FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

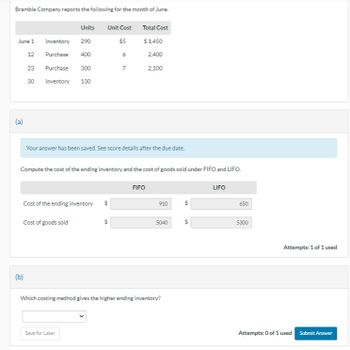

Transcribed Image Text:Bramble Company reports the following for the month of June.

June 1

(a)

12

23

30

(b)

Inventory 290

Purchase

400

Purchase

Inventory

Units Unit Cost

$5

Cost of goods sold

300

130

Cost of the ending inventory

Your answer has been saved. See score details after the due date.

Compute the cost of the ending inventory and the cost of goods sold under FIFO and LIFO.

Save for Later

6

$

7

in

Total Cost

$1,450

2,400

2,100

FIFO

910

5040

Which costing method gives the higher ending inventory?

5

$

LIFO

650

5300

Attempts: 1 of 1 used

Attempts: 0 of 1 used

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cullumber Company sells one product. Presented below is information for January for Cullumber Company. Nov. 1 Inventory 300 units at $ 12 each 5 Purchase 180 units at $ 13 each 10 Sale 410 units at $ 19 each 15 Purchase 410 units at $ 12.50 each 21 Sale 430 units at $ 20 each 30 Purchase 400 units at $ 12.80 each Cullumber uses the FIFO cost flow assumption. All purchases and sales are on account.arrow_forward10. Mama's Mexican Meals, Inc., had the following activity for an inventory item during June: Unit Units Cost Beginning inventory Purchase (June 5). Purchase (June 15) Sale (June 20). Sale (June 25). Purchase (June 30) 50 $10 10 16 30 14 40 20 10 20 Assuming Mama's uses a periodic weighted average cost flow assumption, cost of goods sold for June would be a. $512 b. $560 c. $768 d. $720arrow_forwardCurrent Attempt in Progress Sunland Company reports the following for the month of June. Date Explanation Units Unit Cost Total Cost June 1 Inventory 150 $2 $300 12 Purchase 450 5 2,250 23 Purchase 400 6 2,400 30 Inventory 80 Assume a sale of 500 units occurred on June 15 for a selling price of $7 and a sale of 420 units on June 27 for $8. Calculate the cost of the ending inventory and the cost of goods sold for each cost flow assumption, using a perpetual inventory system. (Round average-cost per unit to 3 decimal places, e.g. 12.520 and final answer to 0 decimal places, e.g. 1,250.) FIFO LIFO Moving-Average Cost The cost ending inventory $Enter a dollar amount $Enter a dollar amount $Enter a dollar amount The cost of goods sold $Enter a dollar amount $Enter a dollar amount $Enter a dollar amount eTextbook and Mediaarrow_forward

- Using the specific identification method: Date Units purchased Cost per unit Ending inventory March 1 18 Xbox′s 360 $ 265 4 Xbox′s from March April 1 43 Xbox′s 360 240 15 Xbox′s from April May 1 68 Xbox′s 360 230 12 Xbox′s from May a. Calculate the ending inventory. b. Calculate the cost of goods sold.arrow_forwardI need help.arrow_forwardThe following three identical units of Item JC07 are purchased during April: Item Beta Units Cost April 2 Purchase $264 April 15 Purchase 268 April 20 Purchase 272 Total $804 Average cost per unit $268 ($804 ÷ 3 units) Assume that one unit is sold on April 27 for $367. Determine the gross profit for April and ending inventory on April 30 using the (a) first-in, first-out (FIFO); (b) last-in, first-out (LIFO); and (c) weighted average cost method. Gross Profit Ending Inventory a. First-in, first-out (FIFO) b. Last-in, first-out (LIFO) c. Weighted average cost 3.arrow_forward

- The following information pertains to Julia & Company: March 1 Beginning inventory = 26 units @ $5.40 March 3 Purchased 17 units @ 4.20 March 9 Sold 26 units @ 8.30 What is the cost of goods sold for Julia & Company assuming it uses LIFO?arrow_forwardWHAT IS THE COST OF GOODS ABAILABLE FOR SALE BASE OFF OF THE CHART? Crane Company reports the following for the month of June. Date Explanation Units Unit Cost Total Cost June 1 Inventory 150 $4 600 12 Purchase 450 5 2250 23 Purchase 400 6 2400 30 Inventory 80 Assume a sale of 500 units occurred on June 15 for a selling price of $7 and a sale of 420 units on June 27 for $8.arrow_forwardCalculate cost of goods sold and ending inventory for Emergicare's bandages orders using FIFO, LIFO and average cost. There are 24 units in ending inventory. (Do not round your intermediate calculation and round your final answers to the nearest cent.) Date January 1 April 1 June 1 September 1 Total Units purchased Cost per unit 42 32 54 47 175 FIFO. Cost of Goods Sold. Ending Inven LIFO Average cost Total cost $ 6.20 6.20 5.20 6.20 $260.40 198.40 280.80 291.40 $ 1,031.00arrow_forward

- Tamarisk, Inc. reports the following for the month of June. June 1. Inventory 364 12 23 30 Purchase Purchase Inventory Units 728 Cost of goods sold 546 182 Cost of the ending inventory eTextbook and Media $ LA Unit Cost $ $4 7 11 Compute the cost of the ending inventory and the cost of goods sold under FIFO and LIFO. Total Cost $ 1,456 FIFO 5,096 6,006 B Which costing method gives the higher ending inventory? LIFOarrow_forwardPlease do not give solution in image formatarrow_forwardRequired information Trey Monson starts a merchandising business on December 1 and enters into the following three inventory purchases. Also, on December 15, Monson sells 30 units for $35 each. Purchases on December 7 Purchases on December 14 Purchases on December 21 20 units @ $14.00 cost 36 units @ $21.00 cost 30 units @ $25.00 costarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education