FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

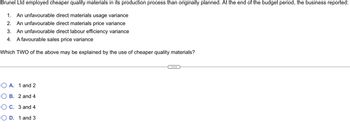

Transcribed Image Text:Brunel

Ltd employed cheaper quality materials in its production process than originally planned. At the end of the budget period, the business reported:

1. An unfavourable direct materials usage variance

2. An unfavourable direct materials price variance

3. An unfavourable direct labour efficiency variance

4. A favourable sales price variance

Which TWO of the above may be explained by the use of cheaper quality materials?

OA. 1 and 2

OB. 2 and 4

OC. 3 and 4

OD. 1 and 3

C...

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Why is the identification of favorable and unfavorable variances so important to a company? How can the identification of the variances help management control costs? Please explain. As you are considering the flexible budgeting topic of the week, it is important for you to look at this analysis as a significant contribution to the management of the company. Knowing what the bottom line profit or loss is important. But what is more important is to understand how your actual results varied in terms of units sold versus how the actual cost of each unit differed from the budget.arrow_forwardWhich statement is true? A. Gross profit (GP) variance analysis, is an essential part of financial statements analysis that is used to evaluate the performance of a firm's departments responsible for the firm's line activities (functions). B. Increases and decreases in sales and cost of sales have direct relationship with increases and decreases in GP. C. If there is a negative sales price variance and there is no cost variance, the gross profit variance will be equal to the sales price variance. D. A zero cost variance indicates that there is no difference between the standard cost prices and actual cost prices. E. none of the abovearrow_forwardWhich of the following statements about fixed overhead variances is FALSE? O The budget variance represents the difference between the original budgeted fixed overhead cost and the applied fixed overhead cost during a period. O An unfavorable volume variance means that a firm's production facilities were under-utilized by producing less units of products than budgeted. O The volume variance is a measure of facility utilization. O Fixed overhead variances consist of a budget variance and a volume variance. Ne: Previousarrow_forward

- Rodolfo works at Johnson Incorporated and is tasked with measuring costs. When Rodolfo identifies that actual sales are less than expected sales, what type of variance did Rodolfo identify? A Fixed cost volume variance B Sales price variance C Favorable variance D Unfavorable variancearrow_forwardNonearrow_forwardDescribe the difference between a direct materials efficiency variance and a variable manufacturing overhead efficiency variance. OA. A direct materials efficiency variance indicates whether more or less of the chosen allocation base was used than was budgeted for the actual output achieved. A variable manufacturing overhead efficiency variance indicates whether more or less direct materials were used than was budgeted for the actual output achieved. OB. A direct materials efficiency variance indicates whether more or less was paid for direct materials than was budgeted for the actual output achieved. A variable manufacturing overhead efficiency variance indicates whether more or less was paid for the chosen allocation base than was budgeted for the actual output achieved. OC. A direct materials efficiency variance indicates whether more or less direct materials were used than was budgeted for the actual output achieved. A variable manufacturing overhead efficiency variance indicates…arrow_forward

- The Provence Company has the following flexible budget variances: unfavorable direct material price variance and favorable direct material quantity variance. A logical explanation for this is: a) They made fewer products than they budgeted for. b) They purchased cheaper material than budgeted. c) All of these choices are logical explanations. d) They purchased higher quality material than budgeted.arrow_forwardty Variance OF Master Budget (19,200 units) 57,600arrow_forwardA company has set a new policy of acquiring materials from a second hand auction because it is cheaper than market price. Upon further investigations you have discovered that the materials from the auction are lower than the normal standard. How is the new policy likely to impact on the following variances: Material Usage: Choose... Labour Efficiency: Choose... Fixed overhead expenditure: Variable overhead efficiency: Previous page Choose... Choose... Next pagearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education