FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Book

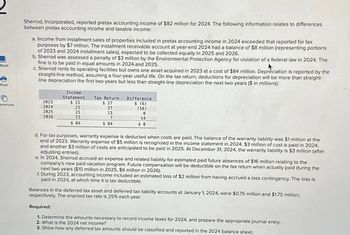

Sherrod, Incorporated, reported pretax accounting income of $82 million for 2024. The following information relates to differences

between pretax accounting income and taxable income:

a. Income from installment sales of properties included in pretax accounting income in 2024 exceeded that reported for tax

purposes by $7 million. The installment receivable account at year-end 2024 had a balance of $8 million (representing portions

of 2023 and 2024 installment sales), expected to be collected equally in 2025 and 2026.

b. Sherrod was assessed a penalty of $3 million by the Environmental Protection Agency for violation of a federal law in 2024. The

fine is to be paid in equal amounts in 2024 and 2025.

c. Sherrod rents its operating facilities but owns one asset acquired in 2023 at a cost of $84 million. Depreciation is reported by the

straight-line method, assuming a four-year useful life. On the tax return, deductions for depreciation will be more than straight-

line depreciation the first two years but less than straight-line depreciation the next two years ($ in millions):

Print

Income

Statement

Tax Return

2023

$ 21

$ 27

ferences

Difference

$ (6)

2024

21

37

(16)

2025

2026

21

13

8

21

$ 84

14

$ 0

7

$ 84

d. For tax purposes, warranty expense is deducted when costs are paid. The balance of the warranty liability was $1 million at the

end of 2023. Warranty expense of $5 million is recognized in the income statement in 2024. $3 million of cost is paid in 2024,

and another $3 million of costs are anticipated to be paid in 2025. At December 31, 2024, the warranty liability is $3 million (after

adjusting entries).

e. In 2024, Sherrod accrued an expense and related liability for estimated paid future absences of $16 million relating to the

company's new paid vacation program. Future compensation will be deductible on the tax return when actually paid during the

next two years ($10 million in 2025; $6 million in 2026).

f. During 2023, accounting income included an estimated loss of $2 million from having accrued a loss contingency. The loss is

paid in 2024, at which time it is tax deductible.

Balances in the deferred tax asset and deferred tax liability accounts at January 1, 2024, were $0.75 million and $1.75 million,

respectively. The enacted tax rate is 25% each year.

Required:

1. Determine the amounts necessary to record income taxes for 2024, and prepare the appropriate journal entry.

2. What is the 2024 net income?

3. Show how any deferred tax amounts should be classified and reported in the 2024 balance sheet.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A company made $49,000 in installment sales in 2021 and will receive payment from customers in 2022-2025. Taxable income for 2021 is $588,000, the enacted tax rate is 20% for all years, this is the only difference between pretax financial income and taxable income, and there were no deferred taxes at the beginning of 2021. What amount of income tax expense should the company report at the end of 2021?arrow_forwardFor 2022, MSU Corporation has $500,000 of adjusted taxable income, $22,000 of business interest income, and $120,000 of business interest expense. It has average annual gross receipts of more than $27,000,000 over the prior three taxable years. a. What is MSU's interest expense deduction for 2022? b. How much interest expense can be deducted for 2022 if MSU's adjusted taxable income is $300,000?arrow_forwardNirvana Corporation reports pretax financial income of $260,000 for 2022. The following items cause taxable income to be different than pretax financial income. Rental income on the 2022 tax return is $65,000 greater than on the income statement. Depreciation expense on the tax return is greater than depreciation on the income statement by $40,000. Interest on an investment in a municipal bond of $6,500 is reported on the income statement. Nirvana's tax rate is 25% for all years. There are no deferred taxes at the beginning of 2022. The company expects to realize only 40% of the benefit of any deferred tax assets. The fiscal year ends December 31, 2022. Required: 1. Prepare the journal entries to record i) income tax expense, income taxes payable, and deferred income taxes for 2022, and ii) any valuation allowance needed. 2. Indicate clearly what would be reported on the income statement beginning with income before income taxes for the year ended December 31, 2022 from just…arrow_forward

- The following information is available for Splish Corporation for 2020. 1. Depreciation reported on the tax return exceeded depreciation reported on the income statement by $116,000. This difference will reverse in equal amounts of $29,000 over the years 2021–2024. 2. Interest received on municipal bonds was $10,200. 3. Rent collected in advance on January 1, 2020, totaled $60,000 for a 3-year period. Of this amount, $40,000 was reported as unearned at December 31, 2020, for book purposes. 4. The tax rates are 40% for 2020 and 35% for 2021 and subsequent years. 5. Income taxes of $312,000 are due per the tax return for 2020. 6. No deferred taxes existed at the beginning of 2020. (a) Compute taxable income for 2020. Taxable income for 2020 $enter Taxable income for 2020 in dollarsarrow_forwardArndt, Incorporated reported the following for 2024 and 2025 ($ in millions): Revenues. Expenses Pretax accounting income (income statement) Taxable income (tax return) Tax rate: 25% 2024 $888 760 $128 $116 a. Expenses each year include $30 million from a two-year casualty insurance policy purchased in 2024 for $60 million. The cost is tax deductible in 2024. Answer is complete but not entirely correct. Deferred tax amounts ($ in millions) Classification Net noncurrent deferred tax asset ✔ $ Net noncurrent deferred tax liability X $ 2025 $980 800 b. Expenses include $2 million insurance premiums each year for life insurance on key executives. c. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2024 and 2025 were $33 million and $35 million, respectively. Subscriptions included in 2024 and 2025 financial reporting revenues were $25 million ($10 million collected in 2023 but not recognized as revenue until 2024) and $33 million,…arrow_forwardThe following information is taken from Igado Company’s 2020 financial records: Pretax accounting income- P1,500,000 Accrued warranty in excess of actual warranty expenditures- P24,500 Excess tax depreciation- P45,000 Taxable income- P1,479,500 The temporary differences were created entirely in 2020. The future deductible amount is expected to reverse in 2021 and the future taxable amount will reverse in equal amounts in the next three years. Tax rates are: 30% in 2020; 32% in 2021; 34% in 2022 and 35% in 2023. How much should Igado Company report as deferred tax asset and deferred tax liability, respectively, at December 31, 2020? A. P7,840 and P14,400 B. P7,350 and P15,150 C. P7,350 and P14,400 D. P7,840 and P15,150arrow_forward

- The information that follows pertains to Esther Food Products: a. At December 31, 2024, temporary differences were associated with the following future taxable (deductible) amounts: Depreciation Prepaid expenses Warranty expenses b. No temporary differences existed at the beginning of 2024. c. Pretax accounting income was $46,000 and taxable income was $9,000 for the year ended December 31, 2024. d. The tax rate is 25%. Required: Complete the following table given below and prepare the appropriate journal entry to record income taxes for 2024. Complete this question by entering your answers in the tabs below. Calculation General Journal $ 32,000 11,000 (6,000) Complete the following table given below to record income taxes for 2024. Note: Amounts to be deducted should be entered with a minus sign. Description Pretax accounting income Permanent differences Income subject to taxation Temporary Differences Income taxable in current year $ Amount 46,000 X Tax Rate = x X Recorded as:arrow_forwardBlossom Ltd. reported the following income for each of the years indicated. For each year, accounting income and income for tax purposes were the same. All tax rates indicated were enacted by the beginning of 2023. Blossom's policy is to carry back any tax losses first before carrying forward any remaining losses to future years. Year Income/(Loss) Tax Rate 2023 55,000 25% 2024 65,600 28% 2025 14,600 30% 2026 (145,700) 33% 2027 (73,800) 27% 2028 93,400 27% Prepare the journal entries for the years 2023 to 2028 to record income taxes. Assume that, at the end of each year, the loss carryforward benefits are judged more likely than not to be realized in the future. Blossom Ltd. follows IFRS. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and List all debit dit atrios)arrow_forwardBonita Inc. reports the following pretax income (loss) for both book and tax purposes. Pretax Year Income (Loss) Tax Rate 2018 $124,000 20 % 2019 86,000 20 % 2020 (89,000 ) 25 % 2021 126,000 25 % The tax rates listed were all enacted by the beginning of 2018. Prepare the journal entries for years 2018-2021 to record income tax expense (benefit) and income taxes payable, and the tax effects of the loss carryforward, assuming that based on the weight of available evidence, it is more likely than not that one-half of the benefits of the loss carryforward will not be realized. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)arrow_forward

- Nonearrow_forwardSherrod, Inc., reported pretax accounting income of $70 million for 2021. The following information relates to differences between pretax accounting income and taxable income: Income from installment sales of properties included in pretax accounting income in 2021 exceeded that reported for tax purposes by $4 million. The installment receivable account at year-end 2021 had a balance of $6 million (representing portions of 2020 and 2021 installment sales), expected to be collected equally in 2022 and 2023. Sherrod was assessed a penalty of $1 million by the Environmental Protection Agency for violation of a federal law in 2021. The fine is to be paid in equal amounts in 2021 and 2022. Sherrod rents its operating facilities but owns one asset acquired in 2020 at a cost of $60 million. Depreciation is reported by the straight-line method, assuming a four-year useful life. On the tax return, deductions for depreciation will be more than straight-line depreciation the first two years but…arrow_forwardAt the end of the year, a deductible temporary difference of $40 million has been recognised due to the difference between the carrying amount of a liability account for estimated expenses and its tax base. Taxable income is $50 million. No temporary differences existed at the beginning of the year, and the tax rate is 35%. Required: a. Prepare the journal entry(s) to record income taxes during the period. b.How much will income tax expense be shown in the income statement? c.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education