Concept explainers

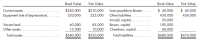

Arnold (A), Bower (B), and Chambers (C) are partners in a small manufacturing firm whose net assets are as follows: (attached)

The

a. Salaries to A, B, and C of $30,000, $30,000, and $40,000, respectively.

b. Bonus to A of 10% of net income after the bonus.

c. Remaining amounts are allocated according to

Unfortunately, the business finds itself in difficult times: Annual profits remain flat at approximately $132,000, additional capital is needed to finance equipment which is necessary to stay competitive, and all of the partners realize that they could make more money working for someone else, with a lot fewer headaches.

Chambers has identified Dawson (D) as an individual who might be willing to acquire an interest in the partnership. Dawson is proposing to acquire a 30% interest in the capital of the partnership and a revised partnership agreement, which calls for the allocation of profits as follows:

a. Salaries to A, B, C, and D of $30,000, $30,000, $40,000, and $30,000, respectively.

b. Bonus to D of $20,000 if net income exceeds $250,000.

c. Remaining amounts are allocated according to profit and loss percentages of 30%, 10%, 30%, and 30% for A, B, C, and D, respectively.

An alternative to admitting a new partner is to liquidate the partnership. Net personal assets of the partners are as follows:

Arnold Bower Chambers

Personal assets. . . . . . . . . . . . . . . . .$240,000 $530,000 $300,000

Personal liabilities . . . . . . . . . . . . . . 228,000 150,000 200,000

Assuming that you are Bower’s personal CPA, you have been asked to provide your client with your opinions regarding the alternatives facing the partnership.

1. Bower does not believe it would be worth it to him to admit a new partner unless his allocation of income increased by at least $10,000 over that which existed under the original partnership agreement. What would the average annual profit of the new partnership have to be in order for Bower to accept the idea of admitting a new partner?

2. Given the net assets of the original partnership, what is the suggested purchase price that Dawson should pay for a 30% interest in the partnership?

3. Assume that the original partnership was liquidated and Bower received a business vehicle, with a fair value of $15,000 and a net book value of $20,000, as part of his liquidation proceeds. Partners with a deficit capital balance will only contribute their net personal assets. How much additional cash would Bower receive if the partnership were liquidated?

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- sarrow_forwardJack, King, Lloyd and Martin formed a partnership, Jack being an industrial partner while King, Lloyd and Martin being capitalist partners who contributed cash amounting to P 30,000, P 50,000 and P 40,000, respectively. The partners share profits based on capital ratio. If the partnership generated income of P 80,000 for the year, how much should Jack, the industrial partner, receive as his share in the profits? Group of answer choices P 16,000 P 20,000 P 33,333 P 26,667arrow_forwardThe partnership agreement of Gibbs and Reed has the following provisions: Salary allowances are $20,000 for Gibbs and $30,000 for Reed. No interest is given on the partners’ capital balances. Any income/loss greater than the salary allowances is divided using a 2:3 ratio. Revenues of $130,000 and expenses of $62,000 resulted in net income for the first year of operations of $68,000. Calculate the net income distributed to each partner.arrow_forward

- The partnership contract of Robert Florence and Karen Partnership provided for the sharing of net income and losses as follows:A) Salaries of $30,000 to Robert, $28,000 to Florence and $26,000 to Karen.B) Interest of 10% a year on average capital balances.C) Any residual income or loss in the ration of 3:5:2 to Robert, Florence, and Karen respectively. The net income for the year is $140,000. The average capital balances were $60,000 for Robert, $40,000 for Florence and $100,000 for Karen. Prepare a journal entry to distribute the profit. Show details of the calculation in the space provided.arrow_forwardRequired information [The following information applies to the questions displayed below.] The partnership agreement of the G&P general partnership states that Gary will receive a guaranteed payment of $13,000, and that Gary and Prudence will share the remaining profits or losses in a 45/55 ratio. For year 1, the G&P partnership reports the following results: Sales revenue Gain on sale of land (§1231) Cost of goods sold Depreciation-MACRS Employee wages Cash charitable contributions Municipal bond interest Other expenses $ 70,000 8,000 (38,000) (9,000) (14,000) (3,000) 2,000 (2,000) Note: Negative amounts should be indicated by a minus sign. c. What do you believe Gary's share of self-employment income (loss) to be reported on his year 1 Schedule K-1 should be, assuming G&P is an LLC and Gary spends 2,000 hours per year working there full time? Self-employment income (loss)arrow_forwardScenario B: Partners A, B, and C operate a business with profit sharing agreement ratios of 5: 3:2, and capital balances of $300,000, $200,000, and $100,000 respectively. The total income for the year is $180,000. Each partner receives a fixed salary of $50, 000, and they are entitled to earn 10% interest on their capital balances. Calculate the total income allocated to Partnerarrow_forward

- D, E and F are partners sharing profits and losses in the ratio 5:3:2, respectively. The December 31, 2019 balance sheet of the partnership before any profit allocation is summarized as follows: ASSETS: Cash 90,000 Inventories 40,000 Furniture & fixtures – net 50,000 Patent 15,000 Total assets 195,000 LIABILITIES AND CAPITAL: Accounts payable 4,000 Loan from F 3,000 D, capital 70,000 E, capital 60,000 F, capital 30,000 F, drawings (2,000) Income summary 30,000 Total liabilities and capital 195,000 On January 1, 2020, F has decided to retire from the partnership and by mutual agreement among the partners, the following have been arrived at: Inventories amounting to 5,000 is considered obsolete and must be written off. Furniture and fixture should be adjusted to its current value of 65,000. The patent is considered worthless and must be written off immediately before the…arrow_forwardEmerson and Dakota formed a partnership dividing income as follows: 1. Annual salary allowance to Emerson of $34,000 2. Interest of 10% on each partner's capital balance on January 1 3. Any remaining net income divided equally. Emerson and Dakota had $34,000 and $142,000, respectively, in their January 1 capital balances. Net income for the year was $230,800. How much net income should be distributed to Dakota?arrow_forwardFind Bonus, Interest, and Reminder to allocate for each The partnership agreement of Jones, King, and Lane provides for the annual allocation of the business's profit or loss in the following sequence: Jones, the managing partner, receives a bonus equal to 10 percent of the business’s profit. Each partner receives 10 percent interest on average capital investment. Any residual profit or loss is divided equally. The average capital investments for 2021 were as follows: Jones $ 80,000 King 160,000 Lane 240,000 The partnership earned $40,000 net income for 2021. Prepare a schedule showing how the 2021 net income should be allocated to the partnersarrow_forward

- Xavier and Yolanda have original investments of $55,000 and $90,300, respectively, in a partnership. The articles of partnership include the following provisions regarding the division of net income: interest on original investment at 20%; salary allowances of $28,000 and $30,500, respectively; and the remainder to be divided equally. How much of the net income of $118,500 is allocated to Xavier? O a. $39,000 O b. $28,000 O c. $54,470 O d. $65,364arrow_forwardAbram, Macher, and Bailey have capital balances of $20,000, $30,000, and $50,000, respectively. The partners share profits and losses as follows: a. The first $30,000 is divided based on the partners' capital balances. b. The next $30,000 is based on service, shared equally by Abram and Bailey. Macher does not receive a salary allowance. с. The remainder is divided equally. Read the requirements. Requirement 1. Compute each partner's share of the $78,000 net income for the year. (Complete all answer boxes. For amounts that are $0, make sure to enter "0" in the appropriate column.) Abram Macher Bailey Total Net income (Iloss) Requirements Capital allocation: Abram 1. Compute each partner's share of the $78,000 net income for the year. Мacher 2. Journalize the closing entry to allocate net income for the year. Bailey Salary allowance: Abram Print Done Macher Bailey Total salary and capital allocation Net income (loss) remaining for allocation Remainder shared equally: Abram Macher Bailey…arrow_forwardLynn Carpenter and Matthew Fredrick formed a partnership in which the partnership agreement provided for salary allowances of $52,000 and $46,000, respectively. Determine the division of a $26,000 net loss for the current year, assuming that remaining income or losses are shared equally by the two partners. Use the minus sign to indicate any deductions or deficiencies.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education