FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

PROBLEM 2 - AUDITING PROBLEM

1. What amount of current liabilities should be reported on the December 31, 2022, statement of financial position ?

2. What amount of noncurrent liabilities should be reported on the December 31, 2022, statement of financial position?

Transcribed Image Text:Problem 2

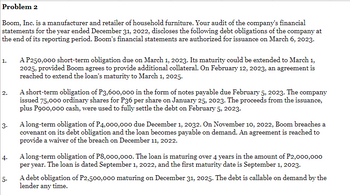

Boom, Inc. is a manufacturer and retailer of household furniture. Your audit of the company's financial

statements for the year ended December 31, 2022, discloses the following debt obligations of the company at

the end of its reporting period. Boom's financial statements are authorized for issuance on March 6, 2023.

1.

2.

4.

A P250,000 short-term obligation due on March 1, 2023. Its maturity could be extended to March 1,

2025, provided Boom agrees to provide additional collateral. On February 12, 2023, an agreement is

reached to extend the loan's maturity to March 1, 2025.

3.

A long-term obligation of P4,000,000 due December 1, 2032. On November 10, 2022, Boom breaches a

covenant on its debt obligation and the loan becomes payable on demand. An agreement is reached to

provide a waiver of the breach on December 11, 2022.

5.

A short-term obligation of P3,600,000 in the form of notes payable due February 5, 2023. The company

issued 75,000 ordinary shares for P36 per share on January 25, 2023. The proceeds from the issuance,

plus P900,000 cash, were used to fully settle the debt on February 5, 2023.

A long-term obligation of P8,000,000. The loan is maturing over 4 years in the amount of P2,000,000

per year. The loan is dated September 1, 2022, and the first maturity date is September 1, 2023.

A debt obligation of P2,500,000 maturing on December 31, 2025. The debt is callable on demand by the

lender any time.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- a) ISA 300 Planning an Audit of Financial Statements provides guidance to auditors. Planning an audit involves establishing the overall audit strategy for the engagement and developing an audit plan. Adequate planning benefits the audit of financial statements in several ways. Required: i) Identify and explain the five stages in audit process ii) Discuss three importance of audit planning.arrow_forwardWhat is the authoritative guidance for AU-C 540 Auditing Accounting Estimates, including Faire Value Accounting Estimates, and Related Disclosures?arrow_forwardQuestion 3 State the principal aspects which the statutory auditor should look into before framing an opinion on finalization of audit of accountsarrow_forward

- Financial audit Q&A What risks that may occur during assertion testing, but cannot be prevented due to the lack of time? What reports that need to be prepared to find out if there are significant changes in the client? What is the parties reported by the auditor that are related to the results of the audit reports made? What terms that must be included in the document prepared by the client? What is the inspection activities to ensure the shipping or Destination Point in the recording of the financial statements is correct in accordance with the fragments? The auditor needs to know that the ending balance recorded in the financial statements is appropriate based on evidence of transactions in the company. What is the audit assertion underlying the vouching procedure? What is the audit assertion underlying the tracing procedure? What is the risk that caused by the sample taken by the Auditor does not describe the characteristics of the data from the entire data population?…arrow_forwardWhat should occur if the audit report has already been issued and the auditor becomes aware of a situation that was present as of the Balance Sheet date (a subsequent event)?arrow_forwardThree common types of attestation services are:- A) audits of historical financial statements, reviews of historical financial statements, and audits of internal control over financial reporting.B) audits of historical financial information, verifications of historical financial information, and attestations regarding internal controls. C) reviews of historical financial information, verifications of future financial information, and attestations regarding internal controls.D) audits of historical financial information, reviews of controls related to investments, and verifications of historical financial informationarrow_forward

- Question 10 When an auditor is reviewing an audit client's allowance for doubtful accounts the auditing is assessing which management assertion about the client's accounts receivables. Existance Completeness Valuation Rights and obligationsarrow_forwardFinancial audit Q&A What is the inspection activities to ensure the shipping or Destination Point in the recording of the financial statements is correct in accordance with the fragments?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education