FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

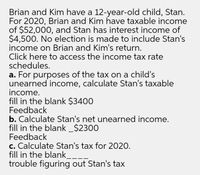

Transcribed Image Text:Brian and Kim have a 12-year-old child, Stan.

For 2020, Brian and Kim have taxable income

of $52,000, and Stan has interest income of

$4,500. No election is made to include Stan's

income on Brian and Kim's return.

Click here to access the income tax rate

schedules.

a. For purposes of the tax on a child's

unearned income, calculate Stan's taxable

income.

fill in the blank $3400

Feedback

b. Calculate Stan's net unearned income.

fill in the blank _$2300

Feedback

c. Calculate Stan's tax for 2020.

fill in the blank_

trouble figuring out Stan's tax

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In 2020, Ashley earns a salary of $ 55,000, has capital gains of $ 3,000, and receives interest income of $ 5,000. Her husband died in 2018. Ashley has a dependent son, Tyrone, who is age eight. Her itemized deductions are $ 9,000. What is her filing status? Calculate Ashley’s taxable income for 2020.arrow_forwardJuanita is a single and is self-employed. Juanita owed $1,300 in taxes on her 2019 return andexpects her taxes to be the same for 2020. Which of the following statements is correct?Select one:a. Juanita will not be required to pay estimated tax payments for 2020.b. Juanita will not be subject to self-employment tax.c. Juanita should take out a loan to pay her 2020 taxes when she files the return.d. Juanita should make estimated tax payments to avoid an underpayment penalty.arrow_forwardChris and Heather are engaged and plan to get married. During 2023, Chris is a full-time student and earns $9,400 from a part-time job. With this income, student loans, savings, and nontaxable scholarships, he is self-supporting. For the year, Heather is employed and has wages of $72,600. Click here to access the standard deduction table to use. Click here to access the Tax Rate Schedules. If an amount is zero, enter, "0". Do not round your intermediate computations. Round your final answer to the nearest whole dollar. a. Compute the following: Gross income and AGI Standard deduction (single) Taxable income Income tax Chris Filing Single Heather Filing Singlearrow_forward

- Joyce Leslie lives with her spouse and 21-year-old blind son, Keith, who qualifies for the disability tax credit. Her spouse had an income of $4,900 in the year. Keith has no income of his own. In 2023, Joyce's taxable income will be $100,000. Required: Determine the total amount of tax credits related to Keith and her spouse that will be available to Joyce.arrow_forwardToby and Nancy are engaged and plan to get married. During 2023, Toby is a full-time student and earns $7,600 from a part-time job. With this income, student loans, savings, and nontaxable scholarships, he is self-supporting. For the year, Nancy is employed and has wages of $59,400. Click here to access the standard deduction table to use. Click here to access the Tax Rate Schedules. If an amount is zero, enter, "0". Do not round your intermediate computations. Round your final answer to the nearest whole dollar. a. Compute the following: Gross income and AGI Standard deduction (single) Taxable income Income tax Gross income and AGI Toby Filing Single b. Assume that Toby and Nancy get married in 2023 and file a joint return. What is their taxable income and income tax? Round your final answer to the nearest whole dollar. Standard deduction (married, filing jointly) Taxable income Income tax Nancy Filing Single Married Filing Jointly c. How much income tax can Toby and Nancy save if…arrow_forwardNicholas died on December 27, 2020. His wife, Jessica, has not remarried. On January 31, 2021, Jessica received a check from Party Central Inc. and a letter explaining that the check represents a final payment for contract work Nicholas performed for them in 2020. What is the correct and most favorable method of reporting this income? As ordinary income on Jessica's 2021 individual tax return. As income paid to Nicholas's estate, reported on Form 1041. On the couple's jointly filed 2020 return. If this was not included in the originally filed return, Jessica should file an amended return to include this income. On a 2021 final tax return for Nicholas that Jessica files on his behalf.arrow_forward

- Subject - account Please help me. Thankyou.arrow_forwardDomesticarrow_forwardLacy is a single taxpayer. In 2021, her taxable income is $42,000. What is her tax liability in each of the following alternative situations? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. (Do not round intermediate calculations. Round your answer to 2 decimal places.) a. All of her income is salary from her employer.arrow_forward

- In 2023, Jasmine and Thomas, a married couple, had taxable income of $162,000. If they were to file separate tax returns, Jasmine would have reported taxable income of $152,000 and Thomas would have reported taxable income of $10,000. Use Tax Rate Schedule for reference. What is the couple's marriage penalty or benefit? Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar. X Answer is complete but not entirely correct. Marriage benefit 23,615 Xarrow_forwardIn 2022, Lisa and Fred, a married couple, had taxable income of $303,600. If they were to file separate tax returns, Lisa would have reported taxable income of $126,800 and Fred would have reported taxable income of $176,800. Use Tax Rate Schedule for reference. What is the couple's marriage penalty or benefit?arrow_forwardHeidi is 23 years old, a full-time student and a dependent of her parents. She earns $4,100 working part-time and receives $2,900 interest on savings. She saves both the salary and interest. (The tax year is 2018.) (Click the icon to view the child tax F(Click the icon to view the standard deduction amounts.) rate brackets.) (Click the icon to view the 2018 tax rate schedule for the Single filing status.) Read the requirements. Requirement a. What is Heidi's taxable income and tax? Amount Taxable income Tax Reference Child's tax rate brackets: 10% tax rate: Portion of taxable income not over ETI plus $2,550 24% tax rate: Portion of taxable income over ETI plus $2,550 but not over ETI plus $9,150 35% tax rate: Portion of taxable come over ETI plus $9,150 but not over ETI plus $12,500 37% tax rate: Portion of taxable income over ETI plus $12,500 a. What is Heidi's taxable income and tax? C b.How would your answer for part a change if Heidi were 16 years old? Print Done Xarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education