Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

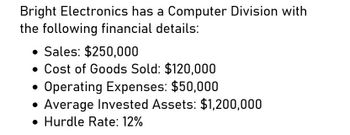

Transcribed Image Text:Bright Electronics has a Computer Division with

the following financial details:

• Sales: $250,000

• Cost of Goods Sold: $120,000

Operating Expenses: $50,000

Average Invested Assets: $1,200,000

⚫ Hurdle Rate: 12%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Scribe Company, a manufacturer of writing instruments, provides the following financial information: Operating income Net sales Total assets at Jan. 1 Pen Division Pencil Division $100,000 $30.000 $500,000 $150,000 $580,000 $255,000 $610,000 $275,000 Total assets at Dec. 31 Calculate the return on investment for the Pencil Division. (Round your answer to two decimal places.) OA. 11.32% OB. 10.91% OC. 11.76% OD. 16.81%arrow_forwardi need solution asap.arrow_forwardThe following data relates to Campus Goods Inc: Amount in $ Revenue 400000 Operating Profit 20% cost of good sold 55% Operating Expense ( as % of revenue ) 25% Required: Based on the above data determine the following: 8A. Cost of Goods Sold in $ is ___________. 250,000 100,000 150,000 220,000 8B. Gross Profit in $ and % is ___________ and ___________ respectively. 250,000 and 20% 180,0000 and 40% 180,000 and 45% 220,000 and 45% 8C. Operating expenses is ___________. 100,000 150,000 200,000 120,000 8D. Operating profit in $ is ___________. 55,000 65,000 80,000 70,000arrow_forward

- D4arrow_forwardFill in the blanks in the schedule below for two separate Investment centers A and B. Note: Round your final answers to 1 decimal place. Investment Center B A Sales $ 10,400,000 Income $ 240,000 Average assets $ 1,200,000 Profit margin 8.0% Investment turnover Return on investment 20 12.0%arrow_forwardTotal Sales: $550,000 Costs/Expenses: Production Labor: 202,000Rent: 25,000Electricity--production: 35,000Electricity--office: 10,000Starting Materials: 10,000Materials Purchased: 165,000Ending Materials: 31,000Factory Supervision: 40,000Office Labor: 25,000 Find: Operating Income and break even sales. Please show your work/formulasarrow_forward

- Rotelco is one of the largest digital wireless service providers in the United States in a recent year it had approximately 100 direct subscribers that generated revenue of $40,400 cost and expenses for the fyear our cost of revenue $17,400 selling general and administrative expenses $12,500 depreciation $4400 assume that 70% of the cost of revenue and 25% of the selling general and administrative expenses are variable to the number of direct subscribers what is rotelle Kos break even number of accounts using the data and assumptions above question B how much revenue per accountWould be sufficient for rotelle code to break even if the number of accounts remained constantarrow_forwardTheir systems uses the following data in its cost profit analysis sales 360, 000 valuable expenses 198,000 contribution marine 162, 000 fixed expenses 112, 000 net income 50,000 what is total contribution if sales volume increases by 40%arrow_forwardCan you please check my workarrow_forward

- HD marketing channel team estimated Net sales and other expenses and created a profit-and-loss statement. Complete the statement using the following information (Q4-6). • Cost of goods sold (50% of net sales) • Sales salaries : 6 millions • 8% commission on sales • advertising and promotion : $10 millions • 3% of sales for cooperative advertising allowances to retailers freight and delivery charges (8% of sales) Managerial salaries and expenses: 3 millions • Indirect overhead: 2 millions Profit-and-loss statement | Net sales Cost of goods sold Gross Margin Marketing Expenses Sales expenses Promotion expenses $238,000,000 $119,000,000 $119,000,000 04 Q5 Freight General and Administrative Q6 expenses Managerial salaries and expenses Indirect overhead $3,000,000 $2,000,000 $5,000,000 $52,780,000 Net Profit before tax Q7. What is the total fixed costs? Q8. What is the total variable costs? Q9 What is the contribution margin (%) ? Q10 What is the break-even sales ($)?_arrow_forwardSuresh Co. expects its five departments to yield the following income for next year. Dept. M $77,000 Dept. O $70,000 Dept. N Dept. P Dept. T Total Sales $ 39,000 $56,000 $ 38,000 $ 280,000 Expenses Avoidable Unavoidable 21,600 5,200 26,800 19,000 14,800 55,800 42,400 18,600 46,800 16,800 144,600 139,600 43, 200 Total expenses 70,600 61,000 62, 200 63,600 284, 200 Net income (loss) $ 6,400 $(22,000) $43, 200 $(6,200) $( 25,600) $ (4,200) Recompute and prepare the departmental income statements (including a combined total column) for the company under each of the following separate scenarios. (2) Management eliminates departments with sales dollars that are less than avoidable expenses. DEPARTMENTS WITH LESS SALES THAN AVOIDABLE EXPENSES ELIMINATED Dept. M Dept. N Dept. O Dept. P Dept. T Total Sales Expenses: Avoidable Unavoidable Total expenses Net income (loss)arrow_forwardRobinson Products Company has two service departments (S1 and S2) and two production departments (P1 and P2). The distribution of each service department's efforts (in percentages) to the other departments is: From S1 S2 S1 S2 To P1 10% 20% ? 10% S1 S2 P1 P2 – P2 $225,000 75,000 62,000 180,000 ?% The direct operating costs of the departments (including both variable and fixed costs) are: 30 Required: 1. Determine the total cost of P1 and P2 using the direct method. 2. Determine the total cost of P1 and P2 using the step method. 3. Determine the total cost of P1 and P2 using the reciprocal method.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning