FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

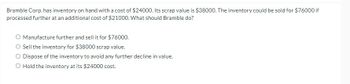

Transcribed Image Text:**Inventory Management Decision-Making Exercise**

Bramble Corp. has inventory on hand with a cost of $24,000. Its scrap value is $38,000. The inventory could be sold for $76,000 if processed further at an additional cost of $21,000. What should Bramble do?

- **Option 1:** Manufacture further and sell it for $76,000.

- **Option 2:** Sell the inventory for $38,000 scrap value.

- **Option 3:** Dispose of the inventory to avoid any further decline in value.

- **Option 4:** Hold the inventory at its $24,000 cost.

**Analysis of Options:**

1. **Manufacture Further:**

- Additional Processing Cost: $21,000

- Potential Sales Revenue after Processing: $76,000

- Net Income from Manufacturing Further: $76,000 (sales) - $21,000 (additional cost) - $24,000 (initial cost) = $31,000

2. **Sell as Scrap:**

- Scrap Value: $38,000

- Net Income from Selling as Scrap: $38,000 - $24,000 (initial cost) = $14,000

3. **Disposing of Inventory:**

- This option typically implies no revenue and possibly additional costs related to disposal. Therefore, not a favorable choice unless there is a significant decline in value expected.

4. **Holding Inventory:**

- This option involves retaining the asset at its initial cost, with no immediate income or additional outlay, but with potential future costs or depreciation.

**Recommendation:**

Based on the analysis, manufacturing the inventory further and selling it for $76,000 yields the highest net income of $31,000. Therefore, the recommended option for Bramble Corp. would be to manufacture further and sell the inventory for $76,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company has old inventory on hand that cost Rs. 15,000. Its scrap value is Rs. 20,000. The inventory could be sold for Rs. 50, 000 by incurring an additional cost of Rs. 15,000. What should the company do?arrow_forwardBlake Company purchased two identical inventory items. The item purchased first cost $27.00, and the item purchased second cost $28.00. Blake sold one of the items for $50.00. Which of the following statements is true? Multiple Choice O The dollar amount assigned to ending inventory will be the same matter which inventory cost flow method is used. Cost of goods sold will be higher if Blake uses the FIFO rather than the weighted-average inventory cost flow method. Ending inventory will be lower if Blake uses the weighted-average rather than the FIFO inventory cost flow method. Gross margin will be higher if Blake uses LIFO rather than the FIFO inventory cost flow method.arrow_forwardThe Manassas Company has 55 obsolete keyboards that are carried in inventory at a cost of $9,600. If these keyboards are upgraded at a cost of $6,500, they could be sold for $19,900. Alternatively, the keyboards could be sold “as is” for $8,400. What is the net advantage or disadvantage of re-working the keyboards?arrow_forward

- Answer the following questions. A company has an inventory of 1,350 assorted parts for a line of missiles that has been discontinued. The inventory cost is $76,000. The parts can be either (a) remachined at total additional costs of $27,500 and then sold for $33,000 or (b) sold as scrap for $4,000. Which action is more profitable? Show your calculations. A truck, costing $101,500 and uninsured, is wrecked its first day in use. It can be either (a) disposed of for $15,500 cash and replaced with a similar truck costing $102,000 or (b) rebuilt for $82,000, and thus be brand-new as far as operating characteristics and looks are concerned. Which action is less costly? Show your calculations. 1. 2. 1. A company has an inventory of 1,350 assorted parts for a line of missiles that has been discontinued. The inventory cost is $76,000. The parts can be either (a) remachined t total additional costs of $27,500 and then sold for $33,000 or (b) sold as scrap for $4,000. Which action is more…arrow_forwardInformation pertaining to the inventory of Palette Company follows. LIFO Selling Replacement Cost Price Cost Category: Supreme Item A $5,600 $6,400 $4,800 Item B 7,200 7,200 7,680 Item C 17,600 17,600 16,800 Category: Classic Item X 28,800 28,800 30,400 Item Y 35,200 42,400 41,600 Item Z 56,000 48,000 52,800 The company has a normal profit margin of 20% of selling price and has no additional costs to complete or sell the items. What is the lower-of-cost-or-market value of the company's inventory applying the rule to (a) each individual item and (b) to each inventory category? Select one: a. Inventory item: $147,200; Inventory Category: $147,200 b. Inventory item: $150,400; Inventory Category: $150,400 c. Inventory item: $143,520; Inventory Category: $150,400 d. Inventory item: $141,120; Inventory Category: $147,520arrow_forwardFarley Bains, an auditor with Nolls CPAs, is performing a review of Indigo Corporation's Inventory account. Indigo did not have a good year, and top management is under pressure to boost reported income. According to its records, the inventory balance at year-end was $801,620. However, the following information was not considered when determining that amount. Prepare a schedule to determine the correct inventory amount. (Show amounts that reduce inventory with a negative sign or parenthesis e.g.-45 or parentheses e.g. (45).) 1. 2. 3. 4. Ending inventory-as reported Included in the company's count were goods with a cost of $205,400 that the company is holding on consignment. The goods belong to Nader Corporation. The physical count did not include goods purchased by Indigo with a cost of $40,300 that were shipped FOB shipping point on December 28 and did not arrive at Indigo's warehouse until January 3. Included in the Inventory account was $16,900 of office supplies that were stored in…arrow_forward

- Poe, Co. uses LIFO for its inventory valuation. The original cost of Item #BB-8, the only inventory item of Poe, was $12,000. The current selling price and replacement cost are $13,500 and $9,500, respectively. Costs to sell are estimated to be $2,700. The normal profit margin is 10% of the original cost.arrow_forwardHanshabenarrow_forwardThe Tolar Corporation has 400 obsolete desk calculators that are carried in inventory at a total cost of $576,000. If these calculators are upgraded at a total cost of $100,000, they can be sold for a total of $160,000. As an alternative, the calculators can be sold in their present condition for $40,000. What is the financial advantage (disadvantage) to the company from upgrading the calculators? Multiple Choice $20,000 $(560,000) $120,000 $(60,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education