FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

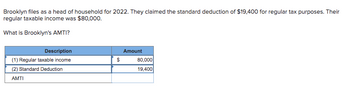

Brooklyn files as a head of household for 2022. They claimed the standard deduction of $19,400 for regular tax purposes. Their regular taxable income was $80,000.

What is Brooklyn's AMTI?

Transcribed Image Text:Brooklyn files as a head of household for 2022. They claimed the standard deduction of $19,400 for regular tax purposes. Their

regular taxable income was $80,000.

What is Brooklyn's AMTI?

Description

(1) Regular taxable income

(2) Standard Deduction

AMTI

$

Amount

80,000

19,400

Expert Solution

arrow_forward

Step 1

AMTI

AMTI is the abbreviated form of Alternate minimum taxable income. This amount is used for taxation purposes and can be determined by summing up the applicable deductions to the amount of taxable income of the taxpayer.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In 2023, a taxpayer who paid $16,500 of self-employment tax would deduct $ deduction. of the tax as a (for/from) I AGIarrow_forwardHenrich is a single taxpayer. In 2019, his taxable income is $456,500. What is his income tax and net investment income tax liability in each of the following alternative scenarios? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates, Estates and Trusts for reference. (Do not round intermediate calculations. Round your answers to 2 decimal places. Leave no answer blank. Enter zero if applicable.) Estates and Trusts If taxable income is over: But not over: The tax is: $ 0 $ 2,600 10% of taxable income $ 2,600 $ 9,300 $260 plus 24% of the excess over $2,600 $ 9,300 $12,750 $1,868 plus 35% of the excess over $9,300 $12,750 $3,075.50 plus 37% of the excess over $12,750 Tax Rates for Net Capital Gains and Qualified Dividends Rate* Taxable Income Married Filing Jointly Married Filing Separately Single Head of Household Trusts and Estates 0% $0 - $78,750 $0 - $39,375 $0 - $39,375 $0 - $52,750 $0 - $2,650 15% $78,751 - $488,850 $39,376…arrow_forwardnearrow_forward

- Hardevarrow_forwardDetermine from the tax table or the tax rate schedule, whichever is appropriate, the amount of the income tax for each of the following taxpayers for 2020. Please show all work and calculations where appropriate. Taxpayer(s) Filing Status Taxable Income Income Tax Macintosh Single $35,700 Hindmarsh MFS $62,000 Kinney MFJ $143,000 Rosenthal H of H $91,500 Wilk Single $21,400arrow_forwardIn 2022, Landon has self-employment earnings of $206,000. Required: Compute Landon's self-employment tax liability and the allowable income tax deduction of the self-employment tax paid. Note: Round your intermediate computations and final answers to the nearest whole dollar value. Total self-employment tax liability Self-employment tax deduction E Amountsarrow_forward

- sarrow_forwardSubject - account Please help me. Thankyou.arrow_forwardEach of the following taxpayers has 2022 taxable income before the standard deduction as shown. Determine from the tax table provided, the amount of the income tax (before an credits) for each of the following taxpayers for 2022: Taxpayer(s) Allen Boyd Caldwell Dell Evans Filing Status Single MFS MFJ H of H Single Taxable Income Before the Standard Deduction $34,600 37,175 62,710 49,513 57,397 Income Taxarrow_forward

- A single person has taxable income of $85,000 per year. She earns $1,800 in interest from a certificate of deposit. How much federal income tax expense will be calculated on these earnings? Tax year 2019. Deduction amount 12,200. Tax rate 24%arrow_forwardes Chuck, a single taxpayer, earns $77,800 in taxable income and $11,500 in interest from an investment in City of Heflin bonds. (Use the U.S tax rate schedule.) Required: a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax rate? Complete this question by entering your answers in the tabs below. Required A Required B Federal tax Required C How much federal tax will he owe? Note: Do not round intermediate calculations. Round "Federal tax" to nearest whole dollar amount. $ Required D 12,424arrow_forwardWhat is the tax liability for a single individual who has taxable income of $115,500, that includes a taxable qualified dividend of $2,000? Use the appropriate Tax Tables and Tax Rate Schedules. (All answers should be rounded to the nearest dollar.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education