Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

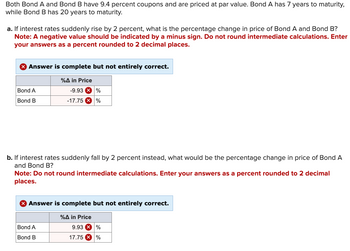

Transcribed Image Text:Both Bond A and Bond B have 9.4 percent coupons and are priced at par value. Bond A has 7 years to maturity,

while Bond B has 20 years to maturity.

a. If interest rates suddenly rise by 2 percent, what is the percentage change in price of Bond A and Bond B?

Note: A negative value should be indicated by a minus sign. Do not round intermediate calculations. Enter

your answers as a percent rounded to 2 decimal places.

X Answer is complete but not entirely correct.

Bond A

Bond B

%A in Price

-9.93 %

-17.75 X %

b. If interest rates suddenly fall by 2 percent instead, what would be the percentage change in price of Bond A

and Bond B?

Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal

places.

Bond A

Bond B

Answer is complete but not entirely correct.

%A in Price

9.93 X %

17.75 X %

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What is the dollar price of a zero coupon bond with 13 years to maturity, semiannual compounding, and a par value of $1,000, if the YTM is: (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) a. 4 percent b. 8 percent C. 12 percent ( Prev 1 of 10 Next >arrow_forwardSuppose the 6-month Mini S&P 500 futures price is 1,345.99, while the cash price is 1,335.81. What is the implied difference between the risk-free interest rate and the dividend yield on the S&P 500? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Implied difference %arrow_forwardRefer to the following table. Maturity (years) Zero-coupon YTM=r Suppose you wanted to lock in an interest rate for an investment that begins in one year and matures in five years. What rate would you obtain if there were no arbitrage opportunities? 1 3.96% The rate for an investment that begins in one year and matures in five years would be. (Round the final answer two decimal places. Round all intermediate values to four decimal places as needed.) K 2 5.73% 3 5.73% 4 5.21% 5 4.68%arrow_forward

- Kk.205.arrow_forwardfollowing questions: a. What is the mid-rate for each maturity? b. What is the annual forward premium for all maturities? (Click on the icon to import the table into a spreadsheet.) Period spot 1 month 2 months 3 months 6 months 12 months 24 months Period Bid Rate Spot 1.3267 1.3265 1.3263 1.3259 1.3250 1.3228 1.3179 a. What is the mid-rate for each maturity? Calculate the mid-rate for each maturity below: (Round to five decimal places.) Days Forward Ask Rate 0 1.3268 1.3266 1.3264 1.3262 1.3252 1.3233 1.3207 Bid Rate US$/€ 1.3267 Ask Rate US$/€ 1.3268 Mid-rate US$/€arrow_forwardsa.3arrow_forward

- Jitu Don't upload any image pleasearrow_forwardNonearrow_forwardBond RTY.AF has a 5 percent coupon, makes semiannual payments, currently has 19 years remaining to maturity, and is currently priced at par value. If interest rates suddenly rise by 2 percent, what is the percentage change in the price of Bond RTY.AF? Be sure to include the sign, especially if the bond price falls and the percentage change is negative. (Do not include the percent sign (%). Enter rounded answer as directed, but do not use the rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e.g., 32.16).)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education