FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

![**Compute Gross Profit Using the Periodic System**

To calculate the gross profit using the periodic inventory system, enter the value in the space provided below.

**Gross Profit:** $ [________]

*Instructions: Calculate and fill in the gross profit based on your inventory data using the periodic system of inventory accounting.*](https://content.bartleby.com/qna-images/question/42077dd4-5a93-4885-bc7c-dca1203ecd7a/f40c2d76-d0d6-4783-8c27-35a60388fa72/phjyw4_thumbnail.png)

Transcribed Image Text:**Compute Gross Profit Using the Periodic System**

To calculate the gross profit using the periodic inventory system, enter the value in the space provided below.

**Gross Profit:** $ [________]

*Instructions: Calculate and fill in the gross profit based on your inventory data using the periodic system of inventory accounting.*

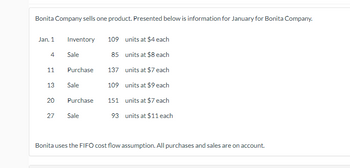

Transcribed Image Text:Bonita Company sells one product. Presented below is information for January for Bonita Company.

**Transactions:**

- **Jan. 1**

- **Inventory**: 109 units at $4 each

- **Jan. 4**

- **Sale**: 85 units at $8 each

- **Jan. 11**

- **Purchase**: 137 units at $7 each

- **Jan. 13**

- **Sale**: 109 units at $9 each

- **Jan. 20**

- **Purchase**: 151 units at $7 each

- **Jan. 27**

- **Sale**: 93 units at $11 each

**Additional Information:**

Bonita uses the FIFO (First-In, First-Out) cost flow assumption. All purchases and sales are on account.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Craig Company buys and sells one product. Its beginning inventory, purchases, and sales during calendar-year 2018 follow. Problem Date Activity Units Acquired at Cost Total Units Sold at Retail Unit Inventory Jan. 1 Beg. Inventory 400 units @ $14 = Jan. 15 Sale Mar. 10 Purchase Apr. 1 Sale May 9 Purchase Sep. 22 Purchase Nov. 1 Sale Nov. 28 Purchase Totals 200 units @ $15 = 300 units @ $16 = 250 units @ $20= 100 units @ $21 = $5,600 - $3,000 - 200 units @ $30 200 units 400 units $5,000 200 units @ $30 $4,800 - 400 units $2,100 - 200 units 500 units 750 units 300 units @ $35 450 units 550 units 1,250 units $20,500 700 units 550 units Additional tracking data for specific identification: (1) January 15 sale-200 units @ $14, (2) April 1 sale-200 units @ $15, and (3) November 1 sale-200 units @ $14 and 100 units @ $20. 1. What is the Cost of Good Available for Sale? How many units available for sale? 2. Using the Periodic System, determine Cost of Goods Sold (COGS) and Ending Inventory…arrow_forwardWarnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Units Sold at Retail Units Acquired at Cost 100 units @ $50 per unit 400 units@ $55 per unit Date Mar. Mar. Mar. Mar. 18 Purchase Mar. 25 Purchase Mar. 29 Sales Activities 1 Beginning inventory 5 Purchase 9 Sales 420 units @ $85 per unit 120 units @ $60 per unit 200 units @ $62 per unit 160 units @ $95 per unit Totals 820 units 580 units 3. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. For specific identification, the March 9 sale consisted of 80 units from beginning inventory and 340 units from the March 5 purchase; the March 29 sale consisted of 40 units from the March 18 purchase and 120 units from the March 25 purchase. es Complete this question by einering your answers in the tabs below. Perpetual FIFO Perpetual LIFO Weighted Average Specific Id Compute the cost assigned to…arrow_forwardABC Company employs a periodic inventory system and sells its inventory to customers for $20 per unit. ABC Company had the following inventory information available for May: May 1 May 3 May 8 May 13 May 18 May 20 May 24 May 30 Beginning inventory 1,900 units @ $10.20 cost per unit Purchased 2,100 units @ $11.60 cost per unit Sold 1,400 units Purchased 3,700 units @ $8.10 cost per unit Sold 2,600 units Purchase 4,100 units @ $14.70 cost per unit Sold 2,900 units Purchased 2,200 units @ $12.60 cost per unit During May, ABC Company reported operating expenses of $14,000 and had an income tax rate of 36%. Calculate the amount of net income shown on ABC Company's income statement for May using the LIFO method.arrow_forward

- Ashavinbhaiarrow_forwardBhilarrow_forwardThe following three identical units of Item JC07 are purchased during April: Item Beta Units Cost April 2 Purchase $264 April 15 Purchase 268 April 20 Purchase 272 Total $804 Average cost per unit $268 ($804 ÷ 3 units) Assume that one unit is sold on April 27 for $367. Determine the gross profit for April and ending inventory on April 30 using the (a) first-in, first-out (FIFO); (b) last-in, first-out (LIFO); and (c) weighted average cost method. Gross Profit Ending Inventory a. First-in, first-out (FIFO) b. Last-in, first-out (LIFO) c. Weighted average cost 3.arrow_forward

- The following information pertains to Julia & Company: March 1 Beginning inventory = 26 units @ $5.40 March 3 Purchased 17 units @ 4.20 March 9 Sold 26 units @ 8.30 What is the cost of goods sold for Julia & Company assuming it uses LIFO?arrow_forwardBonita Company sells one product. Presented below is information for January for Bonita Company. Jan. 1 4 11 13 20 27 Inventory 109 units at $4 each 85 units at $8 each 137 units at $7 each 109 units at $9 each 151 units at $7 each 93 units at $11 each Sale Purchase Sale Purchase Sale Bonita uses the FIFO cost flow assumption. All purchases and sales are on account.arrow_forwardAssume the following events for a month for Company X: Beginning Balance of Inventory is 400 Units and the cost is $ 200 per Unit. October 5 Company X purchases 400 Units at a cost of $220 per Unit. October 9 Company X sells 600 units for $500 per Unit. October 17 Company X purchases 200 Units at a cost of $230 per Unit. October 27 Company X sells 300 units for $500 per Unit. October 29 Company X purchases 200 units for $250 per Unit. Use this data to answer all questions. Using FIFO Periodic, what is the Gross Profit for October?arrow_forward

- 97) A company had the following purchases and sales during its first month of operations: Date January 1 January 9 January 17 January 27 A) $84.00. B) $60.71. Activities C) $23.35. D) $46.70. E) $37.36. Purchase Sales Purchase Sales Units Acquired at Cost 10 units @ $4.00 = $40.00 8 units @ $5.50 = $44.00 Units Sold at Retail 6 units @ $12.00 Using the Periodic weighted average method, what is the value of cost of goods sold? (Round weighted average cost per unit to 2 decimal places.) 7 units @ $12.00arrow_forwardFong Sai-Yuk Company sells one product. Presented below is information for January for Fong Sai-Yuk Company. Jan. 1 Inventory 100 units at $5 each 4 Sale 80 units at $8 each 11 Purchase 150 units at $6 each 13 Sale 120 units at $8.75 each 20 Purchase 160 units at $7 each 27 Sale 100 units at $9 each Fong Sai-Yuk uses the FIFO cost flow assumption. All purchases and sales are on account. (a Assume Fong Sai-Yuk uses a periodic system. Prepare all necessary journal entries, including the end-of-month closing entry to record cost of goods sold. A physical count indicates that the ending inventory for January is 110 units. (If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)arrow_forwardThe following three identical units of Item A are purchased during April: Item A Units Cost $ 68 Apr. Purchase 1 Purchase 14 1 73 28 Purchase 75 1 Total $216 3 $ 72 ($216 + 3 units) Average cost per unit Assume that one unit is sold on April 30 for $118. Determine the gross profit for April and ending inventory on April 30 using the (a) first-in, first-out (FIFO); (b) last-in, first-out (LIFO); and (c) weighted average cost methods.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education