Corporate Fin Focused Approach

5th Edition

ISBN: 9781285660516

Author: EHRHARDT

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

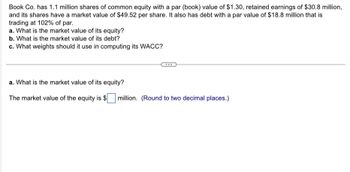

Transcribed Image Text:Book Co. has 1.1 million shares of common equity with a par (book) value of $1.30, retained earnings of $30.8 million,

and its shares have a market value of $49.52 per share. It also has debt with a par value of $18.8 million that is

trading at 102% of par.

a. What is the market value of its equity?

b. What is the market value of its debt?

c. What weights should it use in computing its WACC?

a. What is the market value of its equity?

The market value of the equity is $ million. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 2. Book Co. has 1.5 million shares of common equity with a par (book) value of $1.15, retained earnings of $29.9 million, and its shares have a market value of $50.88 per share. It also has debt with a par value of $18.2 million that is trading at 102% of par. a. What is the market value of its equity? b. What is the market value of its debt? c. What weights should it use in computing its WACC? **round to two decimal places**arrow_forwardBook Co. has 1.3 million shares of common equity with a par (book) value of $1.30, retained earnings of $31.6 million, and its shares have a market value of $50.11 per share. It also has debt with a par value of $20.8 million that is trading at 101% of par. a. What is the market value of its equity? b. What is the market value of its debt? c. What weights should it use in computing its WACC? What is the market value of its debt? The market value of the debt is $ __ million. ? (Round to two decimal places.)arrow_forwardBook Co. has 1.7 million shares of common equity with a par (book) value of $1.45, retained earnings of $28.4 million, and its shares have a market value of $49.09 per share. It also has debt with a par value of $19.6 million that is trading at 105% of par. a. What is the market value of its equity? b. What is the market value of its debt? c. What weights should it use in computing its WACC? a. What is the market value of its equity? The market value of the equity is $ __ million (Round to two decimal places.) b. What is the market value of its debt? The market value of the debt is $ __ million. (Round to two decimal places.) c. What weights should it use in computing its WACC? The debt weight for the WACC calculation is __ % ? (Round to two decimal places.) The equity weight for the WACC calculation is __ % ? (Round to two decimal places.)arrow_forward

- Book Co. has 1.0 million shares of common equity with a par (book) value of $1.00, retained earnings of $30.0 million, and its shares have a market value of $50.00 per share. It also has debt with a par value of $20.0 million that is trading at 101% of par. a. What is the market value of its equity? b. What is the market value of its debt? c. What weights should it use in computing its WACC? a. What is the market value of its equity? The market value of the equity is $ million. (Round to two decimal places.) b. What is the market value of its debt? The market value of the debt is $ million. (Round to two decimal places.) c. What weights should it use in computing its WACC? The debt weight for the WACC calculation is %. (Round to two decimal places.) The equity weight for the WACC calculation is places.) %. (Round to two decimalarrow_forwardAssume JUP has debt with a book value of $20 million, trading at 120% of par value. The firm has book equity of $26 million, and 2 million shares trading at $19 per share. What weights should JUP use in calculating its WACC? O A. 30.97% for debt, 69.03% for equity O B. 34.84% for debt, 65.16% for equity O C. 38.71% for debt, 61.29% for equity O D. 27.1% for debt, 72.9% for equityarrow_forwardBryant Co. has $3.9 million of debt, $1 million of preferred stock, and $2.1 million of common equity. What would be its weight on debt? A) 0.30 B) 0.14 C) 0.56 D) 0.13arrow_forward

- MV Corporation has debt with market value of $95 million, common equity with a book value of $101 million, and preferred stock worth $22 million outstanding. Its common equity trades at $45 per share, and the firm has 5.6 million shares outstanding. What weights should MV Corporation use in its WACC? The debt weight for the WACC calculation is __ % ? (Round to two decimal places.)arrow_forwardWyle Co. has $2.3 million of debt, $2 million of preferred stock, and $2.1 million of common equity. What would be its weight on debt? 0.34 0.31 0.28 0.36arrow_forwardMV Corporation has debt with market value of $97 million, common equity with a book value of $102 million, and preferred stock worth $20 million outstanding. Its common equity trades at $49 per share, and the firm has 5 million shares outstanding. What weights should MV Corporation use in its WACC? The weight of debt for the WACC calculation is %. (Round to two decimal places.)arrow_forward

- In December 2018, General Electric (GE) had a book value of equity of $51.4 billion, 8.6 billion shares outstanding, and a market price of $8.09 per share. GE also had cash of $69.3 billion, and total debt of $109.6 billion. a. What was GE's market capitalization? What was GE's market-to-book ratio? b. What was GE's book debt-equity ratio? What was GE's market debt-equity ratio? c. What was GE's enterprise value?arrow_forwardIn December 2018, General Electric (GE) had a book value of equity of $51.3 billion, 8.9 billion shares outstanding, and a market price of $7.92 per share. GE also had cash of $69.7 billion, and total debt of $108.9 billion. a. What was GE's market capitalization? What was GE's market-to-book ratio? b. What was GE's book debt-equity ratio? What was GE's market debt-equity ratio? c. What was GE's enterprise value? a. What was GE's market capitalization? GE's market capitalization was $enter your response here billion. (Round to one decimal place.)arrow_forwardIn December 2018, General Electric (GE) had a book value of equity of $51.5 billion, 8.6 billion shares outstanding, and a market price of $7.93 per share. GE also had cash of $69.9 billion, and total debt of $109.5 billion. a. What was GE's market capitalization? What was GE's market-to-book ratio? b. What was GE's book debt-equity ratio? What was GE's market debt-equity ratio? c. What was GE's enterprise value? a. What was GE's market capitalization? GE's market capitalization was $enter your response here billion. (Round to one decimal place.) What was GE's market-to-book ratio? GE's market-to-book ratio was enter your response here . (Round to two decimal places.) Part 3 b. What was GE's book debt-equity ratio? GE's book debt-equity ratio was enter your response here . (Round to two decimal places.) Part 4 What was GE's market debt-equity ratio? GE's market debt-equity ratio was enter your response here . (Round to two decimal places.) c. What was GE's enterprise…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you