ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

P3

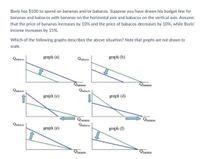

Transcribed Image Text:Boris has $100 to spend on bananas and/or babacos. Suppose you have drawn his budget line for

bananas and babacos with bananas on the horizontal axis and babacos on the vertical axis. Assume

that the price of bananas increases by 10% and the price of babacos decreases by 10%, while Boris'

income increases by 15%.

Which of the following graphs describes the above situation? Note that graphs are not drawn to

scale.

graph (a)

graph (b)

Quabacos

Quahacos

Quananas

Qbananas

Quabacos

Qbabacos

graph (c)

graph (d)

Qoananas

Qbananas

Quabacos

Quabacos

graph (e)

graph (f)

Qbananas

Qbananas

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- What will a $90,000 house cost 10 years from now if the price appreciation for homes over that period .averages 3% compounded annually?arrow_forwardIf $4,000 is borrowed today and $8,955 is paid back in 10 years, what interest rate compounded annually has been earned? % Round entry to one decimal place. Tolerance is ±0.2.arrow_forwardJohn is a very cost-conscious investor. His rule of thumb is that it costs $200 per year, starting in the first year of vehicle life to maintain an automobile. This expense increases by $200 each year over the life of the car. John is now considering the purchase of a four-year old car with 40,000 miles on it for $7,000. How much money will John have to set aside now to pay for maintenance (as a lump sum) if he keeps this car for eight years? John's interest rate is 4% per year. Click the icon to view the interest and annuity table for discrete compounding when i= 4% per year. John will have to set aside $ to pay for maintenance. (Round to the nearest dollar.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education