FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

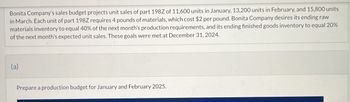

Transcribed Image Text:Bonita Company's sales budget projects unit sales of part 198Z of 11,600 units in January, 13,200 units in February, and 15,800 units

in March. Each unit of part 198Z requires 4 pounds of materials, which cost $2 per pound. Bonita Company desires its ending raw

materials inventory to equal 40% of the next month's production requirements, and its ending finished goods inventory to equal 20%

of the next month's expected unit sales. These goals were met at December 31, 2024.

Prepare a production budget for January and February 2025.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Electro Company budgets production of 700,000 electric panels in the second quarter and 770,000 electric panels in the third quarter. Each panel requires 0.80 pound of direct material at a cost of $2.30 per pound. The company desires to end each quarter with an ending inventory of this material equal to 20% of next quarter's budgeted materials requirements. Beginning inventory of this material is 112,000 pounds. Prepare a direct materials budget for the second quarter.arrow_forwardThe production budget for Juno & Jones, Inc. shows the company expects to produce 450 units in the first quarter and 670 units in the second quarter. Each unit will require 11 pounds of direct materials at a cost of $2.00 per pound. The company prefers to maintain raw materials inventory equal to 40% of the next quarters materials needs. Prepare a production budget for the first quarter. Juno & Jones, Inc. Direct Materials Budget First Quarter Budgeted units to be produced Pounds of materials required per unit Total pounds of materials needed in production Plus desired ending inventory in pounds Total direct materials needed Less pounds of materials in beginning inventory Total Pounds of Direct Materials to be purchased Cost of materials per pound Total cost of materials to be purchased Direct Materials cost per unitarrow_forwardCharm Enterprises' production budget shows the following units to be produced for the coming three months: 11,352 oz. O 11,520 oz. 7,448 oz. April 2,560 Units to be produced A finished unit requires four ounces of a key direct material. The March 31 Raw Materials inventory has 2,560 ounces (oz.) of the material. Each month's ending Raw Materials inventory should be 35% of the following month's production needs. The materials to be purchased during May should be: O 15,384 oz. 7,616 oz. May 2,880 June 2,760arrow_forward

- ABC Company's budgeted sales for June, July, and August are 13,000, 17,000, and 14,700 units, respectively. ABC requires 40% of the next month's budgeted unit sales as finished goods inventory each month. Budgeted ending finished goods inventory for May is 5,200 units. Each unit that ABC Company produces uses 4 pounds of raw material. ABC requires 35% of the next month's budgeted production as raw material inventory each month. Required: Calculate the number of pounds of raw material to be purchased in June. Number of poundsarrow_forwardCanyon Corporation's budgeted production schedule, by quarters, for the coming year is as follows: Quarter 1= 26,500 units Quarter 2 = 23,000 units Quarter 3 = 21,000 units Quarter 4 = 28,000 units Each unit of product requires three pounds of direct material. The company's policy is to begin each quarter with 25% of that quarter's direct materials production requirements. Canyon expects to have 54,000 pounds of direct materials on hand at the beginning of Quarter 1. What would be Canyon budgeted direct materials purchases (in pounds) for the first quarter?arrow_forwardA company budgets production of 4,720 units in May and 6,025 units in June. Each unit requires 4 pounds of direct materials. Direct materials cost $5 per pound. The company maintains direct materials inventory equal to 40% of next month's direct materials requirement. The company has 7,552 pounds of direct materials inventory on April 30. Prepare the direct materials budget for May. Units to produce Direct Materials Budget Materials needed for production (pounds) Total materials required (pounds) Materials to purchase (pounds) Cost of direct materials purchases Mayarrow_forward

- ABC Company’s budgeted sales for June, July, and August are 15,000, 19,000, and 16,700 units, respectively. ABC requires 40% of the next month’s budgeted unit sales as finished goods inventory each month. Budgeted ending finished goods inventory for May is 6,000 units. Each unit that ABC Company produces uses 4 pounds of raw material. ABC requires 35% of the next month’s budgeted production as raw material inventory each month. Required: Calculate the number of pounds of raw material to be purchased in June.arrow_forwardElectro Company manufactures transmissions for electric cars. Management reports ending finished goods inventory for the first quarter at 90,000 units. The following unit sales are budgeted during the rest of the year: second quarter, 450,000 units; third quarter, 525,000 units; and fourth quarter, 475,000 units. Company policy calls for the ending finished goods inventory of a quarter to equal 20% of the next quarter's budgeted unit sales. Prepare a production budget for both the second and third quarters that shows the number of transmissions to manufacture. ELECTRO COMPANY Production Budget Next period budgeted sales units Desired ending inventory units Total required units Units to produce Second Quarter Third Quarterarrow_forwardSunrise Poles manufactures hiking poles and is planning on producing 3,646 units in March and 4,395 in April. Each pole requires a half pound of material, which costs $1.17 per pound. The company’s policy is to have enough material on hand to equal 7% of the next month’s production needs and to maintain a finished goods inventory equal to 17% of the next month’s production needs. What is the budgeted cost of purchases for March? Round to the nearest penny, two decimal places.arrow_forward

- Sill Corporation makes one product. Budgeted unit sales for January, February, March, and April are 9,900, 11,400, 11,900, and 13,400 units, respectively. The ending finished goods inventory equals 20% of the following month's sales. The ending raw materials inventory equals 40% of the following month's raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials. If 61,000 pounds of raw materials are required for production in March, then the budgeted raw material purchases for February is closest to: Multiple Choice 57,500 pounds 104,900 pounds 58,900 pounds 81,900 pounds Sarrow_forwardJSS Company’s sales budget projects unit sales of part X of 15,000 units in January, 16,000 units in February, and 17,000 units in March. Each unit of part X requires 1.5 pounds of materials, which cost $2.5 per pound. JSS Company desires its ending raw materials inventory to equal 35% of the next month’s production requirements, and its ending finished goods inventory to equal 20% of the next month’s expected unit sales. These goals were met at December 31, 2020. Instructions (a) Prepare a production budget for January and February 2021. (b) Prepare a direct materials budget for January 2021arrow_forwardThe production budget for Juno & Jones, Inc. shows the company expects to produce 400 units in the first quarter and 630 units in the second quarter. Each unit will require 11 pounds of direct materials at a cost of $1.90 per pound. The company prefers to maintain raw materials inventory equal to 40% of the next quarters materials needs.Prepare a production budget for the first quarter.Juno & Jones, Inc.Direct Materials BudgetFirst Quarter Budgeted units to be produced Pounds of materials required per unit Total pounds of materials needed in production Plus desired ending inventory in pounds Total direct materials needed Less pounds of materials in beginning inventory Total Pounds of Direct Materials to be purchased Cost of materials per pound Total cost of materials to be purchased Direct Materials cost per unitarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education