ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

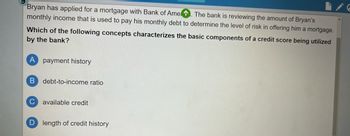

Transcribed Image Text:Bryan has applied for a mortgage with Bank of Amen. The bank is reviewing the amount of Bryan's

monthly income that is used to pay his monthly debt to determine the level of risk in offering him a mortgage.

Which of the following concepts characterizes the basic components of a credit score being utilized

by the bank?

A payment history

B debt-to-income ratio

с available credit

D length of credit history

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Intro to Banking Part III Explain the difference between a defined benefit and defined contribution pension plan. Then examine the City of Chicago’s Police and Firefighters’ Pension Funds. Explain what type of plan (benefit or contribution) they are and what are the problems they currently face (specifically, what is their funding ratio as of December 2020). How did they get into the situation they find themselves today?arrow_forwardEe 133.arrow_forwardEmily and Joel Schumaker 1.Emily and Joel Schumaker are married clients who have just been approved for a twenty-year, $150,000 mortgage. They have been given a choice of two loans. One loan has an annual percentage rate (APR) of 8 percent and does not carry a fee, and the other has an APR of 7.5 percent but carries a discount fee of 2 percent of the initial loan amount. The fee for the second mortgage is payable in cash at loan inception and cannot be financed with the loan. From a present value cost perspective, which loan is the better deal, assuming (a) they sell their home immediately after making ten years’ worth of payments and (b) they require a 9 percent effective annual rate of return? Stated another way, which option has the lower cost? When conducting the analysis, assume all required payments are made at the end of each month and that interest is compounded monthly. Remember to consider the difference in loan payment, the difference in remaining balance at the time of…arrow_forward

- Describe three methods a person could use to acquire legal title to real property.arrow_forwardWhenever the interest charge for any interest period (a year, for example) is based on the remaining principal amount plus any accumulated interest charges up to the beginning of that period, the interest is said to be: a. effective interest b. compound interest c. simple interest d. nominal interest e. none of the choicesarrow_forwardA homeowner’s policy was cancelled by the Illinois insurance guaranty fund due to insolvency of the insurance company the unearned premium was $625.00. What is the premium refund due to the insured for the unexpired policy period? 1. $525 2. $625 3.$1150 4. $0arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education