FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

t9

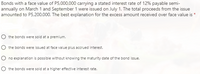

Transcribed Image Text:Bonds with a face value of P5,000,000 carrying a stated interest rate of 12% payable semi-

annually on March 1 and September 1 were issued on July 1. The total proceeds from the issue

amounted to P5,200,000. The best explanation for the excess amount received over face value is *

the bonds were sold at a premium.

the bonds were issued at face value plus accrued interest.

O no explanation is possible without knowing the maturity date of the bond issue.

the bonds were sold at a higher effective interest rate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- u Online C (78) Wha X M Uh-oh! T X Accounti X M Inbox (2, x O SP2021 Answere x E3 My Hom x * Cengage x Bartleby x + D X A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?inprogress=true FMovies | Watch M. BIO201 Connect 10.. M Gmail D YouTube Fourth Homework O eBook 9. MC.12.09 Research and Development 10. MC.12.10 Instructions Chart Of Accounts General Journal 11. RE.12.01.BLANKSHEET Instructions 12. RE.12.02 Notting Hill Company incurred the following costs for R&D activities: 13. RE.12.03.BLANKSHEET Material used from inventory $15,000 14. RE.12.04.BLANKSHEET Equipment purchased (with cash) for R&D with no other use 85,000 Depreciation on building housing multiple R&D activities 10,000 15. RE.12.05.BLANKSHEET Wages and salaries paid to R&D employees 38,500 16. RE.12.06.BLANKSHEET Required: 17. RE.12.07.BLANKSHEET Prepare Notting Hill's journal entry(ies) to record its R&D. 18. RE.12.08 19. RE.12.09.BLANKSHEET 20. RE.12.10.BLANKSHEET 21. EX.12.01 22. EX.12.02.BLANKSHEET O…arrow_forwardAssistarrow_forwardData: So 101; X= 114; 1+r= 1.12. The two possibilities for sr are 143 and 85.arrow_forward

- On January 1, 2025, Blossom Company has the following defined benefit pension plan balances. Projected benefit obligation $4,454,000 Fair value of plan assets 4,140,000 The interest (settlement) rate applicable to the plan is 10%. On January 1, 2026, the company amends its pension agreement so that prior service costs of $509,000 are created. Other data related to the pension plan are as follows. 2025 2026 Service cost $149,000 $177,000 Prior service cost amortization -0- 92,000 Contributions (funding) to the plan 237,000 283,000 Benefits paid 196,000 274,000 Actual return on plan assets 248,400 260,000 Expected rate of return on assets 6% 8% (a) Prepare a pension worksheet for the pension plan for 2025 and 2026. (Enter all amounts as positive.) BLOSSOM COMPANY Pension Worksheet-2025 and 2026 General Journal Entries OCI-Prior Service Cost OCI-Gain/ Pel Lossarrow_forwardHansen Corporation. a C Corporation (mot a manufacturer) reports the following items in income and expenses for 2021 Gross Revenue $900,000 Dividend Received from 30% owned Corp 200,000 LTCG 30,000 STCL 12000 City of Lee's Summit Bond Interest 10000 COGS 375000 Administrative Expenses 325000 Charitable Contribution 60,000 Compute Hansen's C Corp Taxable income?arrow_forwardE12.18arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education