose?Profit when producing 40 items = Number Profit when producing 50 items = Number Can you explain, from our model, why the company makes less profit…arrow_forward

- 1. The following CVP income statements are available for ABC Company and XYZ Company. Sales Variable costs Contribution margin Fixed costs Operating income ABC Company CVP I/S for 2020 $500,000 300,000 200,000 180,000 $ 20,000 XYZ Company CVP I/S for 2020 $500,000 180,000 320,000 300,000 $ 20,000 med m (a) Compute the break-even point in dollars and the margin of safety ratio for each w ww w w w w h m w m ww m company. (b) Compute the degree of operating leverage for each company. (c) Assuming that sales revenue decreases by 20%, each a CVP income statement for w w w w ww w www w w m wm company. (d) Assuming that sales revenue increases by 20%, calculate the operating incomes of the two companies without w w w w ww med m www S WInoul preparing income statement. (Use DOL) nea ww warrow_forwardSkeeter Systems uses the following data in its Cost-Volume-Profit analyses: Sales Variable expenses Contribution margin Fixed expenses Net operating income O $80,000 What is total contribution margin if sales volume increases by 20%? O $158,400 O $200,000 Total $ 400,000 280,000 120,000 100,000 O $144,000 $ 20,000arrow_forwardWhat is operating leverage for the info attached? 1.3, 2.7 or 6.7arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT